[ad_1]

Shares of Chinese language expertise corporations have been among the market’s worst performers over the previous 12 months. Traders dumped the nation’s tech mega-caps after Beijing started a broad regulatory crackdown geared toward reining the sector in early 2021.

At one level, greater than $1 trillion of the mixed market worth of China’s greatest tech corporations, together with Alibaba (NYSE:), Tencent (HK:), and JD.com (NASDAQ:), was worn out amid worries over the damaging affect of the year-long marketing campaign.

Certainly, the KraneShares CSI China Web ETF (NYSE:), which tracks a basket of China-based corporations centered on web and internet-related expertise, has tumbled roughly 73% since reaching an all-time excessive of $104.94 in February 2021.

Regardless of the selloff, shares of China’s tech behemoths may very well be poised for a powerful restoration because the worst of President Xi Jinping’s anti-tech regulatory clamp-down seems to be over in the meanwhile.

The most recent sign got here earlier this week when China’s high financial official, Vice Premier Liu He, mentioned Beijing would assist the event of digital economic system corporations and their public listings.

It was an unusually public present of assist for the once-freewheeling sector because the ruling Communist Social gathering seeks to spice up the economic system within the face of slowing progress as a result of ongoing COVID-19 pandemic.

Baidu: Poised For Rebound

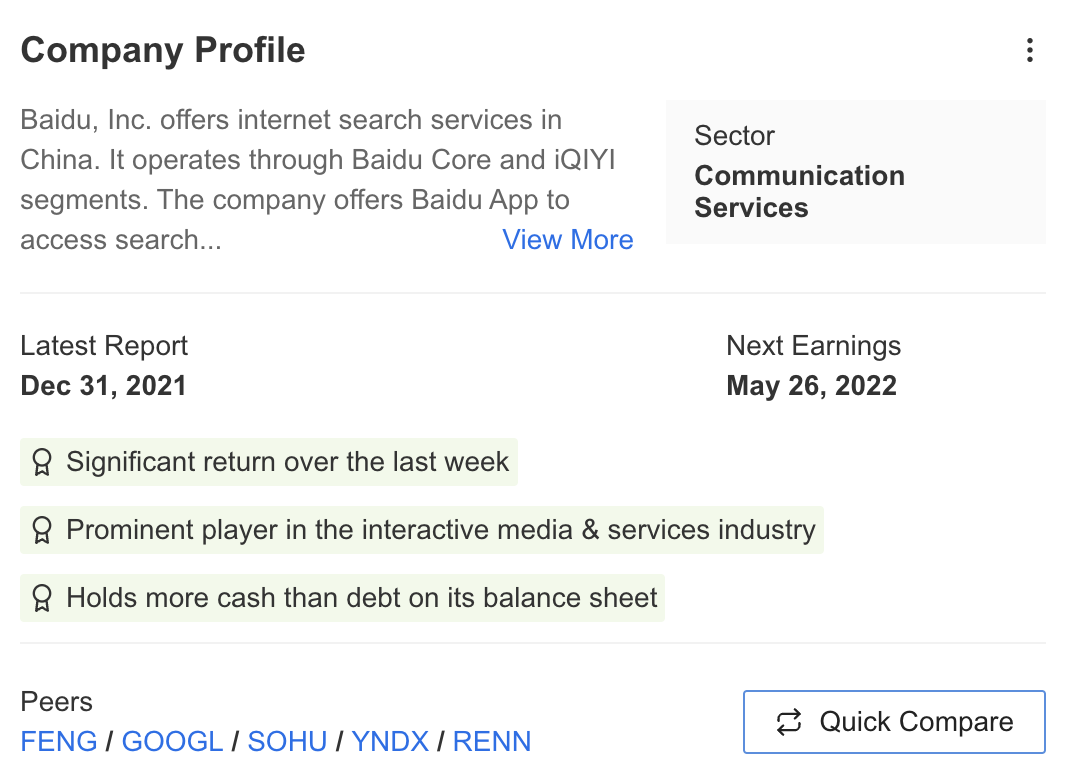

Towards this backdrop, Baidu (NASDAQ:) emerges as a stable purchase as buyers assess receding dangers and uncertainty associated to the regulatory crackdown.

Shares within the Chinese language language web supplier now stand roughly 65% beneath the report peak of $354.82, reached in February 2021, and 23.3% above the 52-week low of $101.62, recorded Might 12. BIDU closed Thursday at $125.34.

At present ranges, Baidu has a valuation of $41.07 billion, making it the fifth-largest tech firm in China when it comes to market cap.

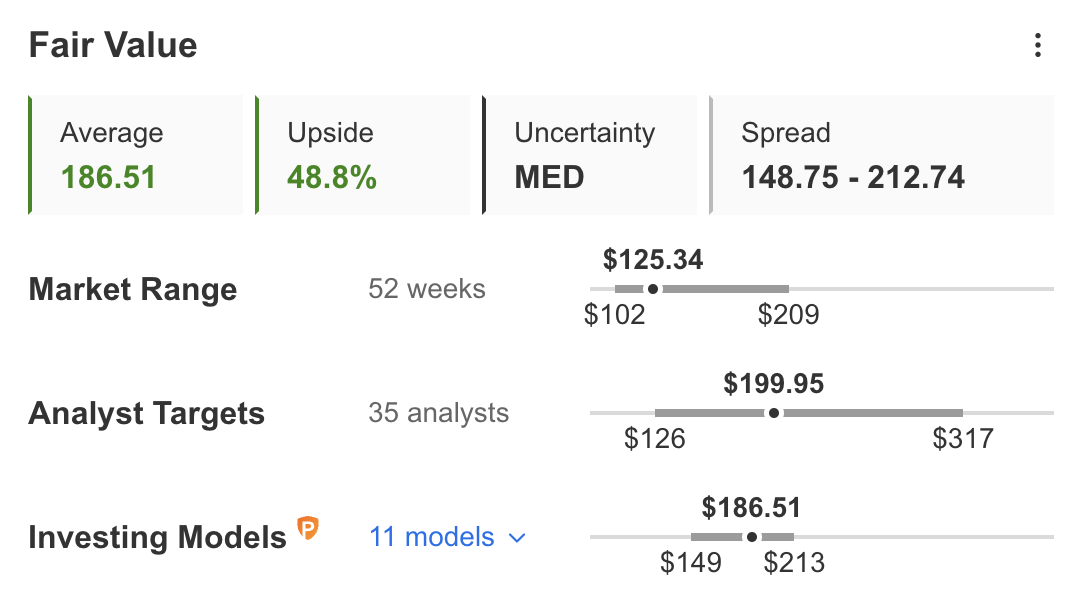

With a good worth of $186.51 per share, the quantitative fashions in InvestingPro level to a 48.8% upside in Baidu inventory over the subsequent 12 months.

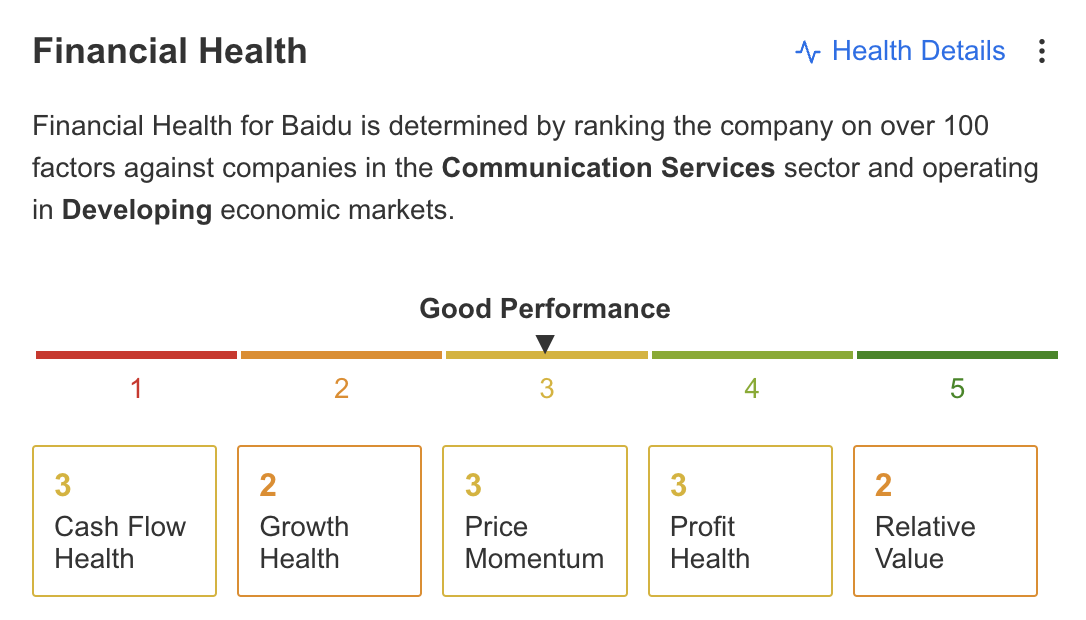

As Professional+ factors out, Baidu is in good monetary well being, incomes a rating of three out of 5, due to a mix of stable money flows and its revenue and progress prospects.

Professional+ calls out a couple of extra key insights on the inventory, with the purpose of it holding extra cash than debt on its stability sheet standing out probably the most:

Baidu Earnings Estimates

The Beijing-based firm—which has for earnings and income for 11 consecutive quarters relationship again to Q2 2019—is slated to report its newest monetary outcomes earlier than the U.S. market opens on Thursday, Might 26.

Consensus estimates name for the tech large to announce earnings per share of RMB5.09 ($0.76), falling 58% from EPS of RMB12.38 ($1.84) within the year-ago interval. Income ought to dip 1% Y-o-Y to RMB27.92 billion ($4.16 billion).

Past the top-and bottom-line numbers, buyers will probably be keen to listen to commentary from Baidu CEO Robin Li relating to the outlook for the months forward because the tech large additional aligns itself with the priorities of China President Xi Jinping.

[ad_2]