[ad_1]

Furthermore, after analysing the motion of rupee towards the US greenback since world monetary disaster interval, SBI Analysis discovered that there have been solely three cases the place the tempo of foreign money depreciation lengthened greater than 4 quarters.

It mentioned that after the foreign money settled at a decrease degree, appreciation of foreign money picked up at a dramatic tempo.

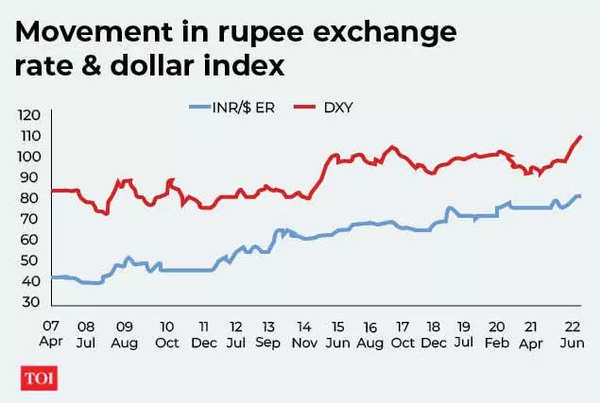

Rupee-dollar trade price is carefully aligned to the greenback index.

Any Appreciation of the greenback results in depreciation of the rupee/greenback trade price. “The correlation between the 2 is excessive at 0.86. Regression of rupee trade price on greenback index (DXY) from Apr-07 to Jul-22 reveals that 1% change in DXY (or appreciation of greenback) results in 1.13% change in rupee trade price (depreciation of the rupee),” mentioned the SBI examine.

The Indian rupee has depreciated by 5.6% vis-à-vis the US greenback for the reason that Russia-Ukraine warfare broke out. The US greenback Index has appreciated by 9.9% throughout the identical interval, thus indicating that a lot of the weak spot in rupee was in lieu of a robust greenback. In actual fact, the correlation coefficient between rupee/$ trade price and DXY has elevated to 0.96 since March 21 from 0.63 between January 8 to February 12.

There have been cases prior to now which exhibits that rupee depreciation has been far more than the appreciation of the greenback (like Jan-08 to Feb-12 and Oct-12 to Could-14), which had occurred due to our weak home macro-economic fundamentals.

Since Russia-Ukraine warfare broke out, RBI’s foreign exchange foreign money belongings (foreign exchange reserves excluding gold, SDR) have declined by $59 billion. Nonetheless, FII outflows throughout the identical interval quantities to $23 billion solely, implying that a part of remaining $36 billion (62% of the full lower in overseas foreign money belongings) decline will be attributed to fall in worth of non-dollar reserves amidst steep and secular greenback appreciation, mentioned the SBI examine.

“We tried to estimate the quantity of decline in FCA held in foreign money apart from greenback by assuming (EUR + Yen + Renminbi) depreciation approximates the non-$ reserves basket: As per our estimate, non-$ foreign money would possibly comprise 45% of the full overseas foreign money belongings of RBI. RBI may not have used greater than $25-30 bn in defending rupee, given the rising penchant of the regulator to intervene in NDF/Future markets….Remainder of the decline is perhaps purely due to valuation…Sufficient help for rupee is thus nonetheless obtainable,” mentioned Dr Soumya Kanti Ghosh, group chief financial adviser at State Financial institution of India.

[ad_2]