[ad_1]

August was the seventh consecutive bull bar on the month-to-month chart. This bull bar streak has solely occurred twice within the 25-year historical past of the E-mini. There has by no means been a streak of 8 months. September ought to subsequently be a bear bar on the month-to-month chart.

On the month-to-month money index chart, there have been 4 streaks of 8 consecutive bull bars up to now 60 years. There has by no means been a streak of 9 months. Due to this fact, September or October needs to be a bear bar on the money index’s month-to-month chart.

The month-to-month E-mini chart closed on its excessive in a powerful bull development. That makes a minimum of barely larger costs seemingly in September. Additionally, the market tends to rally from Aug. 26 to Sept. 5. Count on extra rally.

If there may be an early rally, search for a doable reversal down on the finish of the month to beneath the open of the month. This may very well be the excessive for the rest of the 12 months. There are solely 4 months left within the 12 months and one would be the excessive of the 12 months.

On the day by day chart, yesterday was an inside day (its excessive was beneath Monday’s excessive and its low was above Monday’s low). It’s subsequently each a purchase and promote sign bar.

For the reason that bull development is powerful, there are in all probability consumers not far beneath yesterday’s low if right this moment had been to get there. The bulls will proceed to purchase each 1- to 3-day pullback, as they’ve been doing for a 12 months and a half.

As a result of yesterday didn’t shut on its excessive and it had a bear physique, it’s not a powerful purchase sign bar. Nonetheless, the development is powerful and the chances proceed to favor larger costs.

The day by day chart reached the measured transfer goal based mostly on the peak of the pandemic crash. It would stall right here for every week or so.

Additionally, there have been 2 legs up from the August 19 low. A rally right this moment can be a 3rd leg up. A 3rd leg up in a good bull channel is a parabolic wedge. It usually attracts revenue takers. Due to this fact, the upside might be restricted to a couple days earlier than there’s a 2- to 3-day pullback.

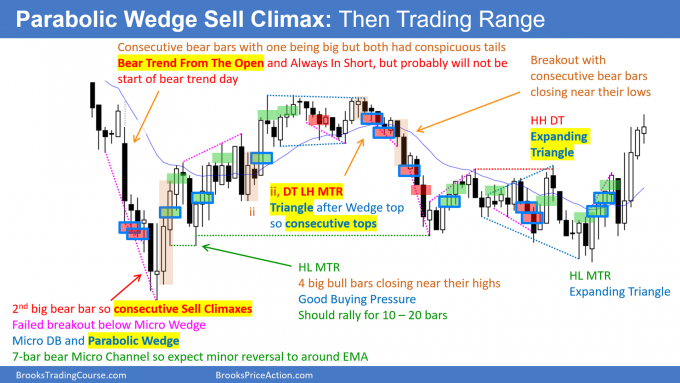

E-mini 5-minute chart and what to anticipate right this moment

E-mini is up 15 factors within the in a single day Globex session. If would possibly hole up above the August excessive.

Small gaps usually shut earlier than the bar closes. Nonetheless, if a small hole on the month-to-month closes, it may well try this at any level within the month and never essentially on the primary day.

If there’s a hole, there may be an elevated probability of a development in both route. Up is extra seemingly as a result of the bull development is so robust on all larger time frames.

If there’s a bull development, it may very well be large as a result of the E-mini may be making a blow-off prime on the day by day chart.

If there’s a bear development, right this moment may very well be an inside day as a result of yesterday’s vary is small.

At the moment will in all probability open across the 4537.00 measured transfer goal on the weekly chart, based mostly on the peak of the pandemic crash.

Yesterday’s E-mini setups

Above is the model that I submit day-after-day. As a result of I usually get questions on what Every day Setups Encyclopedia members see, right this moment I’m together with the instance beneath of that model.

Listed below are a number of affordable cease entry setups from yesterday. I present every purchase entry with a inexperienced rectangle and every promote entry with a crimson rectangle. Patrons of each the Brooks Buying and selling Course and Encyclopedia of Chart Patterns have entry to a way more detailed clarification of the swing trades for every day (see On-line Course/BTC Every day Setups).

My aim with these charts is to current an All the time In perspective. If a dealer was attempting to be All the time In or almost All the time Able all day, and he was not at present out there, these entries can be logical instances for him to enter. These subsequently are swing entries.

It is very important perceive that the majority swing setups don’t result in swing trades. As quickly as merchants are disillusioned, many exit. Those that exit want to get out with a small revenue (scalp), however usually need to exit with a small loss.

If the danger is just too large to your account, you must watch for trades with much less threat or commerce an alternate market just like the Micro E-mini.

[ad_2]