[ad_1]

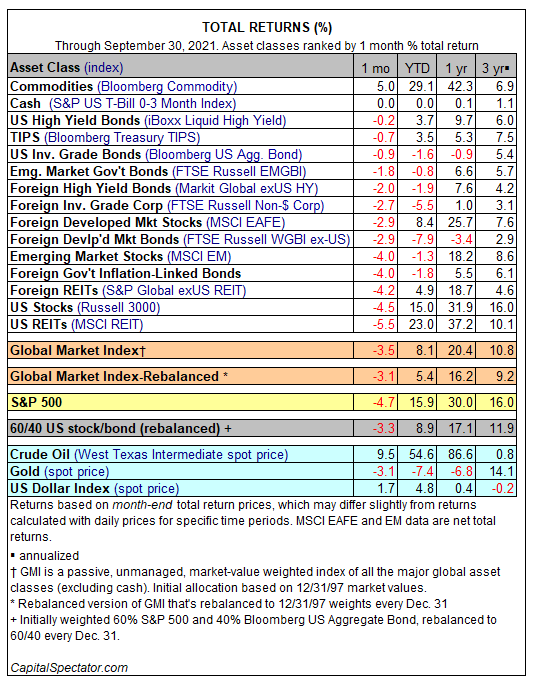

World markets suffered their broadest retreat in a 12 months throughout September. The bullish exception: commodities, which delivered a strong achieve final month. Money, as common nowadays, was flat. In any other case, purple ink dominated performances for the main asset courses final month.

Let’s start with commodities, which rose 5.0% final month, based mostly on the Index. The advance marked the strongest month-to-month achieve since April. It’s truthful to say it’s been a profitable 12 months on this nook: Commodities have scored good points in all however two calendar months throughout 2021. 12 months up to now, commodities are up 29.1% — the highest performer for the main asset courses.

The remainder of the sphere (besides money) posted losses in September. Notably, US shares and bonds misplaced floor, giving assist to issues that the historic diversification advantages of pairing the 2 asset courses is breaking down.

The steepest loss final month was in US actual property funding trusts (REITs). However the 5.5% decline for the MSCI REIT Index in September was overdue – the loss marked the primary month-to-month setback since October 2020. Be aware, too, that on a year-to-date foundation, MSCI REIT continues to be flying excessive through a 23% achieve – second solely to commodities thus far in 2021.

Whole Returns Desk

Meantime, the World Market Index (GMI) took a success final month. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the main asset courses (besides money) in market-value weights, slumped a hefty 3.5%. That’s the primary month-to-month slide since January and the deepest because the coronavirus crash crushed markets in March 2020. 12 months up to now, nevertheless, GMI continues to be posting a strong 8.1% achieve — higher than many of the main asset courses thus far in 2021.

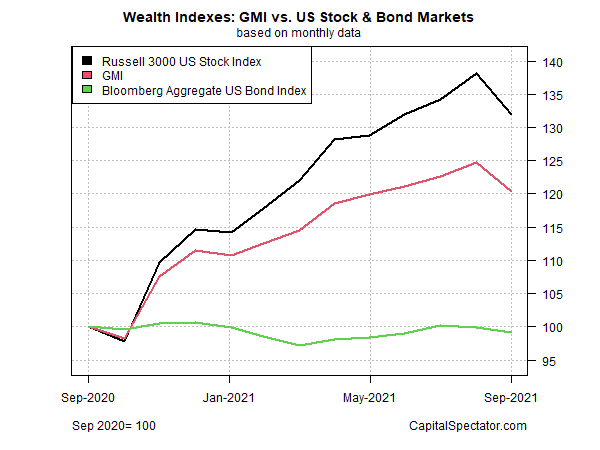

Reviewing GMI relative to US shares and bonds continues to point out a robust middling efficiency over the trailing one-year interval. GMI earned roughly half of the achieve posted by US shares with considerably much less danger over the previous 12 months. US bonds, in contrast, are flat for the trailing 12-month window.

Indexes GMI Vs US Inventory & Bond Markets

[ad_2]