[ad_1]

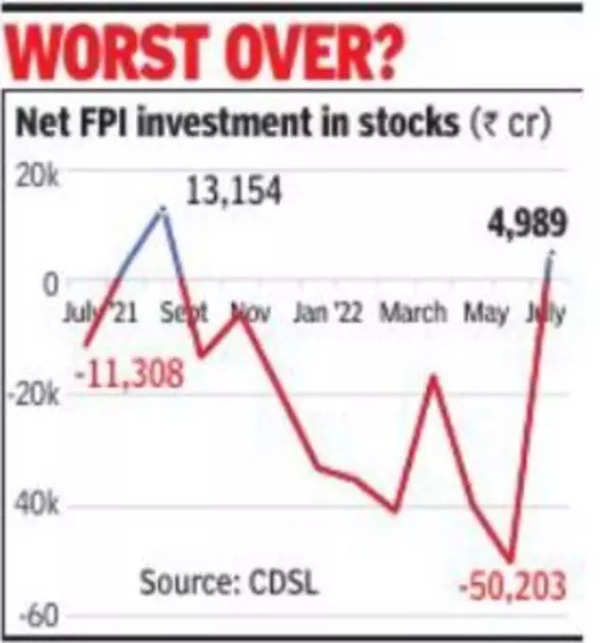

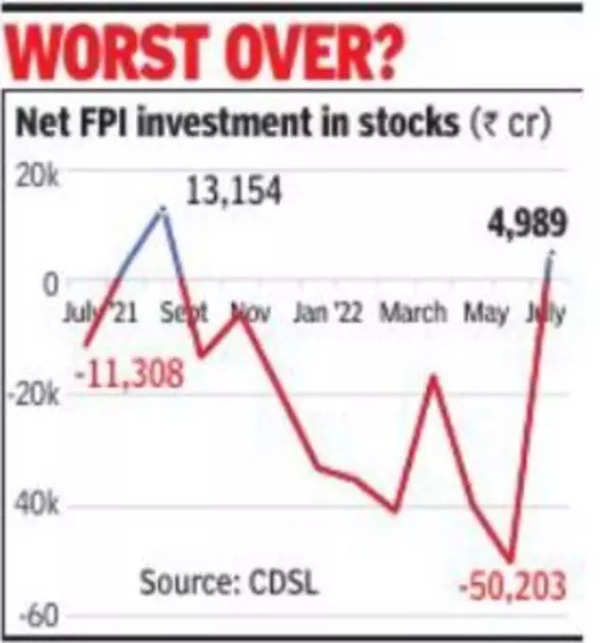

NEW DELHI: After 9 consecutive months of promoting, international buyers have turned web consumers of Indian shares, investing almost Rs 5,000 crore in July on softening greenback index and robust company earnings. That is in sharp distinction to a web withdrawal of Rs 50,203 crore from the inventory market seen in June, which was the very best web outflow since March 2020, when international portfolio buyers (FPIs) had pulled out Rs 61,973 crore from equities.

In response to information with depositories, FPIs infused a web quantity of Rs 4,989 crore in Indian equities in July. Between October 2021 and June 2022, they offered Rs 2. 46 lakh crore in equities section.

In response to information with depositories, FPIs infused a web quantity of Rs 4,989 crore in Indian equities in July. Between October 2021 and June 2022, they offered Rs 2. 46 lakh crore in equities section.

Hitesh Jain of Sure Securities expects FPI flows to stay optimistic throughout August because the worst for the rupee appears to be over, and oil appears to be confining in a spread.

The turning level for the online flows in July was US Federal Reserve Chair Jerome Powell’s assertion that at the moment the US will not be in a recession, Himanshu Srivastava of Morningstar India stated. Nonetheless, FPIs pulled out a web quantity of Rs 2,056 crore from the debt market in July.

[ad_2]