[ad_1]

Friday’s E-mini Setups

Friday made one other new all-time excessive for the and it was one other bull bar closing close to its excessive. It additionally closed simply above the 4600 Huge Spherical Quantity. Since Friday was the final day of the month, with a spot up immediately, there will probably be a spot on the day by day, weekly, and month-to-month charts.

September traded above the August excessive after which under the August low. It was due to this fact an out of doors down month. Alternatively, October was an out of doors up month. Consecutive exterior bars types an E-mini OO sample (outside-outside) Breakout Mode. Which means merchants will purchase above and promote under.

A minimal purpose is a measured transfer primarily based on the peak of the E-mini OO sample. For the bulls, a measured transfer up is 4934.50.

Two weeks in the past on the day by day chart, the E-mini additionally broke above a 4-month buying and selling vary. A measured transfer up primarily based on that buying and selling vary is 4802.00.

Since October closed close to its excessive, November ought to commerce above the October excessive, which might set off the OO purchase sign. It’s going to most likely do this immediately or early this week. There’s all the time a bear case, and there’s all the time at the least a 40% probability of it taking place. Bears desire a reversal down, even when there’s first a breakout above the month-to-month OO sample.

An inside bar after an out of doors bar is frequent. If November is a bear inside bar closing close to its low, there can be an ioi Breakout mode sample (August is within September’s vary). That, or any bear bar closing close to its low in November or December, can be a reputable promote sign on the month-to-month chart. In the meanwhile, merchants anticipate larger costs in November.

There’s a seasonal tendency for the market to rally between Oct. 26 and Nov. 5. That will increase the possibility of a break above the October excessive this week.

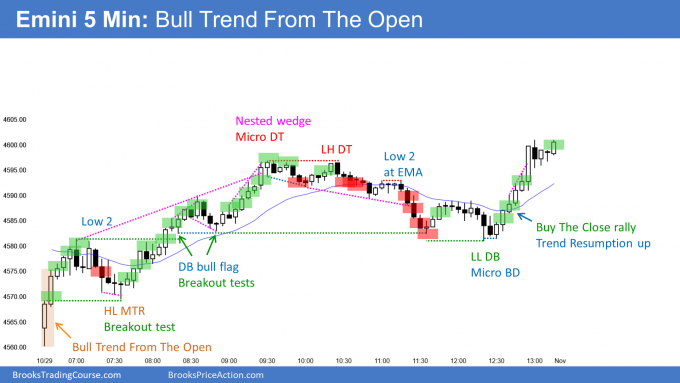

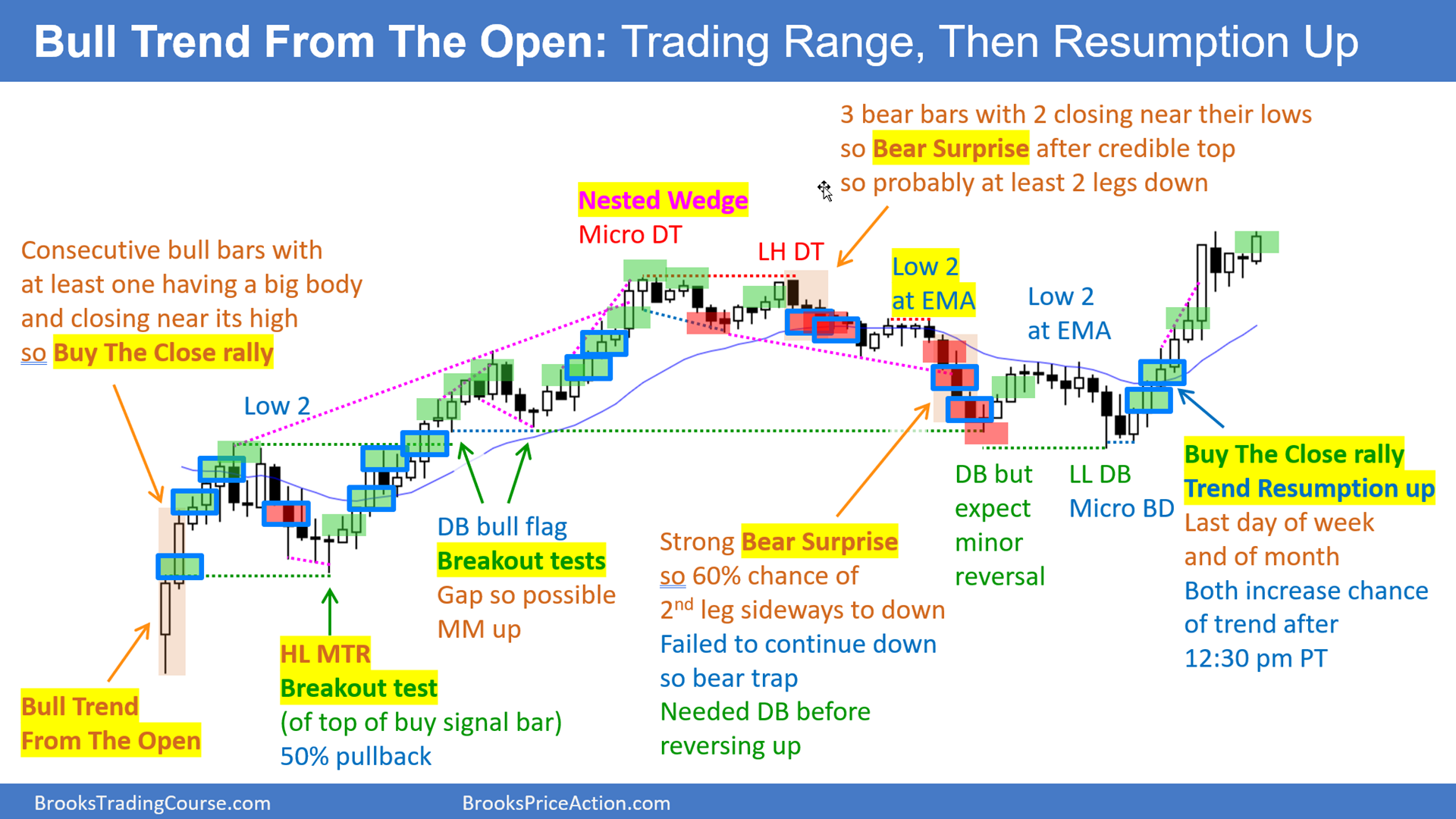

E-mini 5-minute chart and what to anticipate immediately

E-mini was up 12 factors within the in a single day Globex session. It’s going to most likely hole up immediately, forming a spot up on the day by day, weekly, and month-to-month charts. A spot as much as a brand new excessive will increase the possibility of a development day immediately. If there’s a development, it’s extra more likely to be within the path of the hole (up). When there’s a hole, there’s typically an try to shut the hole, particularly within the 1st hour.

Bulls will search for a reversal up from round Friday’s excessive. Typically a spot will shut and the E-mini will nonetheless reverse up and kind a bear development. The bears desire a Bear Pattern From The Open. If they can not get that, they want immediately to dump in some unspecified time in the future after which shut under yesterday’s excessive. That might improve the possibility of decrease costs tomorrow. Nevertheless, the perfect they most likely can get is a pullback lasting just a few days.

The E-mini has rallied in a decent bull channel for a number of weeks. That will increase the possibility of a pullback after which a 1- to 2-week buying and selling vary beginning at any time.

Above is the model that I publish day by day. As a result of I typically get questions on what Every day Setups Encyclopedia members see, immediately I’m together with the instance under of that model.

[ad_2]