[ad_1]

Initially Revealed At Epoch Instances

“Don’t be bearish.” That was the message delivered by a Wall Road Journal article in August 2021, discussing the “new era” of “monetary media stars.” To wit:

“Because the U.S. retreated amid the pandemic to its couches, thousands and thousands of would-be inventory pickers—some flush with stimulus money—fired up social-media and messaging apps and dove headlong into the world of retail investing.

Many of those influencers haven’t any formal coaching as monetary advisers and no background in skilled investing, main them to select shares based mostly on the whims of well-liked opinion or to dispense money-losing recommendation.”

Since younger traders needed a “fast and simple” roadmap to make “massive earnings,” these on-line “stars” doling out free recommendation was the proper supply.

Nevertheless, such needs to be no shock given the near-vertical market advance from the 2020 lows. Younger traders have elevated monetary danger with the “Fed” offering insurance coverage in opposition to loss. We’ve got famous a few of these tales beforehand.

As we famous then, the actions of retail traders had been all too paying homage to what we witnessed main as much as the “Dot.com” crash. Nevertheless, you possibly can hardly blame them, given that is the one investing atmosphere they’ve ever identified.

However therein lies the remainder of the story.

Solely One-Half Of The Story

In accordance, to the article, there are solely 3-rules you want to know to be a “social media monetary star.”

- Be Relatable

- Promote The Dream

- All Bulls, No Bears

In different phrases, in case you are making use of for a job, the signal states: “Don’t be bearish. No expertise required.”

Technology Z, born between 1992 and 2002, was between 5 and 16 years outdated throughout the monetary disaster. Such is a crucial level as a result of they’ve by no means actually skilled a “bear market.”

Any recommendation they could have acquired from monetary advisors suggesting warning, asset allocation, or danger administration was repeatedly confirmed to underperform the market.

“Ha….Boomers simply don’t get it.”

Such led to a extreme case by retail traders who demanded a bullish bias. To wit:

“Like most web content material, influencer movies thrive on reputation. And within the midst of a long-running bull market, what’s well-liked are success tales and sizzling suggestions solely.

Many influencers report that after they hype an funding, they get the web page views they crave. When the message is bearish, nevertheless, viewers flip away, or worse, assault the messenger with vicious trolling.“ – WSJ

The issue with the “don’t be bearish” bias needs to be evident. Solely listening to one-half of the story makes traders “blindsided” by the opposite half.

“We all know that day buying and selling doesn’t produce long-term wealth for the overwhelming majority of people that do it, however these influencers are preying on that a part of the human mind that has fewer inhibitions, that thinks: ‘I would be the exception.’ That results in hypothesis and different kinds of very high-risk habits.” – Ted Klontz, Professor Of Behavioral Finance, Creighton College.

The demand by Gen Z’ers for “don’t be bearish” commentary is why they ignored the identical indicators that negatively impacted each Millennials and Boomers beforehand.

It Was Enjoyable Whereas It Lasted

As we speak’s downside for younger retail traders is that the markets “defied logic” so typically that it turned synonymous with “crying wolf.” Positive, valuations are traditionally costly, however “so what.” The Fed is continuous to push financial lodging.

“Don’t be bearish.” Yep, it was enjoyable whereas it lasted.

For the reason that center of 2021 and persevering with in 2022, the speculative fervor of retail traders chasing shares like AMC Leisure Holdings (NYSE:), GameStop (NYSE:), Mattress Bathtub & Past (NASDAQ:), and lots of others, ended simply as anticipated.

As rates of interest rose, liquidity reversed, and the Fed turned extra aggressive on financial coverage, the “YOLO” shares turned “OH NO.”

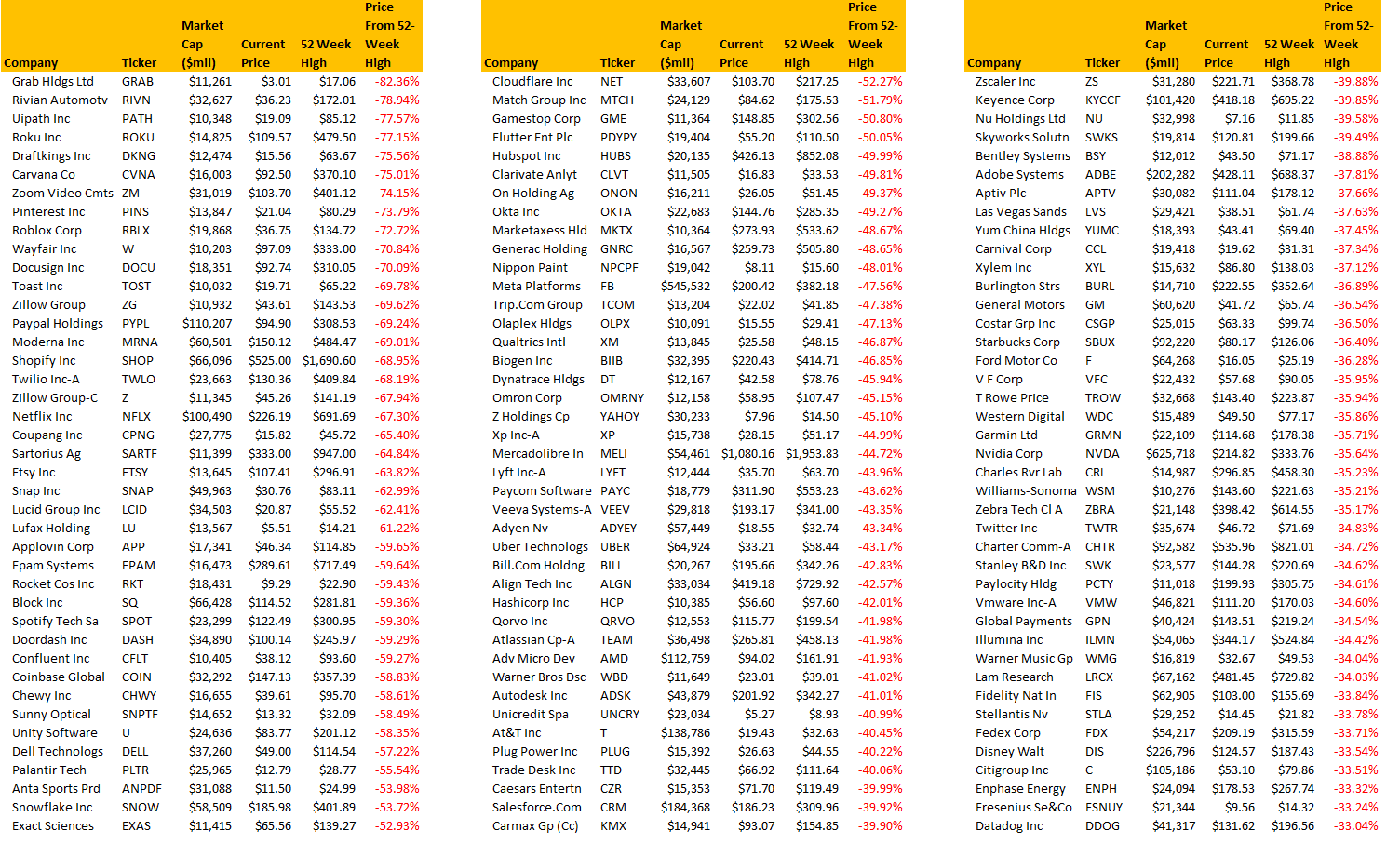

Because the desk beneath reveals, of the 700 corporations screened with market capitalizations above $7 billion, the 120 corporations confirmed essentially the most value destruction from their 52-week highs.

Many had been the “meme inventory” favorites like Zillow (NASDAQ:), Zoom Video (NASDAQ:), Pinterest (NYSE:), Netflix (NASDAQ:), and many others. These corporations are down 33% or extra from their 52-week highs.

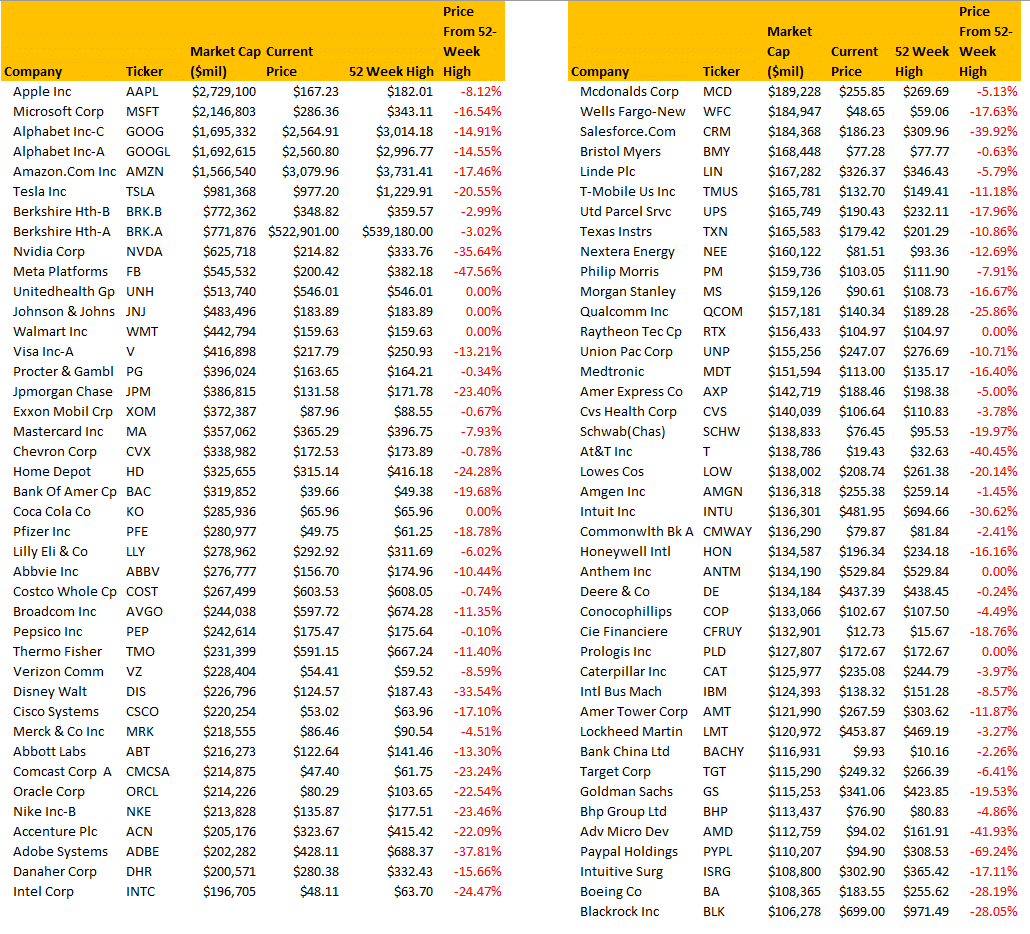

The next desk beneath reveals the 81 corporations with the biggest market capitalization. You’ll be aware many corporations which are down considerably greater than the index in 2022.

Firms like NVIDIA (NASDAQ:), Fb (NASDAQ:) (Meta), Salesforce (NYSE:), PayPal Holdings (NASDAQ:), Qualcomm (NASDAQ:), and even Tesla (NASDAQ:) are down 20% or extra from their 52-week highs.

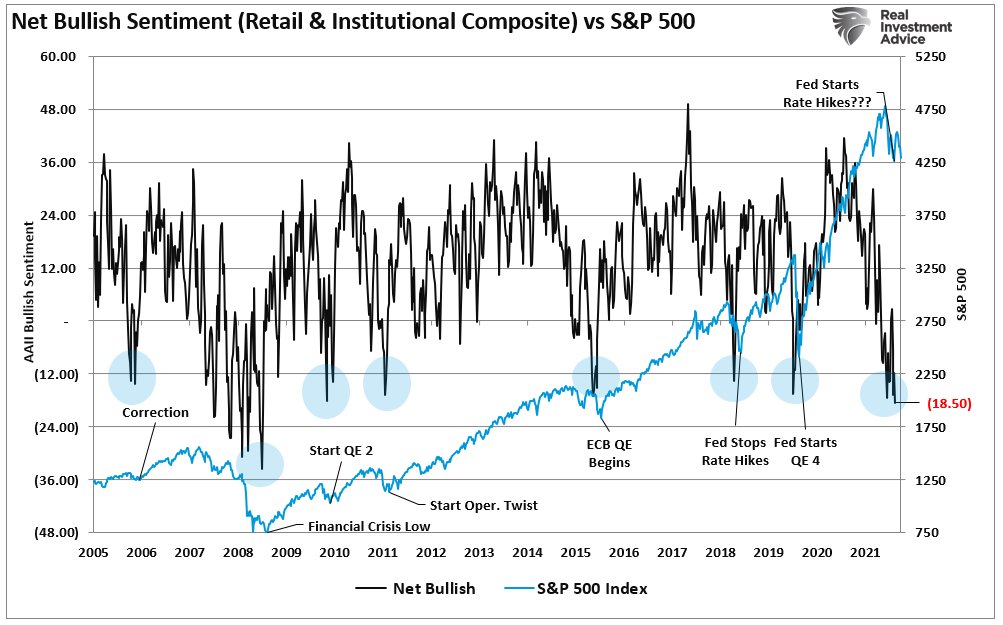

In fact, that destruction of capital weighs on investor sentiment. Whereas retail traders loved the liquidity-induced “feeding frenzy,” many have now suffered a extreme “bear market” of their portfolios.

Not surprisingly, investor sentiment is at ranges most frequently related to extra important corrections and main bear markets.

We Tried To Warn You

As famous in our earlier posts, the motion by younger retail traders was comprehensible. Flush with a “stimmy” test and a buying and selling app, the “Wall Road on line casino” was open for enterprise.

Nevertheless, the end result of younger traders approaching the market with a “can’t lose” angle was evident. Whereas social media stars “received wealthy” for his or her free “don’t be bearish” investing recommendation, it’s value noting their “riches” didn’t come from their investing talent.

As an alternative, it got here from their talent in producing merchandise and adverts. Such is just not a lot totally different than how Wall Road makes its cash.

Expertise tends to be a brutal instructor, however it’s only by way of expertise that we learn to construct wealth efficiently over the long run.

As Ray Dalio as soon as quipped:

“The largest mistake traders make is to consider that what occurred within the latest previous is prone to persist. They assume that one thing that was a very good funding within the latest previous continues to be a very good funding. Usually, excessive previous returns merely indicate that an asset has develop into costlier and is a poorer, not higher, funding.”

Such is why each nice investor in historical past, in numerous kinds, has one primary investing rule in widespread:

“Don’t lose cash.”

The reason being easy: you’re out of the sport should you lose your capital.

Many younger traders have gained loads of expertise by giving most of their cash to these with expertise.

It is among the oldest tales on Wall Road.

So, whereas Millennials had been fast to dismiss the “Boomers” within the monetary markets for “not getting it.”

There was a extra easy fact.

We did “get it.”

We’ve got been round lengthy sufficient to know the way these items finally finish.

[ad_2]