[ad_1]

Final week, the U.S. Federal Reserve reiterated statements in help of continued straightforward cash insurance policies and help for a recovering U.S. financial system. Moreover, Fed Chair Jerome Powell made a press release suggesting tightening too early could possibly be rather more damaging than ready till ample headwinds are behind us. I interpret this as stating the present inflationary issues are much less essential than the present world market expectations. We will doubtless climate average inflationary issues if the financial system continues to strengthen – whereas tightening proper now could not cut back inflationary issues and will immediate a broad market slowdown throughout the U.S. and globally.

In brief, merchants and traders perceived these feedback as “Right here we go off to the races once more,” and the U.S. markets rallied sharply on Friday and in early buying and selling on Monday, Aug. 30, 2021.

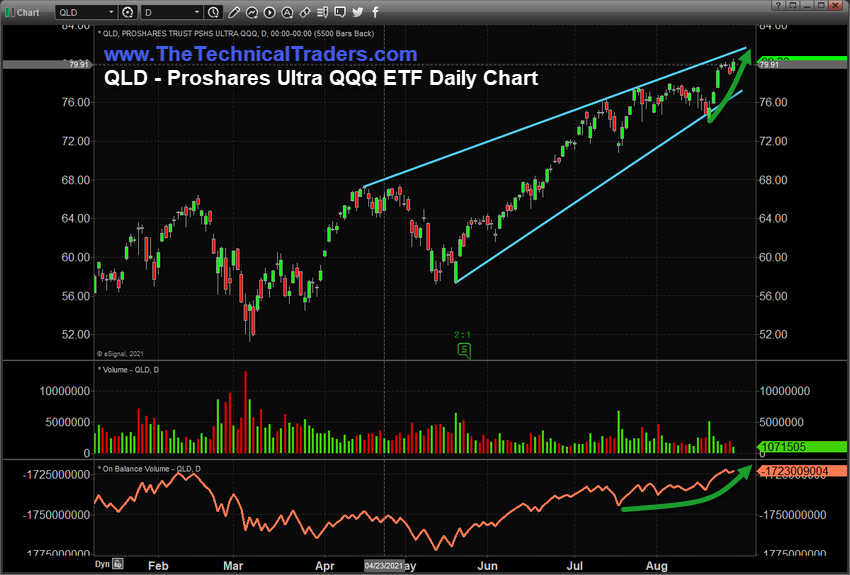

NASDAQ/Know-how Main The Rally Cost

This ProShares Extremely QQQ (NYSE:) ETF each day chart highlights the prolonged rally section of the NASDAQ/QQQ. With the present Fed statements, we count on $80 to be damaged as this new rally section makes an attempt to focus on $82 to $84 – one other 5% larger (or extra).

IWM Breaks Above Twin-Pennant/Flag Formations.

This iShares ETF (NYSE:) each day chart clearly illustrate a really sturdy dual-pennant/flag breakout that has taken place with Friday’s rally try. The transfer above $222.50 may be very clearly an try to interrupt above the dual-pennant/flag channels and to interrupt into a brand new bullish value pattern.

As soon as resistance close to $227.50 is damaged, the Russell 2000 ETF, IWM, ought to try a much bigger rally try focusing on $233 to $235.

We have to see this momentum carry ahead by means of the tip of September as the tip of Q3:2021 ought to proceed to pattern larger with the Federal Reserve’s latest statements. Moreover, merchants needs to be positioning capital forward of the tip of Q3:2021 anticipating one other spherical of sturdy earnings and earnings in October/November – pushing the Christmas Rally into excessive gear.

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or injury because of reliance on the knowledge together with knowledge, quotes, charts and purchase/promote alerts contained inside this web site. Please be totally knowledgeable relating to the dangers and prices related to buying and selling the monetary markets, it is likely one of the riskiest funding types attainable.

[ad_2]