[ad_1]

- Shares of Cisco Methods are down greater than 31.5% because the begin of 2022

- New software program and chip expertise to be introduced throughout Cisco Reside occasion

- Lengthy-term traders might contemplate investing now

- For instruments, knowledge, and content material that will help you make higher investing selections, attempt InvestingPro+.

Shareholders within the networking gear chief Cisco Methods (NASDAQ:) have seen the worth of their investments decline nearly 20% over the previous 12 months and 31.8% thus far this 12 months. By comparability, the and index are down roughly 30.7% and 31.7%, respectively in 2022.

Supply: Investing.com

On Dec. 29, shares within the San Jose, US-based world communications gear behemoth went over $64 to hit a multi-year excessive. Nevertheless, on Could 19, shares noticed a multi-year low of $41.02. The inventory’s 52-week vary has been $41.02-$64.28, whereas the market capitalization at the moment stands at $178.2 billion.

Cisco enjoys spectacular ranges of market share in several segments. As an illustration, within the enterprise community infrastructure market, it instructions greater than 55% of the market.

It additionally has a dominating place within the ethernet change and enterprise WLAN markets. In 2021, Cisco Methods noticed the “largest telco market share achieve”.

As we write, administration is holding the Cisco Reside occasion, which usually options new software program releases and chip expertise enhancements.

Current Metrics

Cisco Methods launched Q3 figures on Could 18. nearly flat year-over-year, coming in at $12.8 billion. Adjusted web earnings of $3.6 billion translated into 87 cents per share, up 5%. The tech identify ended the quarter with $7.7 billion in money and equivalents.

On the metrics, CEO Chuck Robbins stated:

“We continued to see strong demand for our applied sciences and our enterprise transformation is progressing effectively. Whereas COVID lockdowns in China and the battle in Ukraine impacted our income within the quarter, the basic drivers throughout our enterprise are sturdy and we stay assured in the long run.”

For This autumn, the corporate expects its revenues to say no by 1% to five.5% YoY and EPS to return between 76 cents and 84 cents. Provide-chain challenges, geopolitical issues, and continued lockdowns in China are prone to imply headwinds for the corporate.

Previous to the discharge of the quarterly outcomes, CSCO inventory was round $50. Worse-than-expected Q3 top-line numbers and the This autumn steerage that was weaker than analysts’ forecast triggered one other sell-off in CSCO inventory.

On the time of writing, the inventory is altering palms at $42.90, down greater than 14%. Nevertheless, potential traders might need to know that even on the low finish of steerage, Cisco continues to be anticipated to ship document EPS numbers. Lastly, the present share worth additionally helps a dividend yield of three.5%.

Subsequent Transfer In CSCO Inventory

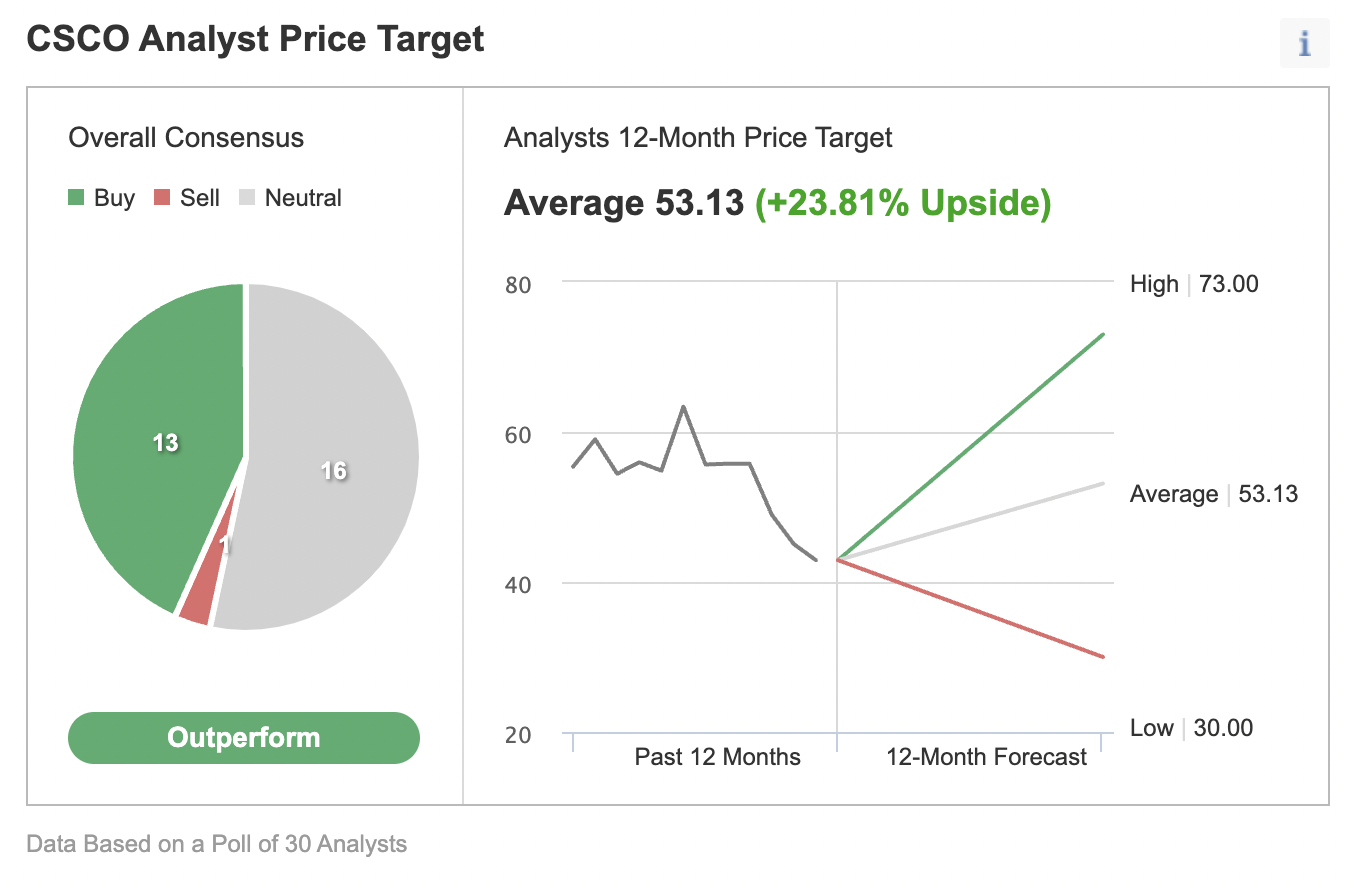

Amongst 30 analysts polled by way of Investing.com, CSCO inventory has an “outperform” score. Wall Road has a 12-month median worth goal of $53.13 for the inventory, suggesting a rise of greater than 23% from the present worth. The 12-month worth vary at the moment stands between $30 and $73.

Supply: Investing.com

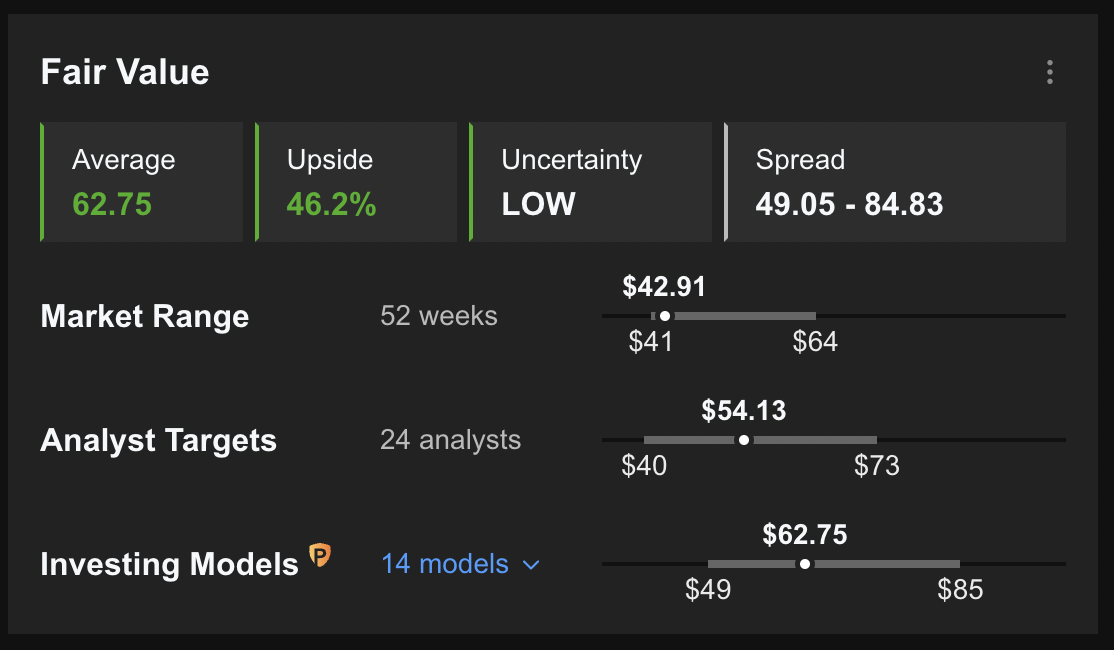

Equally, in response to plenty of valuation fashions together with P/E or P/S multiples or terminal values, the typical honest worth for CSCO inventory on InvestingPro stands at $62.75.

Supply: InvestingPro

In different phrases, basic valuation suggests shares might enhance by 46%.

Readers who watch technical charts is perhaps to know that plenty of Cisco’s short- and intermediate-term oscillators are oversold. Though they will keep prolonged for weeks—if not months—the decline within the CSCO share worth is also coming to an finish.

Our expectation is for CSCO to search out sturdy help across the $42.5 degree. Though it’d initially dip beneath it, shares are prone to bounce again earlier than too lengthy. Afterward, Cisco inventory would probably commerce sideways whereas it establishes a brand new base.

Money-Secured Places On Cisco Methods

Worth Now: $42.90

Traders who aren’t involved with day by day strikes in worth and who consider within the long-term potential of the corporate might contemplate investing in CSCO inventory now. They might count on the shares to make a transfer towards $53.13, or analysts’ estimate.

Those that are skilled with choices might additionally contemplate promoting a cash-secured put choice in CSCO inventory—a method we usually cowl. Because it entails choices, this setup won’t be acceptable for all traders.

Such a bullish commerce might particularly enchantment to those that need to obtain premiums (from put promoting) or to presumably personal Cisco shares for lower than their present market worth of $42.90.

A put choice contract on CSCO inventory is the choice to promote 100 shares. Money-secured means the investor has sufficient cash in his or her brokerage account to buy the safety if the inventory worth falls and the choice is assigned. This money reserve should stay within the account till the Cisco choice place is closed, expires, or is assigned, which suggests possession has been transferred.

Let’s assume an investor needs to purchase Cisco inventory, however doesn’t need to pay the total worth of $42.90 per share. As an alternative, the investor would like to purchase the shares at a reduction throughout the subsequent a number of months.

One risk can be to attend for CSCO inventory to fall additional, which it’d or may not do. The opposite risk is to promote one contract of a cash-secured Cisco Methods put choice.

So the dealer would sometimes write an at-the-money (ATM) or an out-of-the-money (OTM) put choice and concurrently put aside sufficient money to purchase 100 shares of the inventory.

Let’s assume the dealer is placing on this commerce till the choice expiry date of Aug. 19. Because the inventory is $42.90 on the time of writing, an OTM put choice would have a strike of $40.

So the vendor must purchase 100 shares of Cisco on the strike of $40 if the choice purchaser had been to train the choice to assign it to the vendor.

The CSCO Aug. 19 40-strike put choice is at the moment provided at a worth (or premium) of $1.45.

An choice purchaser must pay $1.45 X 100, or $145, in premium to the choice vendor. This premium quantity belongs to the choice vendor it doesn’t matter what occurs sooner or later. The put choice will cease buying and selling on Friday, Aug. 19.

Assuming a dealer would enter this cash-secured put choice commerce at $42.90 now, at expiration on Aug. 19, the utmost return for the vendor can be $145, excluding buying and selling commissions and prices.

The vendor’s most achieve is that this premium quantity if CSCO inventory closes above the strike worth of $40. Ought to that occur, the choice expires nugatory.

If the put choice is within the cash (that means the market worth of Cisco inventory is decrease than the strike worth of $40) any time earlier than or at expiration on Aug. 19, this put choice will be assigned. The vendor would then be obligated to purchase 100 shares of CSCO inventory on the put choice’s strike worth of $40 (i.e. at a complete of $4,000).

The break-even level for our instance is the strike worth ($40) much less the choice premium obtained ($1.45), i.e., $38.55. That is the worth at which the vendor would begin to incur a loss.

Money-secured put promoting is a reasonably extra conservative technique than shopping for shares of an organization outright on the present market worth. This generally is a technique to capitalize on the choppiness in Cisco Methods inventory within the coming weeks.

Traders who find yourself proudly owning CSCO shares because of promoting places might additional contemplate organising coated calls to extend the potential returns on their shares. Thus, promoting cash-secured places could possibly be considered step one in inventory possession.

***

Seeking to rise up to hurry in your subsequent concept? With InvestingPro+ yow will discover

- Any firm’s financials for the final 10 years

- Monetary well being scores for profitability, progress, and extra

- A good worth calculated from dozens of monetary fashions

- Fast comparability to the corporate’s friends

- Basic and efficiency charts

And much more. Get all the important thing knowledge quick so you may make an knowledgeable choice, with InvestingPro+. Be taught Extra »

[ad_2]