[ad_1]

Fed chairs feedback spur reversals

The Fed chair pivoted by retiring “transitory” from inflation.

The influence as seen the US shares transfer decrease (with the Nasdaq shifting from optimistic to down -1.24%). The USD has reversed increased, and the yields have come off low ranges.

A snapshot of the inventory market at present exhibits:

- Dow Jones -500 factors or -1.43% at 34635

- S&P index -63 factors or -1.36% at 4591.50

- NASDAQ index -209 factors or -1.32% at 15573.90

- Russell 2000-40.318 factors or -1.8% at 2201.65

within the US debt market:

- 2 12 months is up 20.537% after buying and selling as little as 0.441%

- 5year 1.181% after buying and selling as little as 1.070%

- 10 12 months 1.475% after buying and selling as little as 1.412%

- 30 12 months 1.815% after buying and selling as little as 1.795%

IN different markets:

- Spot gold has turned again damaging and at present trades $-6.50 or -0.36% at $1778. It traded as excessive as $1808.72 earlier than reversing course

- WTI crude oil futures are nonetheless down $-2.78 at $67.24 however off the lows of $66.54

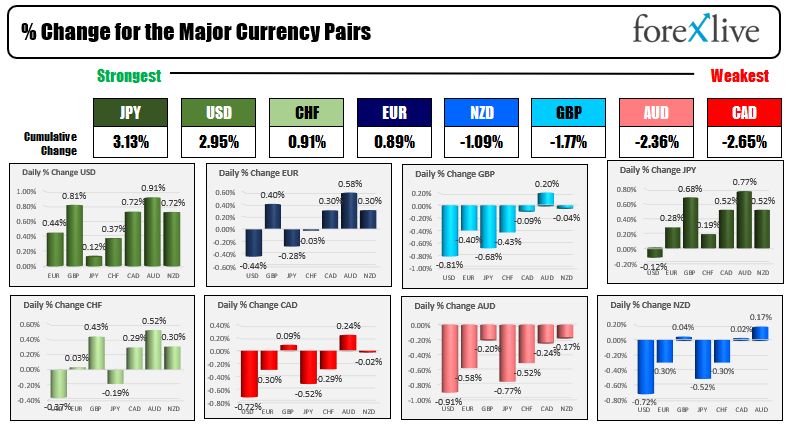

The US greenback went from the weakest currencies to one of many strongest. The JPY is the strongest adopted by the USD. The CAD and AUD are the weakest.

[ad_2]