[ad_1]

The payments for the Biden administration’s multi-trillion greenback American Jobs and American Households plans are anticipated to be footed by further revenues generated by The Made in America Tax Plan. A headline characteristic of the plan raises earnings taxes on the highest-earning American households, the 1.8 % of households incomes over $400,000 per yr. Taxes on the remaining 98.2 % center class and poor American households could be unaffected—proper? Incorrect. A poorly-understood characteristic of the Biden plan penalizes the worldwide reinsurance trade, which might make property insurance coverage costlier, particularly for houses and companies in Florida, the place premiums are already rising steeply. The plan functionally introduces what could also be considered as a “hurricane tax:” elevating company taxes and introducing new guidelines impacts worldwide monetary transactions, which will increase the price of reinsurance and adversely impacts main insurers and consumers of house owner’s insurance coverage, particularly in catastrophe-prone areas. Insurers and their prospects needs to be involved as a result of householders in states like Florida are already seeing rate-driven double-digit premium will increase.

Ending the BEAT

The primary approach the Made in America Tax Plan impacts world reinsurance is thru its proposed substitute of the Base Erosion and Anti-Abuse Tax (BEAT) with Stopping Dangerous Inversions and Ending Low-Tax Developments (SHIELD). BEAT, a provision of the 2017 Tax Cuts and Jobs Act, was meant to generate near $4 billion/yr in further tax income by, amongst different issues, imposing a ten % (rising to 12.5 % in 2026) tax on reinsurance cessions by U.S. insurers to affiliated offshore entities. BEAT has been acknowledged as a failure. The Made in America Tax Plan states that BEAT has been “largely ineffective at curbing revenue shifting by multinational firms.” In 2018, the primary yr BEAT was in impact, it generated revenues of $1.8 billion, half of the Treasury’s expectations.

BEAT failed to satisfy its anticipated income targets as a result of, quite than be topic to BEAT’s 10 % tax, insurers responded in two methods: they decreased cessions to affiliated offshore entities whereas growing cessions to non-affiliated reinsurers; they usually elevated their retentions in the USA.

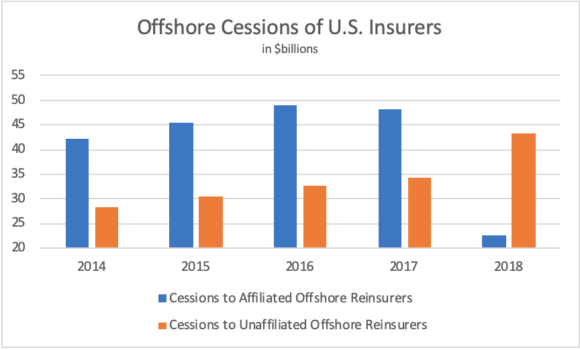

The chart under reveals that in 2018, the primary yr BEAT took impact, cessions to affiliated offshore reinsurers plummeted whereas cessions to unaffiliated insurers skyrocketed.

(Supply: Reinsurance Affiliation of America, Offshore Reinsurance within the U.S. Market, 2018 knowledge.)

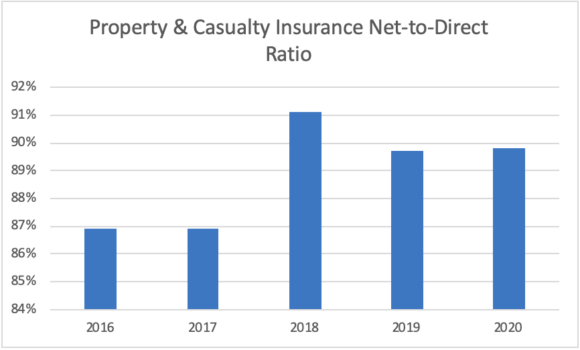

2018 additionally noticed a rise within the net-to-direct premium ratio for the property and casualty trade, indicating that insurers retained extra danger in the USA than in overseas jurisdictions, as proven within the chart under. The web-to-direct ratio rose from just below 87 % in 2016 and 2017 to over 91 % in 2018. The mix of those two responses enabled U.S. insurers to beat BEAT.

(Supply: S&P World Intelligence)

The Made in America Tax Plan replaces BEAT with SHIELD, which introduces a world minimal tax charge. The initially proposed SHIELD charge of 21 % was whittled down to fifteen % in late Might. SHIELD is conceived as a stronger strategy to shift earnings to low-tax jurisdictions. What’s extra, it will try and incentivize different international locations to undertake increased minimal company taxes. Such a coverage might erect a barrier to forestall corporations from “inverting,” whereby a U.S. firm merges with a overseas firm to cut back its efficient tax charge. Burger King and Coca-Cola are examples of corporations that inverted.

The imposition of a world minimal tax is anticipated to have damaging results on all multinationals, together with world reinsurers. Antagonistic impacts on reinsurers will result in increased reinsurance charges, which can be handed on to main insurers and insurance coverage consumers for causes unrelated to loss. There are numerous unknowns surrounding SHIELD, whose contours and numbers require elucidation. Implementation of SHIELD would require not solely U.S. congressional approval, but additionally worldwide settlement insofar as a world minimal tax could be launched. Clarification of particulars involving SHIELD and different provisions of the Made in America Tax Plan that would impression world reinsurance have been anticipated to be supplied within the Treasury Division’s “Inexperienced Ebook,” which offers explanations of the Administration’s Income Proposals. The newest Inexperienced Ebook, launched on Might 28, isn’t completely clear on how precisely SHIELD would function. As a result of reinsurance is by its nature a world enterprise and SHIELD’s goal is multinational corporations, insurers must pay shut consideration to the plan and push again the place applicable, lest they be put within the place of absorbing further burdensome taxes they must go on to their prospects.

Florida Impression

Florida policyholders already pay the very best charges within the nation for householders’ insurance coverage. Premiums for house owner insurance coverage from the highest 25 Florida householders’ insurers common $1,774. Charges are rising from elements unrelated to altering reinsurance prices. For instance, the Florida Workplace of Insurance coverage Regulation (FLOIR) accepted two residential householders charge will increase in 2020—a 12.4 % charge enhance efficient in Might and a further 7.0 % in December. If consultant, these charges would drive common Florida householders’ premium to $2,134. Reinsurance accounts for a significant factor of Florida householders’ premium—a couple of third. Ought to the Biden plan be applied, its SHIELD-related provisions will drive reinsurers to lift charges for insurers, who in flip will go on the rise to householders, rendering Florida insurance coverage prices exorbitant, exacerbating the already-near-crisis circumstances in Florida’s insurance coverage market. So make no mistake about it—the Biden tax plan will hit center and decrease class People within the pocketbook. Within the curiosity of Floridians and their insurers, we should always oppose the Biden Made in America Tax Plan.

Subjects

Reinsurance

Fascinated by Reinsurance?

Get computerized alerts for this matter.

[ad_2]