[ad_1]

-

Finest Purchase is a client electronics retailer, buying and selling, like many different friends, close to its 52-week low. Regardless of or maybe due to that, InvestingPro views it as one of the vital undervalued shares.

-

This text exhibits how we discovered Finest Purchase Co (NYSE:), what its set-up is, what headwinds it’s dealing with, and what upside potential it has.

-

When you’re focused on upgrading your seek for new investing concepts, take a look at InvestingPro.

One other Retail Alternative

Because the market continues to seek for a course heading into the summer season, a lot of sectors are persevering with to endure. Retail is one in every of them, as traders attempt to perceive whether or not demand shifts are short-term or everlasting, and as stock challenges proceed to pop up for companies.

Final time, we wrote about The Youngsters’s Place (NASDAQ:), a clothes retailer with sturdy fundamentals at the same time as it’s uncovered to price inflation and a troublesome surroundings. This time, utilizing InvestingPro instruments, we are going to analyze one other retailer that could be set as much as ship sturdy returns regardless of what appears to be like like a troublesome short-term state of affairs.

This text will analyze Finest Purchase (NYSE: BBY), a outstanding participant within the Specialty Retail business. Given the InvestingPro mannequin advised vital upside potential, nice monetary well being, and up to date quarterly earnings mentioned intimately on this article, we imagine the corporate is poised to outperform the market even amid ongoing inflationary pressures that negatively have an effect on the business.

Be aware: All pricing information is as of June eighth closing worth.

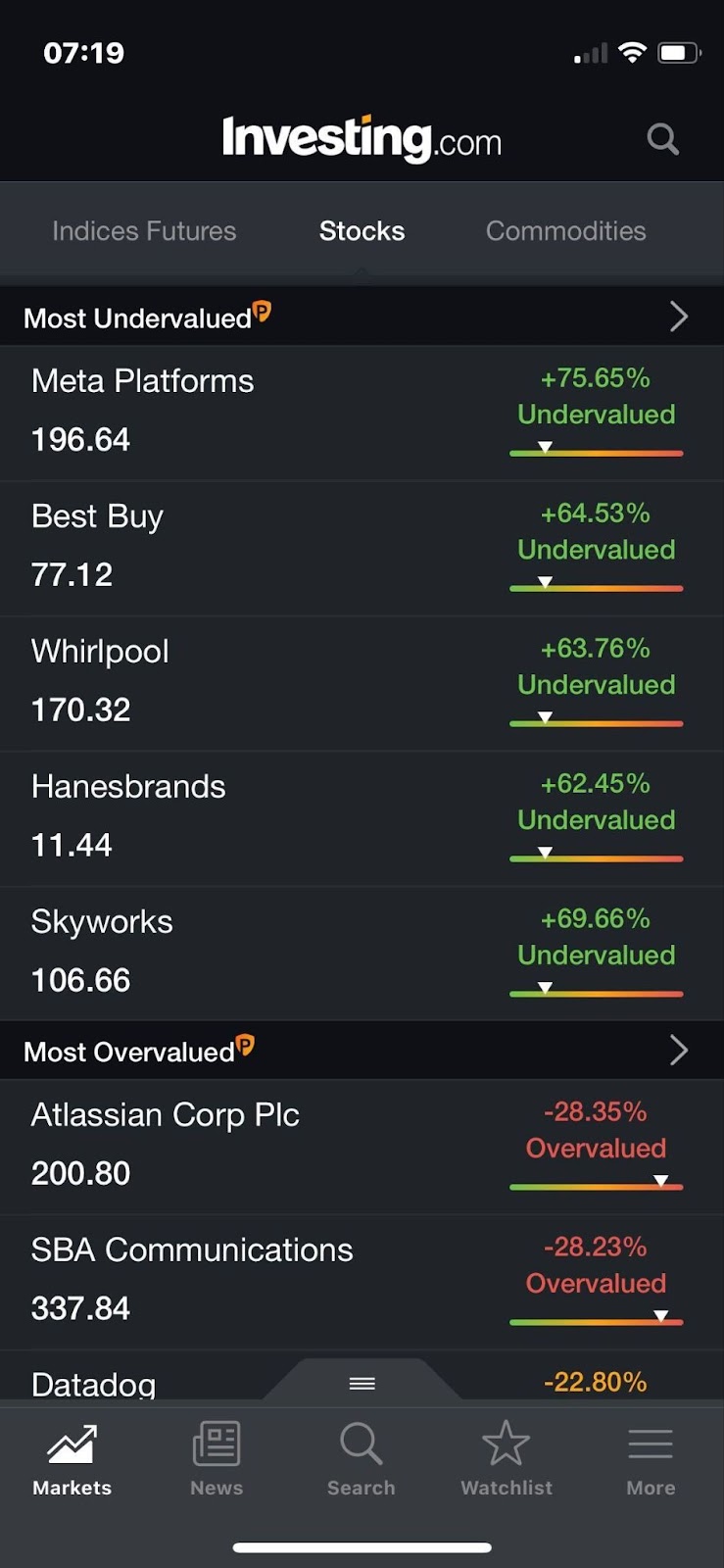

Discovering a Discount Inventory

Let’s go step-by-step by way of the method of choosing Finest Purchase as at the moment’s inventory for evaluation. We began with Investing.com cell app. InvestingPro exhibits the listing of most undervalued/overvalued shares, out of which Finest Purchase caught our consideration. Given the remaining challenges within the Retail sector, and the current enormous inventory selloff following some massive gamers’ disappointing quarterly outcomes, Finest Purchase appeared an attention-grabbing candidate with its 64.5% upside potential. Furthermore, the corporate’s inventory worth continues to be down 24% yr up to now, even after its restoration from the mid-Could 52-week low.

Supply: InvestingPro

Finest Purchase: Is Now the Proper Time to Make investments?

Primary stats:

-

Present worth/52-week vary: $77.12 ($69.07 – $141.97)

-

Market cap: $17.40 billion

-

P/E Ratio: 8.7x

-

Income compound annual development final 5 years: 5.6%

Finest Purchase Co., Inc. is likely one of the outstanding gamers within the Specialty Retail house, promoting know-how merchandise in america and Canada, by way of its 1,144 shops (as of January 30, 2022) and its web sites underneath the Finest Purchase, Finest Purchase Adverts, Finest Purchase Enterprise, Finest Purchase Well being, CST, Present Well being, Geek Squad, Vigorous, Magnolia, Finest Purchase Cellular, Pacific Kitchen, Dwelling, and Yardbird, in addition to domains bestbuy.com, currenthealth.com, full of life.com, yardbird.com, and bestbuy.ca.

InvestingPro exhibits that the typical worth goal for the 21 analysts who observe the inventory, is $94.24 (22.2% upside from present inventory worth), whereas the honest worth based mostly on InvestingPro fashions is $126.89 (64.5% upside from present inventory worth).

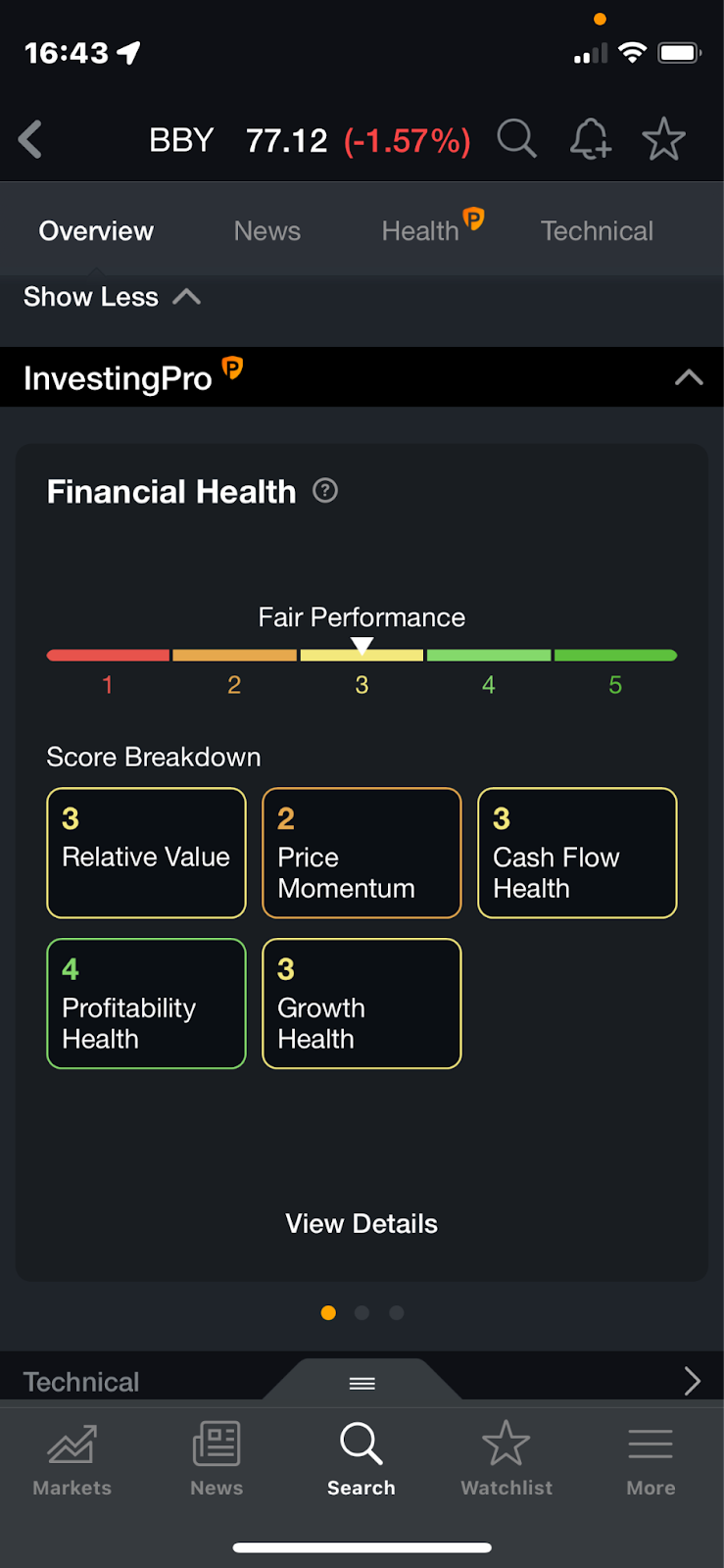

Supply: InvestingPro

InvestingPro charges the corporate’s monetary well being as a 3 out of 5, positioning Finest Purchase for honest efficiency, with profitability well being because the spotlight.

Supply: InvestingPro

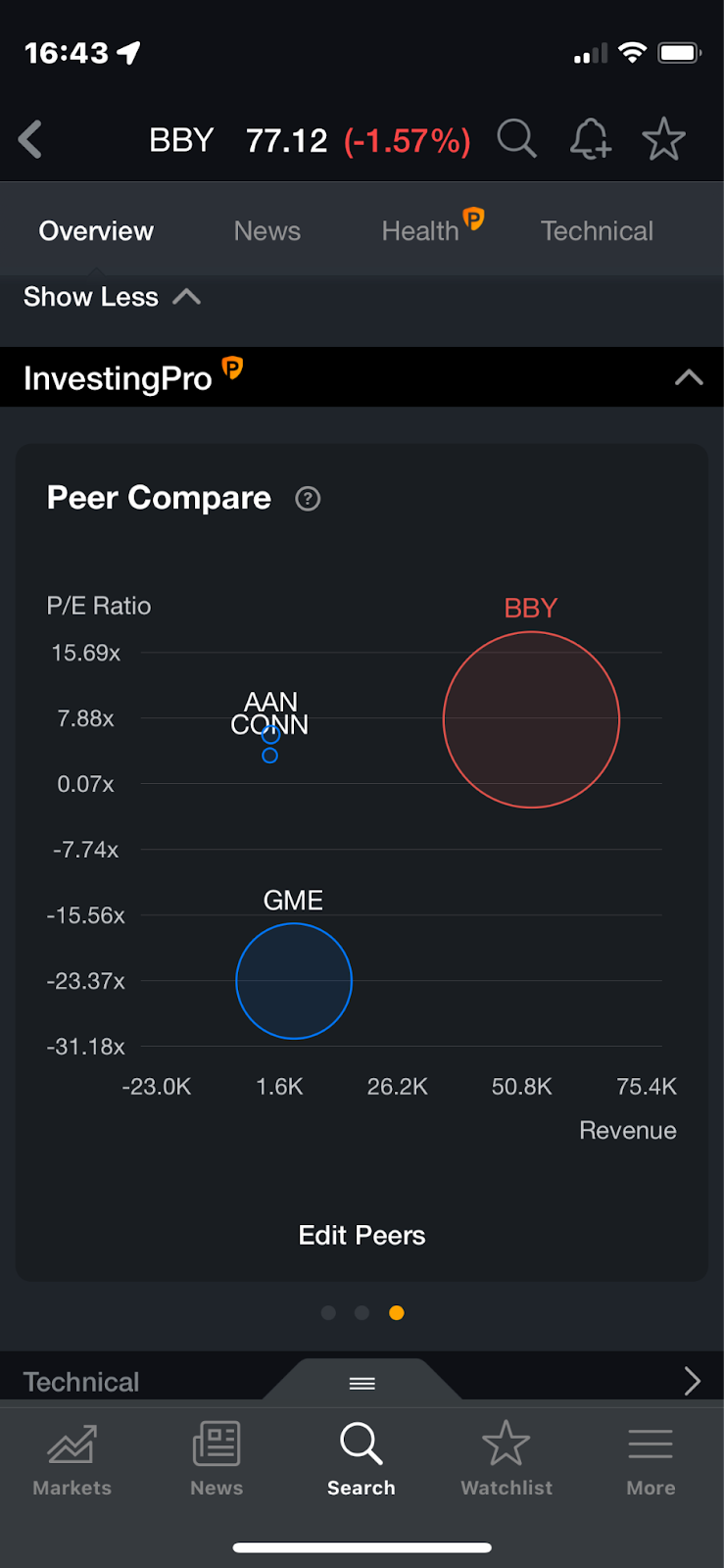

As will be seen from the Efficiency vs. Valuation Benchmarks graph, all the firm’s friends even have very low PE ratios.

Supply: InvestingPro

Dealing with Unsure Macro Surroundings

Finest Purchase Co., Inc., in addition to the vast majority of its friends, face pressures as a result of rising inflation and rates of interest, affordability points for key merchandise, the Russia/Ukraine Struggle additional weighing on client confidence, and additional provide chain challenges in China. However the firm appears to handle effectively on this difficult macro surroundings, as will be seen from its current quarterly earnings report. Moreover, the corporate is benefiting from rising demand for sure merchandise, resembling laptops and pc equipment as many raced to purchase merchandise for his or her dwelling places of work as a result of COVID-19 pandemic.

Current Earnings Report & Outlook

On Could 24, 2022, the corporate reported its Q1 outcomes, with income coming in at $10.65 billion, beating the consensus estimate of $10.44 billion. EPS was $1.57, in comparison with the consensus estimate of $1.63. The inventory worth elevated about 14% for the reason that earnings announcement.

Regardless of the miss, the corporate lowered its full 2023-year steerage lower than feared. It now expects EPS within the vary of $8.40-$9.00, in comparison with the Road estimate of $8.90, and income within the vary of $48.3-49.9 billion, in comparison with the Road estimate of $50.12 billion.

Administration expressed uncertainty on how lengthy gross sales declines may persist on the again of elevated stimulus spending in 2022 or general client spending slowing down in 2023 as a result of inflationary issues and/or shifts in client spending away from durables to experiences.

Regardless of the decrease outlook, the corporate expects a fabric sequential enchancment in comp gross sales.

Abstract

At a worth level of $77.12, we imagine Finest Purchase Co., Inc. is poised for development. Initially, the current quarterly outcomes confirmed the corporate is managing effectively regardless of ongoing macro challenges. Given the inventory popped initially after its current earnings announcement, bouncing again from its 52-week low on Could 20, it appears traders are optimistic concerning the outlook, and the worst could also be priced in.

Second, Professional model-based honest worth estimate of $126.89 implies an upside of 64.53% within the subsequent 12 months. And eventually, the Professional profitability well being rating of 4 is a reminder that BBY’s enterprise is stable and arrange for fulfillment.

Fascinated about discovering your subsequent nice concept? InvestingPro provides you the prospect to display by way of 135K+ shares to search out the quickest rising or most undervalued shares on this planet, with skilled information, instruments, and insights. Study Extra »

Disclaimer: The creator has no positions in any shares talked about on this article.

[ad_2]