[ad_1]

- Experiences Q1 2022 outcomes on Tuesday, Sept. 21, after the shut

- Income expectation: $21.9 billion

- EPS expectation: $4.94

The COVID-fueled celebration may be over for FedEx (NYSE:). After an sudden surge in demand for its supply providers in the course of the pandemic, the freight and logistics large is now struggling to manage prices and rent employees.

These challenges are prone to harm the bottom-line of the Memphis, Tennessee-based parcel service when it reviews its fiscal 2022, first quarter earnings tomorrow. Gross sales will seemingly decline to $21.9 billion from $22.6 billion within the , in response to analysts consensus estimates. The per share adjusted revenue may even fall to $4.94 from $5.01.

These subdued expectations have harm the shares of the transportation colossus. The inventory is down greater than 20% because the June excessive of $319.90. It closed on Friday at $255.22.

Buyers turned bullish on FedEx early this 12 months, inspired by rising demand for the corporate’s supply providers in the course of the pandemic when consumers switched to e-commerce throughout lockdowns and an total stay-at-home atmosphere.

The corporate’s enterprise restructuring—which had been deliberate earlier than the pandemic—proved to be an excellent launching pad for FedEx on this new atmosphere. Earlier than COVID-19 unfold throughout the globe, the corporate had already moved to a seven-day service mannequin, expanded capability for bigger packages, launched new routing software program, and commenced pushing extra Specific packages into its lower-cost Floor community.

These modifications helped FedEx improve revenue on a flood of residential packages whereas its extra profitable enterprise supply service suffered in the course of the US lockdown. Going ahead, the massive problem for the corporate is to comprise its prices in an atmosphere the place inflation and employee shortages are hurting many companies.

Lengthy-Time period Enchantment Stays Intact

FedEx informed traders in June that its capital spending will rise greater than 20% throughout its fiscal 2022. Nonetheless, many analysts consider that FedEx is a long-term purchase as a result of persevering with growth of on-line purchasing. UBS, whereas chopping its earnings estimate for FedEx, mentioned in a be aware to shoppers on Friday that labor market points are seemingly hurting the corporate’s profitability.

In accordance with the be aware, carried by CNBC.com:

“Visibility to the trail ahead on margin efficiency is proscribed at the moment as it isn’t clear how a lot of the 1Q points will stay as a headwind wanting ahead.”

UBS minimize its value goal on FedEx to $380 per share from $397, however stored its purchase score on the inventory. UBS added the start-up prices for a brand new hub in California are non permanent, however it was unclear when earnings would get well.

JPMorgan, whereas sustaining its obese score on the inventory, mentioned in a latest be aware that FedEX is a multiyear progress story within the transportation sector, with the corporate’s Floor division main the beneficial properties. The be aware added:

“After a string of earnings disappointments, the basic momentum in every phase mixed with well-timed strategic initiatives creates essentially the most engaging multi-year progress story in transports.”

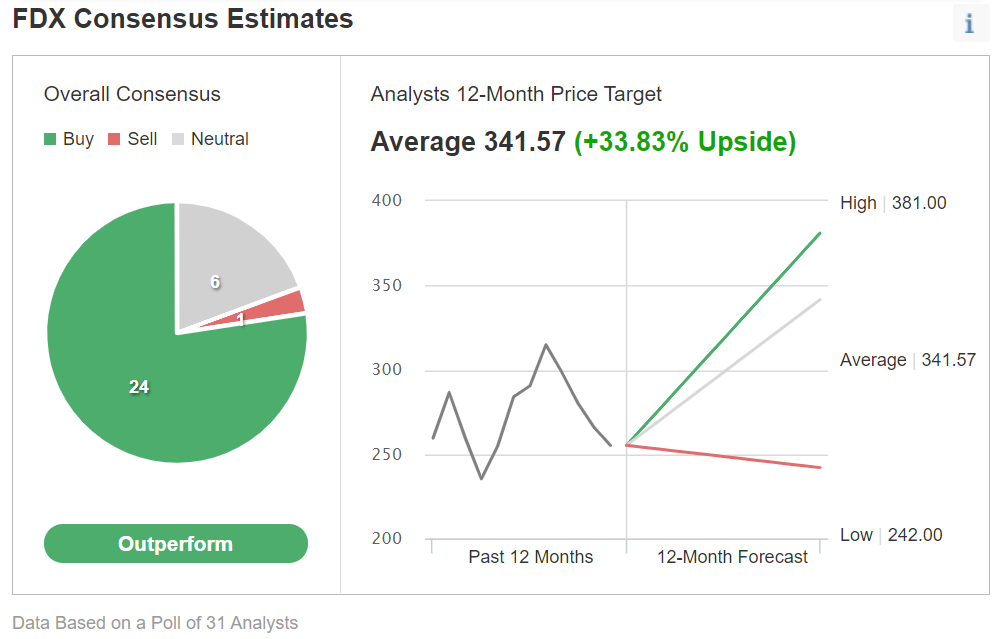

Of 31 analysts masking the inventory for Investing.com, 24 have given it an “Outperform” score.

Chart: Investing.com

The consensus value estimate amongst analysts polled is $341.57—a 33% upside potential goal from Friday’s closing value.

Backside Line

FedEx is going through non permanent value escalations because the supply large expands to cater to rising e-commerce demand. However the macro developments are in favor of the enterprise, making its inventory a long-term purchase after the present spell of weak spot.

Tuesday’s earnings report will seemingly show that time.

[ad_2]