[ad_1]

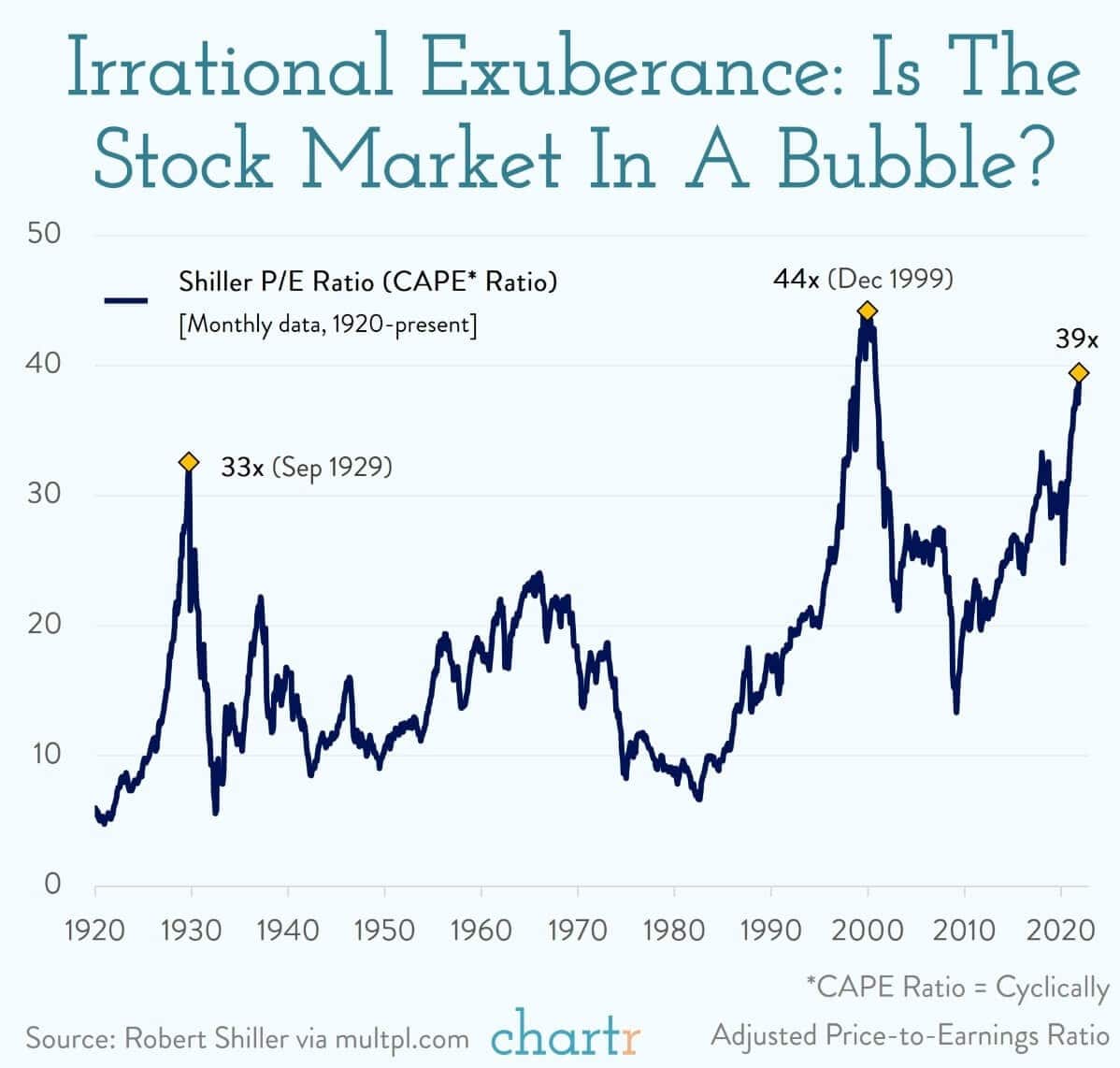

The “shopping for” stampede continues, pushing inventory market valuations to extremes. As of Friday, the Shiller PE valuation rose above 40. As famous in “Did The Fed Set The Market Up For A Crash,” present valuations now dwarf that seen in 1929 and solely bettered by the latter months of 1999.

Whereas the inventory market rallies, pushing valuations increased, there are regarding indicators a peak could also be close to. As an example, the volatility index is increased. Sometimes shares and volatility are negatively correlated. Thus, on the uncommon instances after they do transfer upwards in unison, a reversal in inventory costs is predicted.

What To Watch In the present day

Earnings

Pre-market

- 6:30 a.m. ET: Coty (NYSE:) to report adjusted earnings of three cents on income of $1.36 billion

Put up-market

- 4:00 p.m. ET: Roblox (NYSE:) to report adjusted losses of 19 cents on income of $639.86 million

- 4:00 p.m. ET: SmileDirectClub (NASDAQ:) to report adjusted losses of 12 cents on income of $185.09 million

- 4:05 p.m. ET: Virgin Galactic(NYSE:) to report adjusted losses of 29 cents on income of $1.83 million

- 4:05 p.m. ET: Zynga (NASDAQ:) to report adjusted losses of 53 cents on income of $708.25 million

- 4:05 p.m. ET: TripAdvisor (NASDAQ:) to report adjusted earnings of 24 cents on income of $303.5 million

- 4:05 p.m. ET: Clover Well being (NASDAQ:) to report adjusted losses of 23 cents on income of $338.67 million

- 4:05 p.m. ET: The RealReal (NASDAQ:) to report adjusted losses of 49 cents on income of $113.73 million

- 4:15 p.m. ET: PayPal (NASDAQ:) to report adjusted earnings of $1.07 on income of $6.23 billion

- 4:15 p.m. ET: AMC Leisure (NYSE:) is predicted to report adjusted losses of 53 cents on income of 708.25 million

- 4:35 p.m. ET: Lemonade (NYSE:) to report adjusted losses of $1.16 on income of $33.81 million

Courtesy of Yahoo

Market Again To Excessive Overbought

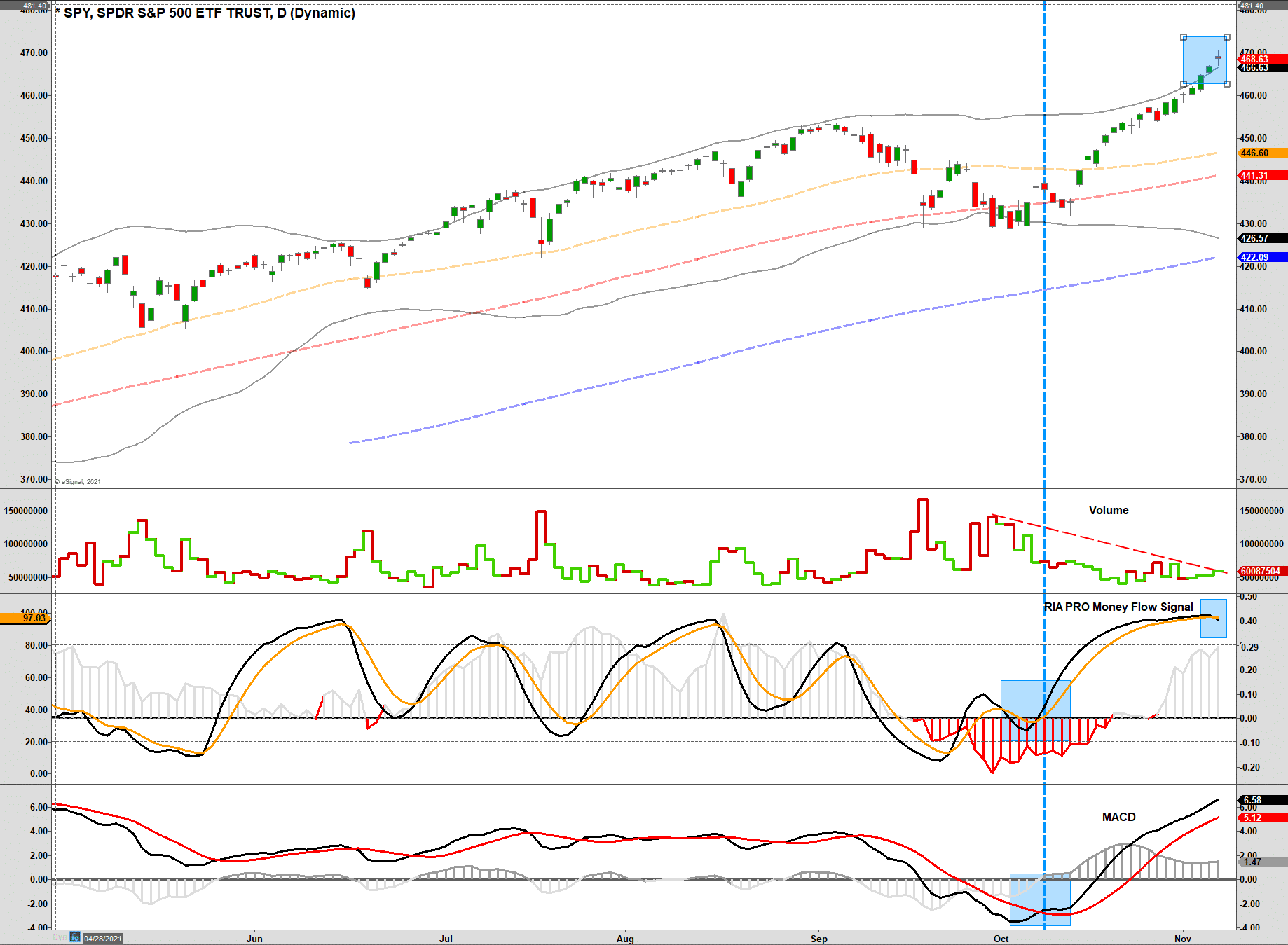

Within the short-term “valuations” matter little to the inventory market. The extra important concern to the stays the underlying technical situation of the market. Whereas the rally has been spectacular, rising to all-time highs, the market is now again to extra excessive overbought ranges.

Moreover, our “cash circulate purchase sign” is close to a peak and barely triggered a “promote sign.” Nonetheless, with the MACD nonetheless optimistic, the sign suggests a consolidation reasonably than correction. Nonetheless, a confirming MACD typically aligns with short-term corrections at a minimal. Subsequently we are going to watch that sign carefully. Additionally, this whole rally from the latest lows has been on very weak quantity, which suggests a scarcity of dedication.

Demand For Put Choices Falls To Low

As we’ve famous beforehand, inventory market valuations, by themselves, are a horrible timing metric. Nonetheless, they inform us an excellent deal about anticipated future returns and present market psychology.

In the case of “irrational exuberance,” there are different indicators higher at revealing hypothesis within the markets which have preceded a inventory market crash.

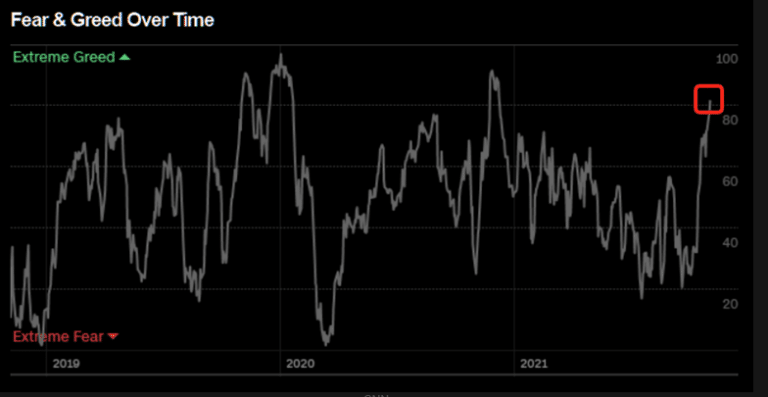

The CNN Concern/Greed index is now at excessive greed territory.

Chart courtesy of TheMarketEar by way of Zerohedge

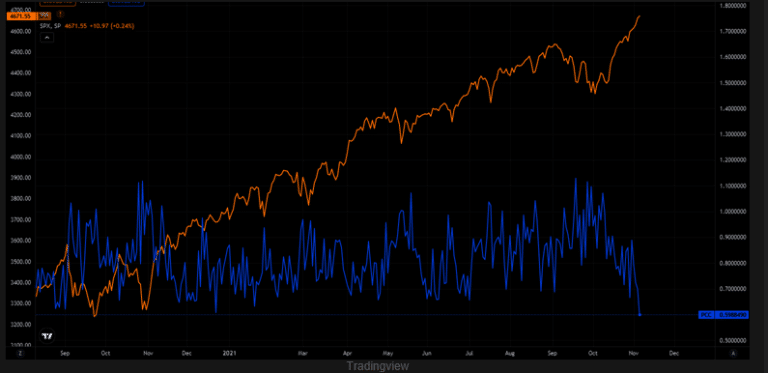

Moreover, the demand for defense towards a inventory market crash (put choices) fell to new lows.

Chart courtesy of TheMarketEar by way of Zerohedge

Traditionally, such durations of “speculative” exercise led to a minimal of short-term inventory market corrections, however a crash shouldn’t be past the realm of potentialities.

S&P 500 File-Setting Streak

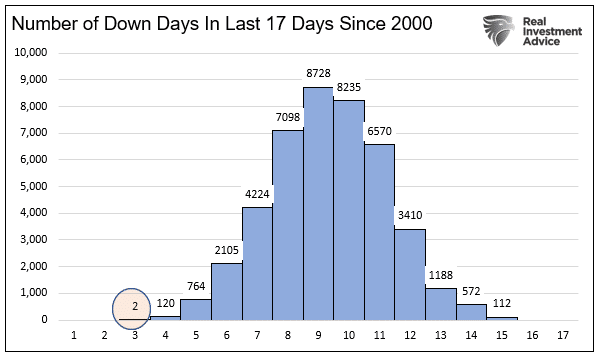

At present, the bulls management the market as we’re in the midst of a “shopping for stampede.” Traditionally, shopping for stampedes final on common between 7 and 12 days. Logically, shopping for stampedes all the time get adopted by promoting stampedes of comparable lengths. Nonetheless, there are occasions these stampedes can final for much longer than anticipated.

We’re at present in a kind of longer-term durations. As proven beneath, the has solely been down in 2 of the final 18 days. How uncommon is that? Within the earlier 20-years of the S&P 500, the variety of instances the market completed such a feat was exactly ZERO.

Quantity Of Down Days In Final 17 Days Since 2000

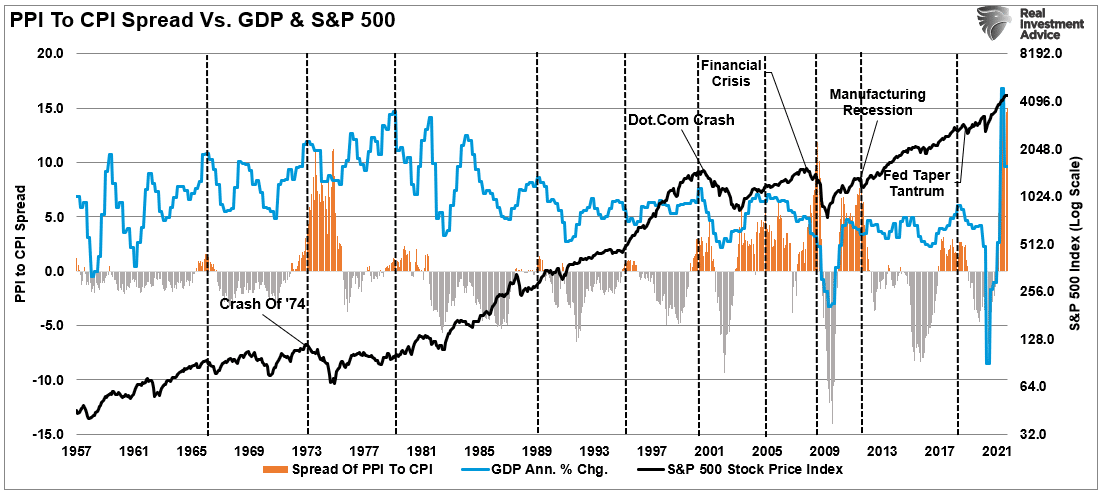

Producer Worth Inflation Versus Client Worth Inflation

At present, with on the highest unfold to in historical past, it suggests producers can’t go on prices to prospects. Such equates to weaker revenue margins and earnings sooner or later. Nonetheless, in the event that they elect to go these prices onto customers, such will increase residing prices effectively above wages.

As Michael famous final week:

“‘Selling the soundness of the monetary system’ appears to be an unofficial mandate. May the Fed be dragging their toes to scale back crisis-driven coverage as a result of they concern a inventory market crash? Extra particularly, can excessive inventory valuations be justified with out an excessively aggressive Fed?

The newest Fed assembly makes it more and more clear that financial coverage modifications are extra a perform of the asset markets and never the Fed’s congressionally said mandates.”

The Fed’s option to ignore inflation danger is probably going unwise. Earlier spikes within the inflation unfold aligned with weaker financial development, inventory market contractions, or crashes.

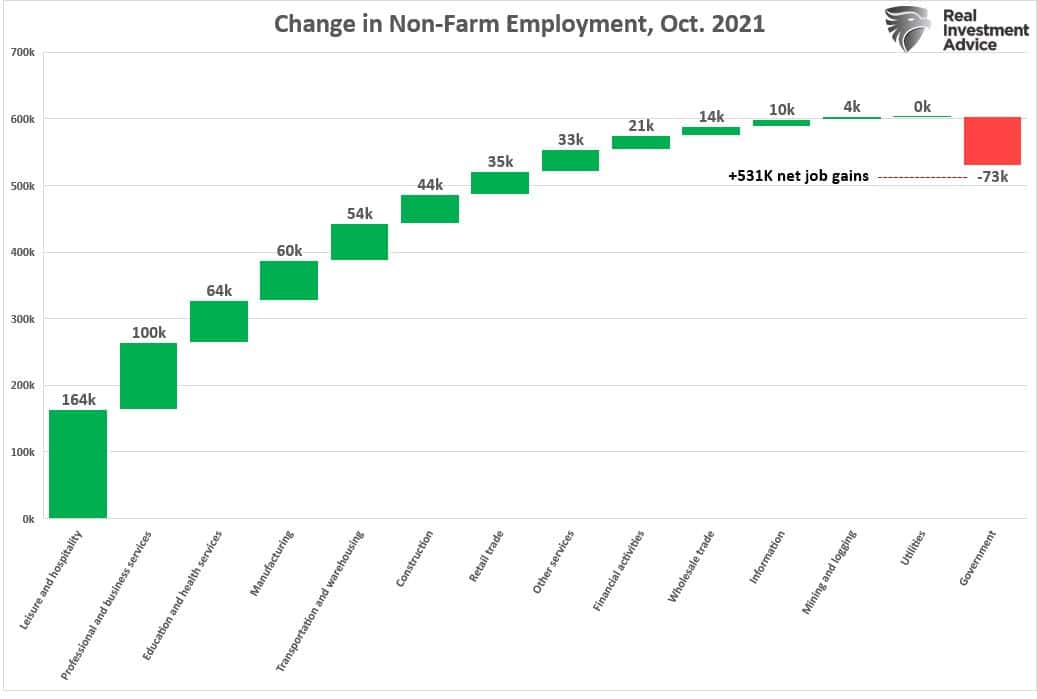

The BLS Employment Report

As foreshadowed by Wednesday’s ADP report, the was robust. 531k jobs had been added in October, bringing the right down to 4.6% from 4.8%. The prior two months had been revised increased by 235k jobs. Month-to-month slipped from +0.6% to +.04%, however wages rose 4.9% versus 4.6% on a year-over-year foundation. The common workweek declined by a tenth of an hour, stunning given the robust demand for labor. Jerome Powell’s key determine, the labor participation fee, was unchanged from final month regardless of the robust job development. Throughout his submit FOMC , he talked about on quite a few events that he want to see the participation fee rise earlier than entertaining fee hikes.

The graph beneath exhibits October’s employment positive aspects or losses by trade. As proven, leisure and hospitality added 164k jobs to the economic system, accounting for nearly one-third of the brand new jobs. The federal government sector was the one sector to lose jobs.

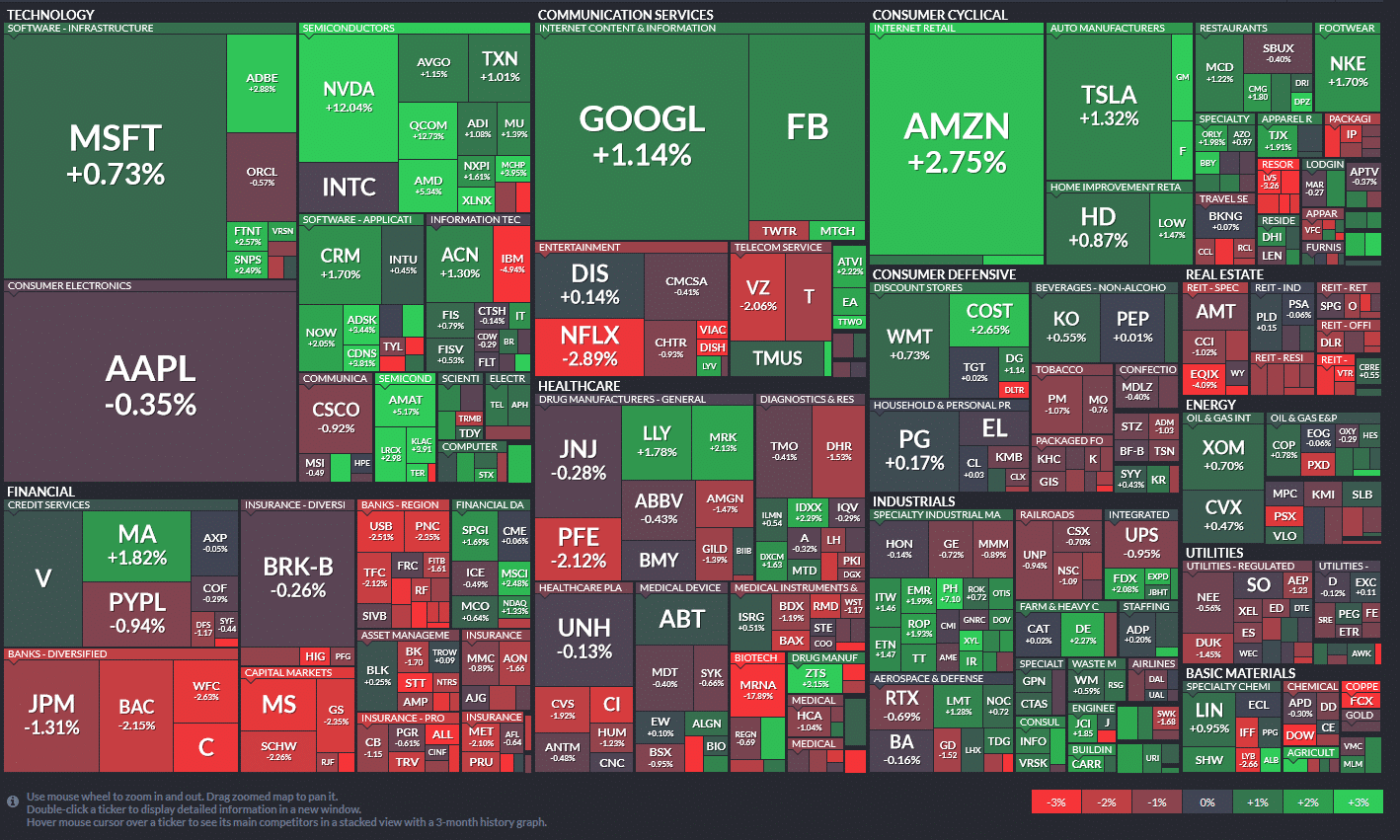

Ripples In Nonetheless Water

On the floor, on Friday, essentially the most adopted inventory indexes gave the looks of simply one other wholesome market rise. The S&P was up 20 factors and the up 1.25%. The tech sector carried the load with semiconductor shares, notably being the most effective performers. Nonetheless, beneath the floor, there are ripples. The warmth map beneath exhibits over half the shares within the S&P 500 had been down on the day. Additionally of concern, the volatility index rose 5%, bond yields fell sharply, and gold was up 1.75%. Divergences and poor breadth are price watching as they will sign a change in route. Our fashions are alerting us to overbought situations, so a drawdown wouldn’t be stunning.

[ad_2]