[ad_1]

The bulls tried to nip a win earlier than the shortened week was out, however it was to not be. Wednesday’s features had been reversed on Thursday’s motion, leaving markets to sweat out the lengthy weekend.

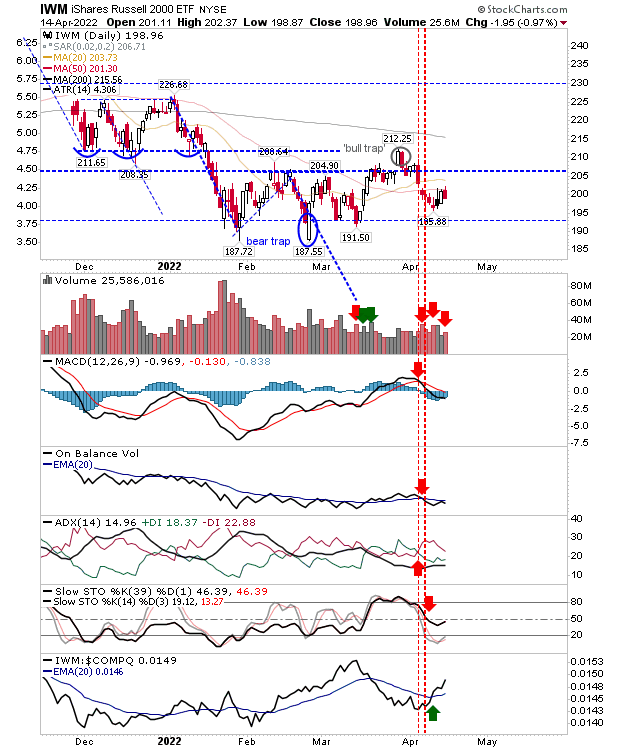

The held up one of the best of the indices, though the ETF () completed with internet distribution. On the plus aspect, the index is outperforming its friends – so if there’s a main candidate for a rally, the Russell 2000 is the index to do the legwork.

IWM day by day chart.

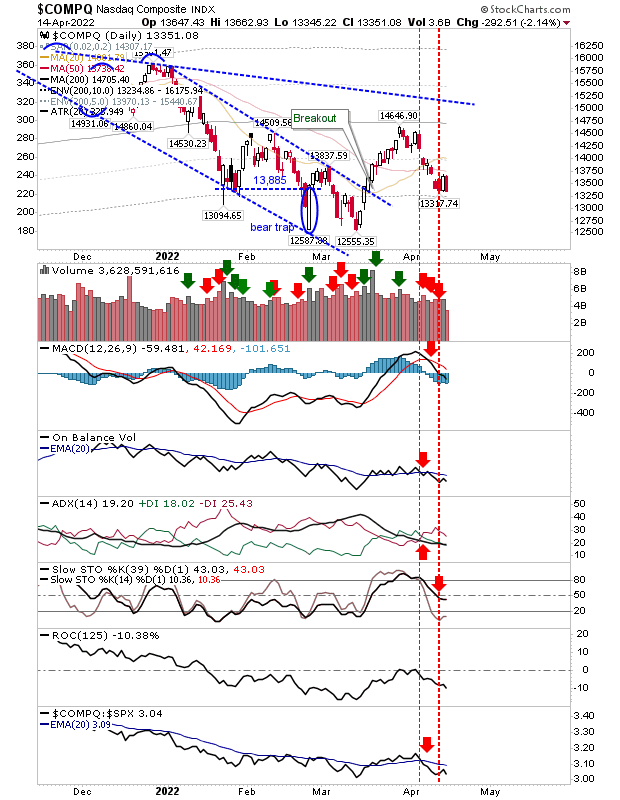

There wasn’t a lot to separate the and . Each indices gave again all Wednesday’s features, leaving bulls gasping for air.

The NASDAQ stays technically internet bearish, however intermediate stochastics [39,1] have solely undercut the mid-line to push it to the bearish aspect of the fence however left it a good distance from turning into oversold.

COMPQ day by day chart.

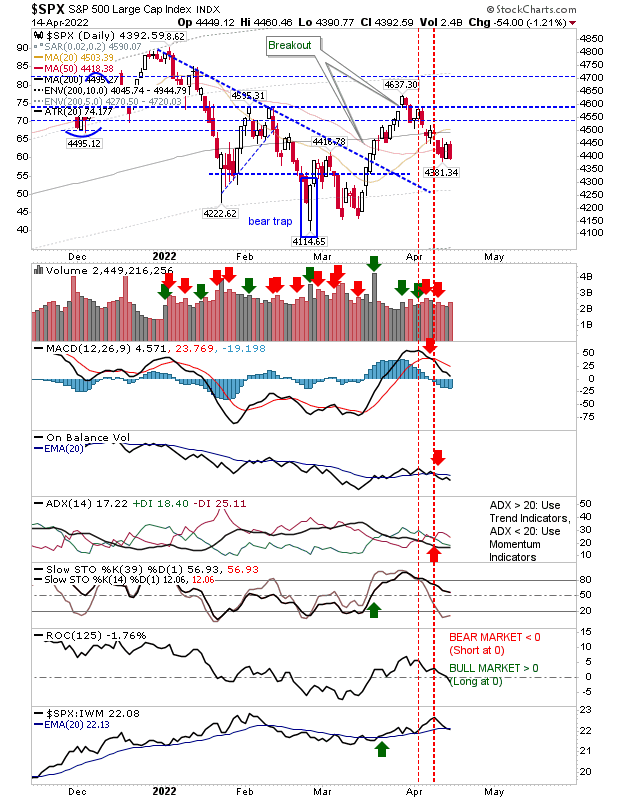

The S&P can also be working a retest of March lows, though it nonetheless has round 200 factors to lose earlier than it will get there. In contrast to the NASDAQ, stochastics stay bullish regardless of the bearishness elsewhere.

SPX Every day Chart

Monday is about up for a niche down, barring some constructive information to reverse that. The Russell 2000 has the potential to buck this pattern because it’s holding up higher than the NASDAQ and the S&P 500.

[ad_2]