This text was written completely for Investing.com

- Bitcoin and the $40,000 pivot level

- Ethereum is close to the $2,900 degree

- Nearer to the January 2022 lows than the November 2021 highs

- Three bullish elements and three bearish elements

- Tightly coiled springs

One of many points going through the cryptocurrency asset class is expectations. After rising from 5 cents in 2010 to almost $69,000 per token in mid-November 2021, market members grew to become accustomed to wild value swings and selloffs that offered golden shopping for alternatives. The asset class was dynamic, creating unbelievable alternatives for income. Many market members who ventured into and had no ideological connection to the libertarian technique of change. Their ideology was income.

When Bitcoin and Ethereum discovered bottoms on Jan. 24, 2022, each digital tokens went to sleep. The revenue ideologues have departed the asset class, trying to find different, extra unstable venues, providing higher potential for income. Bitcoin and Ethereum have gone into volatility hibernation, which continues in early Might 2022.

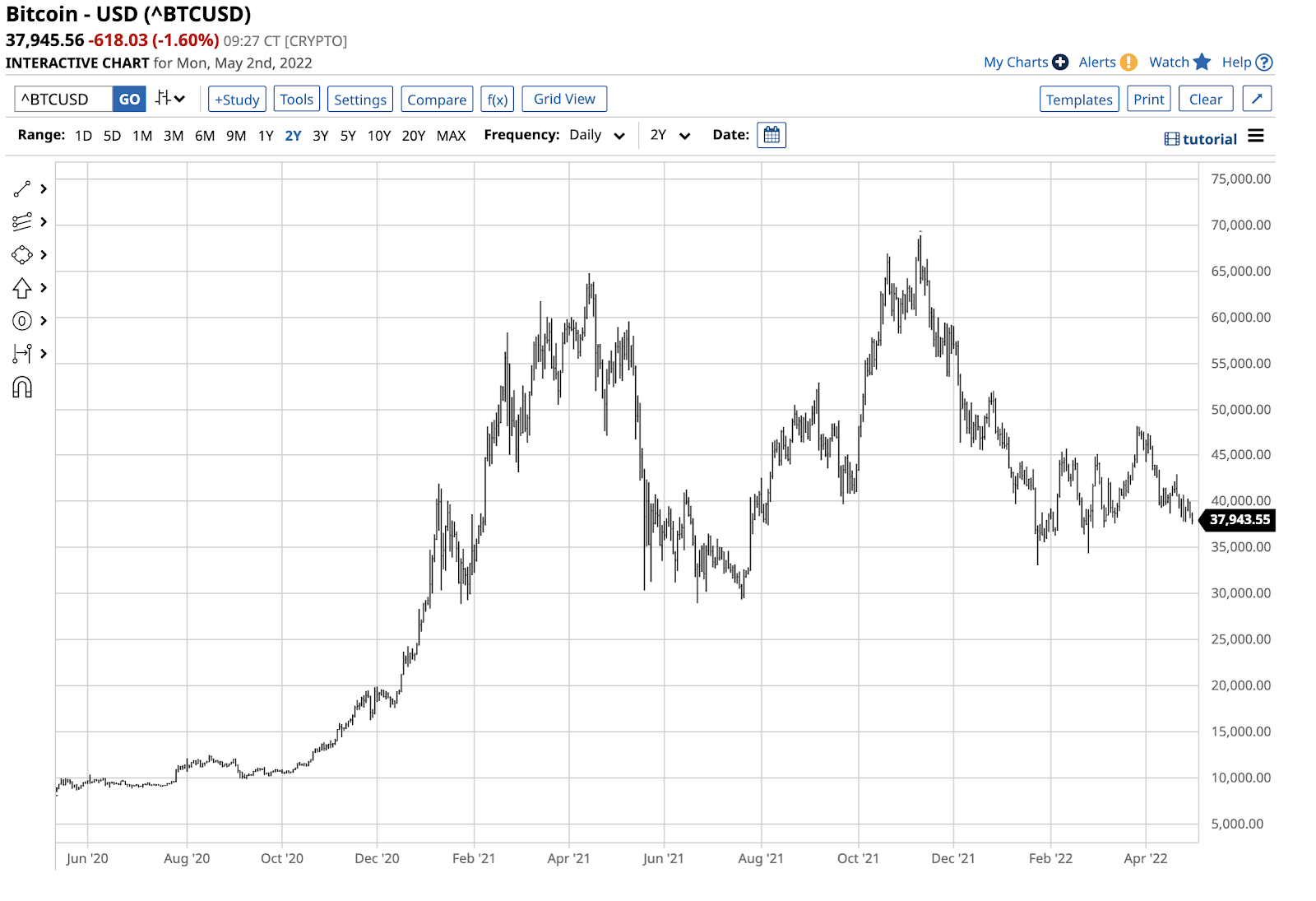

Bitcoin and the $40,000 pivot level

After years of untamed volatility within the cryptocurrency area, the value motion in Bitcoin and the opposite over 19,150 tokens has calmed in 2022.

Supply: Barchart

The chart exhibits that Bitcoin’s 2021 vary was from $28,740.04 to $68,906.48 per token, a $40,166.44 buying and selling band. Over the primary 4 months of 2022, the vary has been from $33,076.69 to $48,187.21, or $15,110.52. Whereas the 2022 value vary for many belongings can be unstable, market members within the crypto area have come to anticipate far greater value variance than seen up to now this 12 months.

In the meantime, Bitcoin has made greater lows since June 2021, which is now a bearish sample for the crypto that continues to consolidate across the $40,000 pivot level, which is the midpoint of the 2022 buying and selling vary.

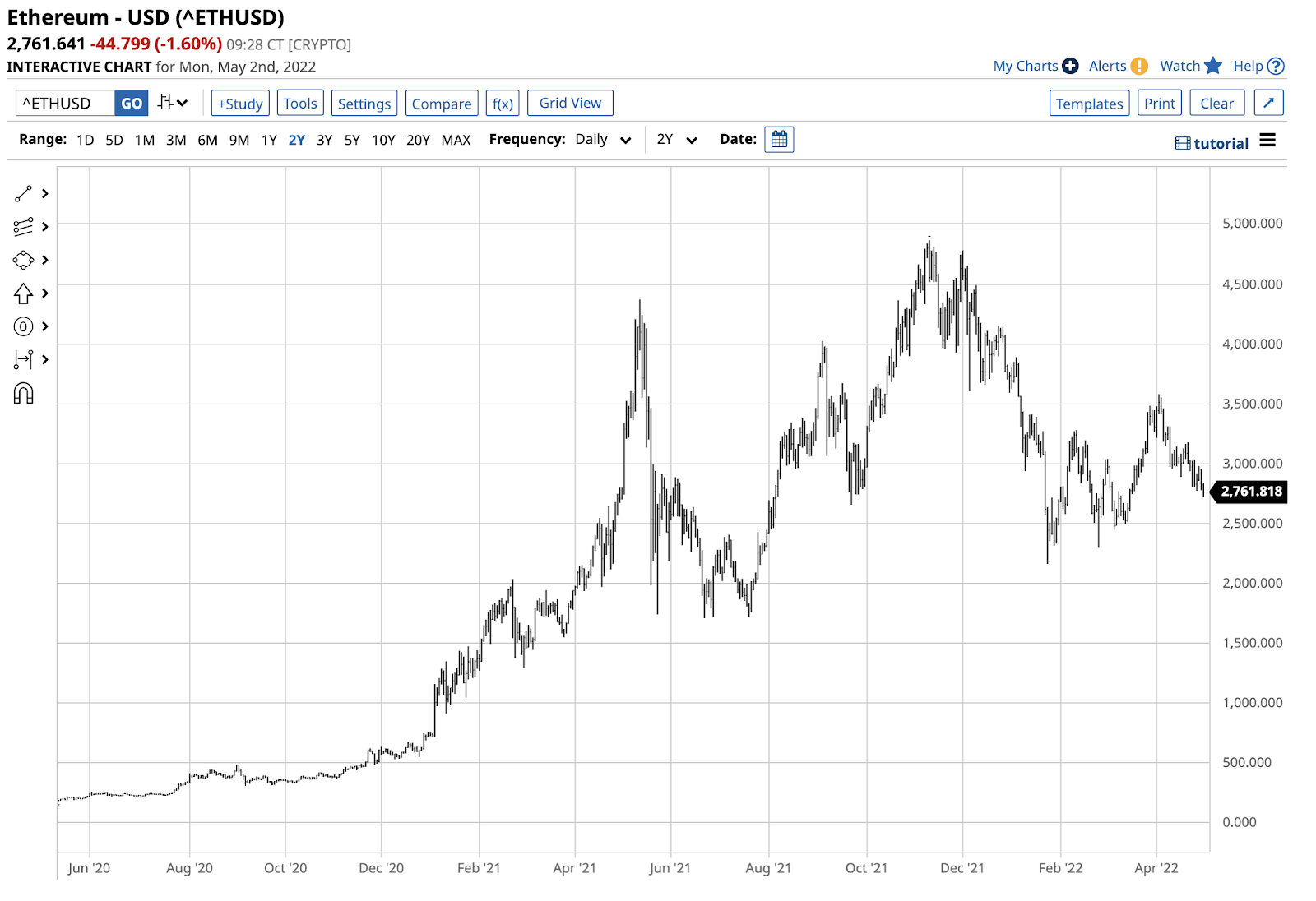

Ethereum is close to the $2,900 degree

Ethereum, the second-leading crypto, has additionally settled right into a buying and selling vary for the reason that finish of 2021.

Supply: Barchart

In 2021, Ethereum’s value vary was from $716.919 to $4,865.426 per token, a $4,248.507. Over the primary 4 months of 2022, it has been between $2,163.316 and $3,888.805 or $1,725.489. On the $2,761 degree on Might 1, Ethereum was $240 under the $3,000 midpoint, which is the pivot degree over the previous months.

In the meantime, like Bitcoin, Ethereum has made greater lows since June 2021.

Nearer to the January 2022 lows than the November 2021 highs

At $2,760 for Ethereum and $37,950 for Bitcoin, the costs stay rather a lot nearer to the Jan. 24, 2022 lows, than the Nov. 10, 2021 document highs. Bitcoin, Ethereum, and plenty of different cryptocurrencies have been sleeping in 2022 in comparison with their exercise in earlier years.

On Might 1, the asset class’s market cap stood on the $1.71 trillion degree, nicely under the 2021 document excessive. The one constant bull transfer within the asset class has been the rising variety of tokens coming to market. On the finish of 2020, there have been 8,153 tokens in our on-line world, and final 12 months ended with 16,238, almost double the extent in a 12 months. On Might 1, there have been 19,206 tokens, and by the point Investing.com publishes this text, there will probably be extra.

Three bullish elements and three bearish elements

Bullish and bearish elements are pulling cryptocurrencies in reverse instructions in 2022.

On the bull aspect:

- The unbelievable returns over the previous decade proceed to draw traders and merchants in search of the following Bitcoin that can recognize from 5 cents to almost $69,000 on the excessive.

- Declining religion in fiat currencies will increase the demand for options, and cryptos are filling that void. In 2021, El Salvador made Bitcoin its nationwide forex. Final week, the Central African Republic adopted Bitcoin as an official forex.

- Futures, choices, ETFs, ETNs, and pick-and-shovel firms that transfer greater and decrease with cryptocurrency values have shifted them extra in the direction of mainstream funding belongings.

On the bearish aspect:

- Custody and safety stay important elements and roadblocks for the asset class as rising hacking is inflicting market members to lose holdings.

- The correction from the November 2021 highs has triggered losses for speculators who purchased cryptos too late and held on too lengthy. The worth motion wants to show bullish for them to return to the asset class.

- Governments proceed to hate cryptocurrencies as they threaten their management of the cash provide.

These opposing magnetic forces have created a narrower buying and selling vary in 2022 than in 2021.

Tightly coiled springs

I view the sample of upper lows in Bitcoin and Ethereum as an indication that they are going to get away of the 2022 doldrums. Whereas the technical sample suggests a considerable transfer, it could possibly be greater or decrease. In the meantime, the percentages favor the upside due to the declining religion in fiat currencies and the advantages of blockchain know-how that’s the foundation for the crypto asset class.

Over the weekend, on the Berkshire Hathaway (NYSE:) annual occasion in Omaha, Nebraska, Warren Buffett mentioned he won’t ever purchase Bitcoins even at $25 because it “doesn’t produce something tangible.” He additionally mentioned he wouldn’t pay $25 for all of the Bitcoin on the planet. Help for the cryptocurrency asset class has elevated, however the detractors haven’t backed down. Final 12 months, Mr. Buffett’s associate, Charlie Munger, known as Bitcoin “disgusting and opposite to the pursuits of civilization.”

The buying and selling patterns in Bitcoin, Ethereum, and plenty of different over 19,200 cryptos are creating tightly coiled springs that can finally snap greater or decrease. My wager stays on the upside because the fintech revolution is monetary evolution.