[ad_1]

Tech firm Snowflake (NYSE:), went public in September 2020 at a gap worth of $230.76. Shares of the Montana-based cloud computing-based knowledge warehousing firm closed at $293.80 on Sept. 29, which signifies that within the final yr the inventory gained about 25%.

The 52-week vary for SNOW inventory has been between $184.71 (Might 2021) – $429.00 (August 2020). The corporate’s market capitalization stands at $88.1 billion.

Snowflake launched sturdy Q2 on Aug. 25. SNOW’s platform “allows knowledge storage, processing and analytic options which are quicker, simpler to make use of, and way more versatile than conventional choices.”

In the course of the quarter, complete income was $272.2 million, representing 104% year-over-year development. Of that quantity, product income was $254.6 million and rose 103% YOY.

The corporate elevated its forecast for FY21 product income development. Buyers have been additionally happy to see Snowflake has virtually 5,000 purchasers. Of these, 116 have every contributed greater than $1 million in income previously 12 months.

Earlier than the quarterly announcement, SNOW inventory was buying and selling round $285. On Sept. 17, it hit an intraday excessive of $328.06. Nevertheless, since then the shares have come underneath strain and misplaced round 11%.

Subsequent Transfer In SNOW Inventory?

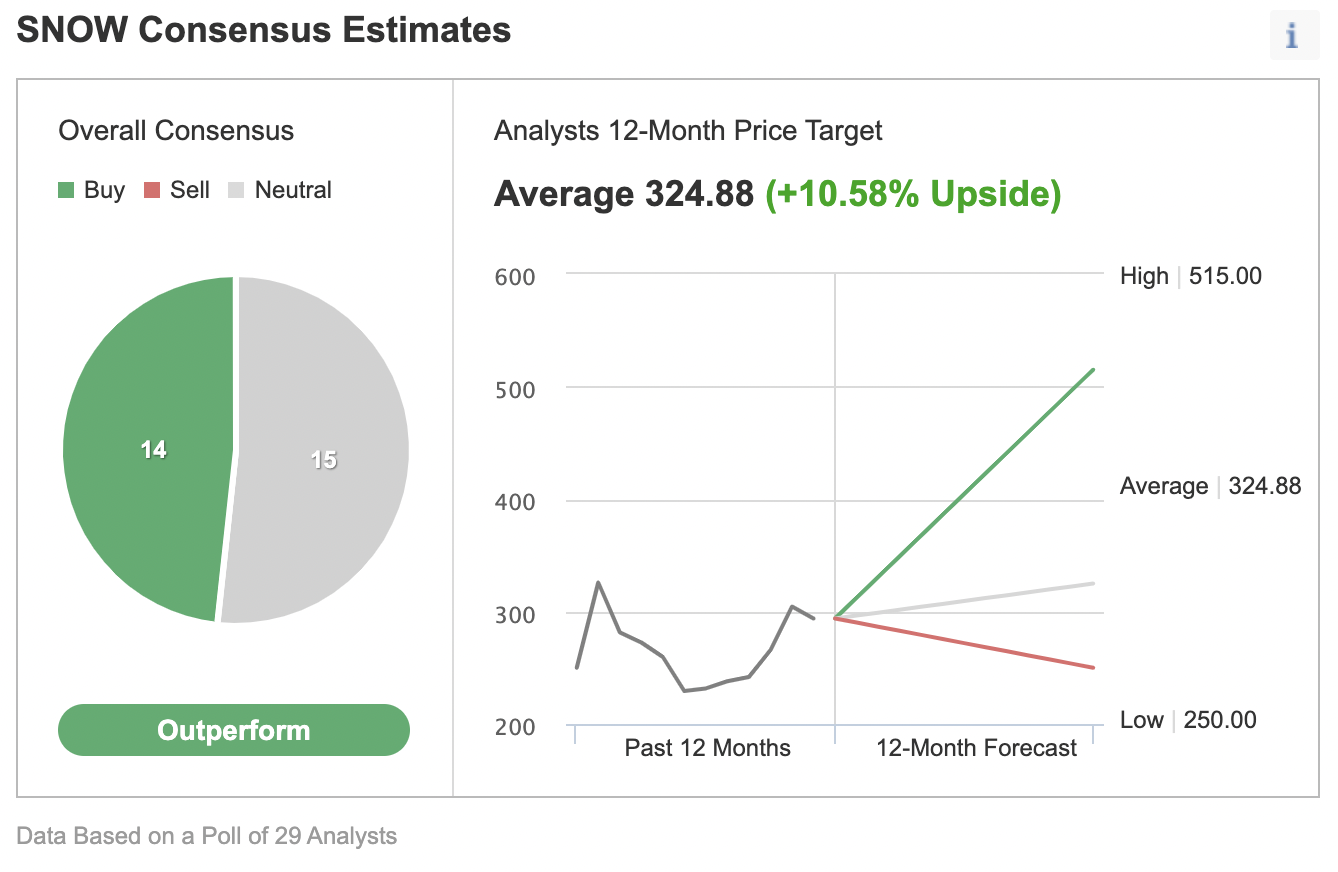

Amongst 29 analysts polled by way of Investing.com, SNOW shares have an “outperform” score, with a mean 12-month worth goal of $324.88. Such a transfer would suggest a rise of about 10% from the present stage. The goal vary is between $250 and $515.

Chart: Investing.com

In different phrases, Wall Road is optimistic concerning the long-term transfer in SNOW inventory regardless of the current choppiness. Thus, plenty of traders would possibly take into account shopping for the inventory for his or her long-term portfolios. However investing in 100 shares of Snowflake inventory would value round $29,380, a substantial funding for most individuals.

In the meantime, others may nonetheless be nervous about how far the inventory may doubtlessly fall earlier than making a brand new bull leg up. Due to this fact, some traders would possibly desire to place collectively a “poor particular person’s lined name” on the inventory as a substitute.

So, at the moment we introduce a diagonal debit unfold on SNOW by utilizing LEAPS choices, the place each the revenue potential and danger are restricted. Such a technique may very well be used to duplicate a lined name place at a significantly decrease value, and likewise assist lower the portfolio volatility.

Buyers who’re new to choices would possibly wish to revisit our earlier articles on LEAPS choices first (for instance, and ) earlier than studying additional.

Diagonal Debit Unfold On SNOW Inventory

Present Value: $293.80

A dealer first buys a “longer-term” name with a decrease strike worth. On the similar time, the dealer sells a “shorter-term” name with a better strike worth, creating an extended diagonal unfold.

Thus, the decision choices for the underlying inventory have completely different strikes and completely different expiration dates. The dealer goes lengthy one choice and shorts the opposite to make a diagonal unfold.

On this technique, each the revenue potential and danger are restricted. The dealer establishes the place for a web debit (or value). The online debit represents the utmost loss.

Most merchants coming into such a technique can be mildly bullish on the underlying safety. As a substitute of shopping for 100 shares of SNOW, the dealer would purchase a deep-in-the-money LEAPS name choice, the place that LEAPS name acts as a “surrogate” for proudly owning the inventory.

For the primary leg of this technique, the dealer would possibly purchase a deep in-the-money (ITM) LEAPS name, just like the SNOW 19 Jan. 2024, 220-strike name choice. This feature is presently supplied at $113.35. It will value the dealer $11,335 to personal this name choice that expires in lower than two and a half years as a substitute of $29,380 to purchase the 100 shares outright.

The delta of this selection is near 80. Delta exhibits the quantity an choice’s worth is anticipated to maneuver primarily based on a $1 change within the underlying safety.

If SNOW inventory goes up $1 to $294.80, the present choice worth of $113.35 can be anticipated to extend by roughly 80 cents, primarily based on a delta of 80. Nevertheless, the precise change may be barely roughly relying on a number of different elements which are past the scope of this text.

For the second leg of this technique, the dealer sells a barely out-of-the-money (OTM) short-term name, just like the SNOW 17 Dec. 2021 300-strike name choice. This feature’s present premium is $20.70. The choice vendor would obtain $2,070, excluding buying and selling commissions.

There are two expiration dates within the technique, making it fairly troublesome to provide a precise method for a break-even level on this commerce. Totally different brokers would possibly provide “profit-and-loss calculators” for such a commerce setup.

Calculating the worth of the back-month choice (i.e., LEAPS name) when the front-month (i.e., the shorter-dated) name choice expires requires a pricing mannequin to get a “guesstimate” for a break-even level.

Most Revenue Potential

The utmost potential is realized if the inventory worth is the same as the strike worth of the brief name on its expiration date. So the dealer desires the SNOW inventory worth to stay as near the strike worth of the brief choice (i.e., $300 right here) as doable at expiration (on Dec. 17, 2021), with out going above it.

Right here, the utmost return, in principle, can be about $2,430 at a worth of $300 at expiry, excluding buying and selling commissions and prices. (We arrived at this worth utilizing an choices profit-and-loss calculator). With out using such a calculator, we may additionally arrive at an approximate greenback worth. Let’s have a look:

The choice vendor (i.e., the dealer) acquired $2,070 for the bought choice. In the meantime, the underlying SNOW inventory elevated from $293.80 to $300, a distinction of $7.20 per share, or $720 for 100 shares.

As a result of the delta of the lengthy LEAPS choice is taken as 80, the worth of the lengthy choice will, in principle, improve by $675 X 0.8 = $540.

Nevertheless, in follow, it may be roughly than this worth. There’s, for instance, the component of time decay that will lower the value of the choice. In the meantime, modifications in volatility may improve or lower the choice worth as effectively.

The overall of $2,070 and $540 involves $2,610. Though it isn’t the identical as $2,480, we will regard it as a suitable approximate worth.

Understandably, if the strike worth of our lengthy choice had been completely different (i.e., not $220.00), its delta would have been completely different, too. Then, we might want to make use of that delta worth to reach on the approximate remaining revenue or loss worth.

Right here, by not investing $29,380 initially in 100 shares of SNOW, the dealer’s potential return is leveraged.

Ideally, the dealer hopes the brief name will expire out-of-the cash (nugatory). Then, the dealer can promote one name after the opposite, till the lengthy LEAPS name expires in a couple of yr and half.

Backside Line On SNOW Inventory

Excessive development expertise shares usually want quick income development and robust buyer retention—two catalysts that Snowflake has. Administration believes it may attain $10 billion in product income by the tip of the last decade.

As such, we discover SNOW inventory to be a stable alternative for many portfolios, both as a buy-and-hold funding or as a part of a buying and selling technique instance given above.

[ad_2]