[ad_1]

Right here at Contrarian Outlook, we’ve been speaking lots about crypto recently—however not in the way in which you may suppose.

We’re not consumers—removed from it! As a substitute, we’re utilizing a savvy, dividend-focused technique to set ourselves up for some good positive aspects (and dividend payouts!) as gamblers flee crypto and speculative tech shares. (I’ll highlight two closed-end funds which might be aligned to scoop up our “crypto refugees” whereas handing us dividends yielding as much as 11% in only a second.)

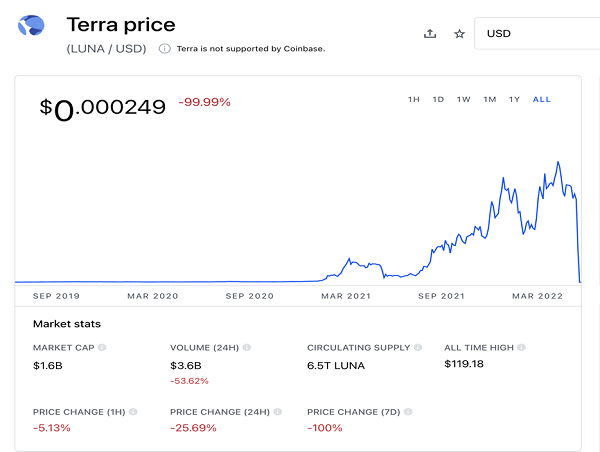

I’m reminded of crypto proper now as a result of many of those “cash” have fallen exhausting not too long ago—and final week, we obtained phrase of 1 that went basically to zero!

Crypto-Wipeout

Cryptocurrency Terra/ (these are literally two cryptocurrencies each launched by the identical folks) misplaced virtually 100% of its worth, with $40 billion in valuation disappearing into skinny air.

Buyers who obtained in early have been bragging about 100-times (and higher) returns, however those that obtained out too late misplaced their entire funding.

Now, as you’ll be able to see from Coinbase (NASDAQ:) and most different cryptocurrency exchanges, buying and selling of Terra/Luna is not supported.

That $1.6-billion market cap at which the coin is at the moment valued? It doesn’t exist. As a result of the currencies are not supported, and has been shut down, anybody who nonetheless has one of many 6.5 trillion Luna cash of their cryptowallets will discover that they’ll’t use them or trade them for money.

Construct Lasting Wealth With 6%+ Yielding CEFs

Clearly, anybody who went all in on Terra/Luna isn’t somebody we anticipate to maneuver into CEFs—they’ve misplaced all their cash! However many different (former) crypto and speculators are little question on the lookout for locations to park what’s left of their money.

And wholesome dividends like these supplied by CEFs can have numerous enchantment—particularly with inflation consuming away at what they’ve left.

That is the place the 2 CEFs I discussed a second in the past are available in. They’re good examples of the sorts of funds that may enchantment to our crypto refugees: the Liberty All Star Fairness Closed Fund (NYSE:) and the Gabelli Dividend & Revenue Closed Fund (NYSE:).

A few years in the past, they have been yielding 10.4% and seven.9%, respectively. Since then, GDV’s dividend has stayed strong (it now yields 6.1%) and comes your method month-to-month. USA, which pays quarterly, has seen its dividend rise by almost 30%, for an 11.1% yield.

A Pay Elevate and Huge Features

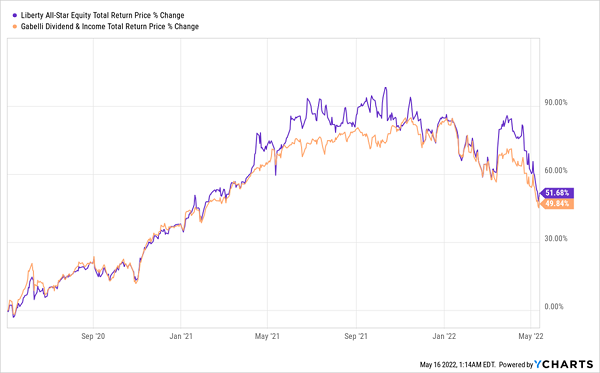

GDV-USA Whole Returns

These funds have additionally seen the worth of their portfolios rise strongly since then. And whereas each are down from the all-time highs they hit late final yr (as, it must be famous, is nearly every part out there), each are nonetheless up a strong 50% in simply two years. And in contrast to cryptocurrencies, these funds’ belongings have truly grown:

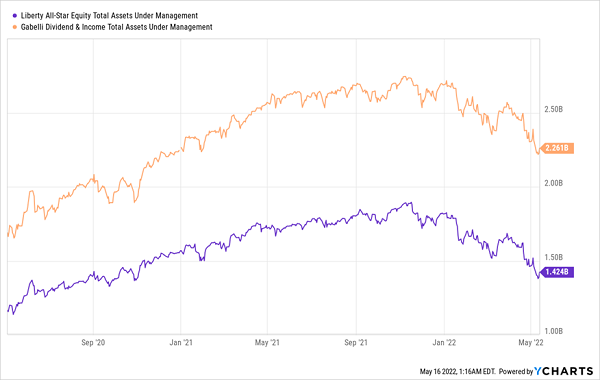

Actual Development Backed By Robust Belongings

GDV-USA Asset Development

As you’ll be able to see above, these funds’ liquidation values have gone up over the past couple of years, due to precise elementary positive aspects within the inventory market, generated by the rising money flows and future earnings potential of the businesses these funds maintain.

Talking of their portfolios, the administration groups at each of those funds have carried out a pleasant job of positioning them for the present market. USA, for instance, holds Alphabet (NASDAQ:), UnitedHealth Group (NYSE:), and Visa (NYSE:), three corporations which have lengthy histories of optimistic earnings, excessive margins and development.

GDV, in the meantime, holds Microsoft (NASDAQ:), which is taking advantage of rising demand for cloud companies; tobacco agency Swedish Match (ST:), whose inventory has jumped on an aggressive acquisition try from Philip Morris (NYSE:), and JPMorgan Chase (NYSE:), which earnings as rising rates of interest increase its mortgage revenue.

In different phrases, GDV and USA provide huge dividends and development potential backed by actual firms making actual earnings by offering actual items and companies.

That’s about as far-off from the crypto on line casino as you will get, and it’s a superb instance of how high-dividend CEFs are all the time a better option than speculations, regardless of how huge the historic positive aspects of mentioned speculations is likely to be.

Disclosure: Brett Owens and Michael Foster are contrarian revenue traders who search for undervalued shares/funds throughout the U.S. markets. Click on right here to learn to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”

[ad_2]