[ad_1]

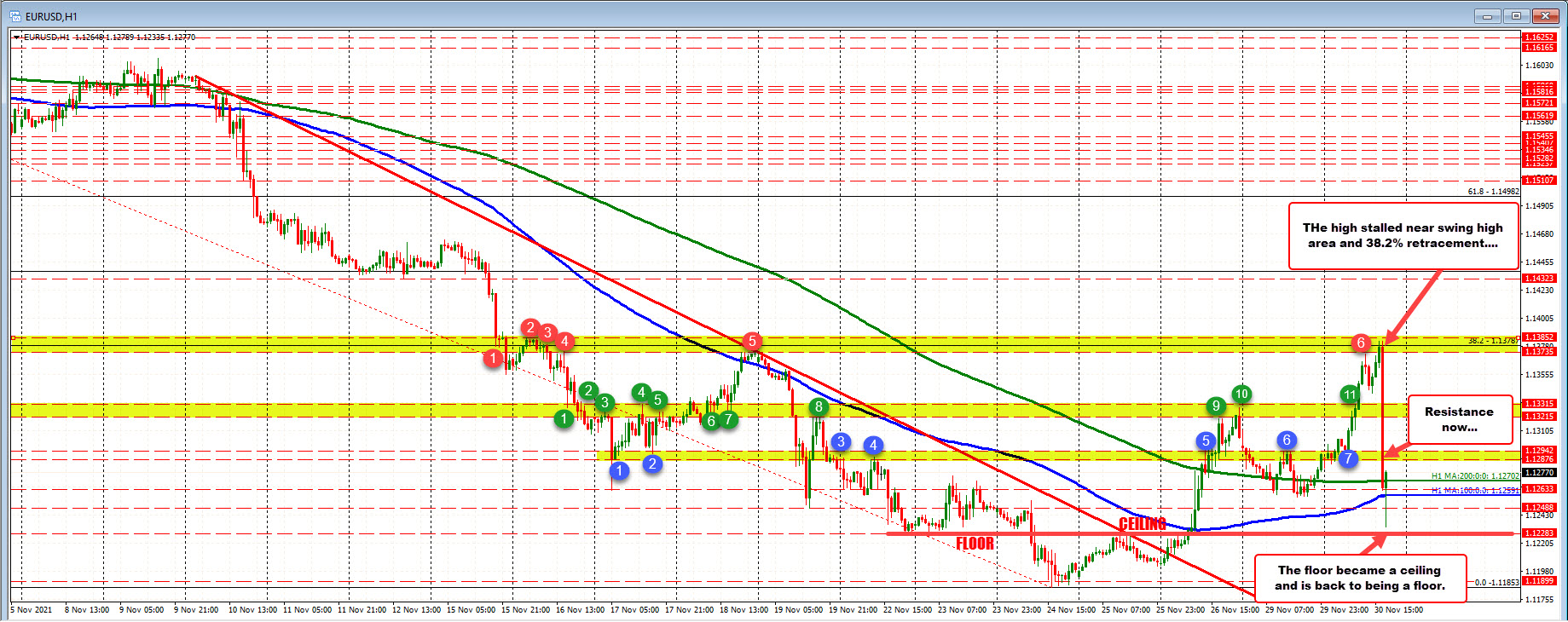

Worth is again buying and selling above and under the 200 and 100 hour shifting averages

The feedback from Fed chair Powell despatched the EURUSD again to the draw back – erasing the beneficial properties for the week and shifting again towards a flooring/ceiling stage close to 1.12283. The low value reached 1.12335 simply above that flooring/ceiling stage.

The value decline got here from a better swing space between 1.13735 and 1.13852. The 38.2% retracement of the transfer down from the October 28 excessive was between these swing ranges at 1.13787.

On the transfer decrease, the pair moved under a swing space at 1.13215 to 1.13315, and one other swing space between 1.12876 and 1.12942 (see blue numbered circles). That areas now shut resistance. Keep under retains the sellers comfy. A transfer above would muddy the waters for the bias.

Between the ground/ceiling sits the 100/200 hour shifting averages at 1.1259 and 1.12702. The value because the low has traded above and under that stage. Merchants are okay for now stalling round these shifting common ranges – for now no less than.

As I submit:

- Dow industrial common is down -525 factors or -1.49%

- S&P index is down -65 factors or -1.39%

- NASDAQ index is down -223 factors or -1.41%

- Russell 2000 is down 41 factors or -1.84%

- 2 yr yield is 0.553%

- 10 yield is 1.466%

For the NASDAQ index, the value is again under its 200 hour shifting common at 15651.01. The excessive value as we speak stalled forward of its 100 hour and 50 hour shifting averages close to 15846.24.

Spend money on your self. See our foreign exchange schooling hub.

[ad_2]