[ad_1]

- Ruble-denominated Bitcoin volumes reached a 9-month excessive as traders fled to safe-haven property.

- A lot of the buying and selling is on cryptocurrency change Binance, in accordance with particulars cited by CoinDesk.

Increasingly more folks have regarded to purchase Bitcoin and different cryptocurrencies throughout Russia and Ukraine amid the impression of warfare on native currencies, information exhibits.

In accordance with information from crypto monitoring web site Kaiko, ruble and Ukrainian hryvnia-to-crypto volumes have shot up previously week to multi-month highs.

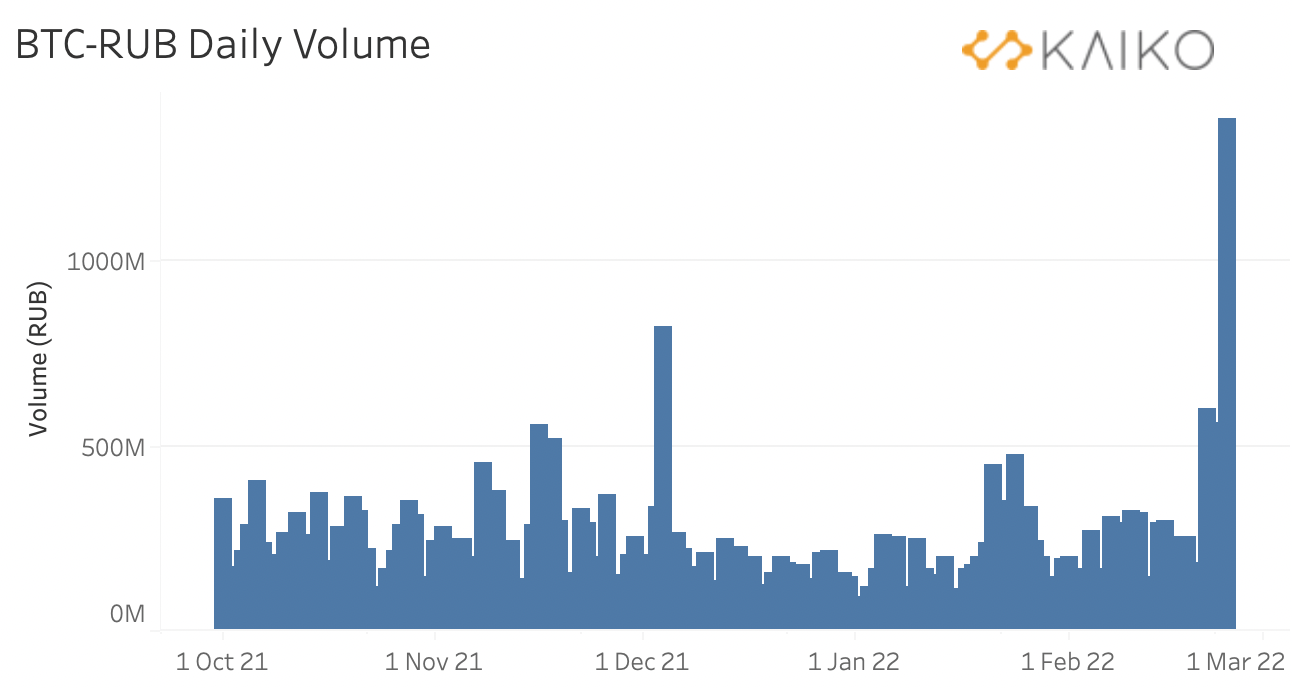

Per the info, buying and selling volumes denominated within the ruble-bitcoin (BTC-RUB) pair elevated sharply to hit ranges final seen in April-Could 2021.

Ruble-denominated BTC quantity soared by 1.5 billion RUB on 24 February, in accordance with Kaiko, simply forward of the weekend’s stiffer sanctions that noticed Russian banks lower off from the SWIFT system.

Ruble-denominated BTC quantity. Supply: Kaiko

Ruble-denominated BTC quantity. Supply: Kaiko

Ukraine’s hryvnia-BTC quantity additionally surge

Whereas the ruble noticed probably the most buying and selling quantity amid the frenzy to hedge in opposition to the impression of sanctions, traders in Ukraine had been equally nervous. Kaiko’s Medalie stated that though nonetheless low, the bitcoin-Ukrainian hryvnia (BTC-UAH) pair spiked over the week.

Tether-ruble (RUB-USDT) and tether-hryvnia (UAH-USDT) buying and selling volumes have additionally elevated in respect of the invasion, the info confirmed.

A lot of the rising volumes have been on Binance- and LocalBitcoins- which permits for peer-to-peer Bitcoin change.

Falling ruble

The rising volumes are majorly pushed by a rush to safe-haven property by traders spooked by the sanctions and the potential ramifications for the ruble.

Gold, US Treasuries, USD, and the Swiss franc are among the many property to see an uptick in buy-side strain over the previous few days. Bitcoin additionally soared to highs close to $40k over the weekend however continues to face strain alongside shares.

Already, sanctions have seen Russia’s ruble fall to new lows of 119 in opposition to the greenback, with the Central financial institution of Russia shifting to undertake measures meant to defend the fiat forex from additional depreciation and inflation hits.

Amongst these measures is Monday’s transfer to lift key rates of interest from 9.5% to twenty%, and an order to native brokers prohibiting them from offering providers to foreigners looking for to promote securities.

[ad_2]