[ad_1]

Shareholders within the memory-chip and storage options heavyweight Micron Expertise (NASDAQ:) have seen the worth of their funding drop near 21% over the previous 52 weeks, and 26.8% year-to-date (YTD). By comparability, the is down greater than 26.0% YTD, 8.8% decrease over the previous 12 months.

On Jan. 5, MU shares went over $98, hitting a report excessive. Nevertheless, since then, 2022 has not been sort to know-how and progress shares, in addition to the broader indices. In consequence, Micron shares and peer shares have suffered double-digit losses. The inventory’s 52-week vary has been $65.67-$98.45, whereas the market capitalization (cap) at present stands at $76.2 billion.

How Latest Metrics Got here In

Micron launched Q2 2022 figures on Mar. 29. of $7.786 billion meant a rise of 25% year-over-year (YoY). DRAM gross sales, which represent 73% of complete high line, grew 29%. In the meantime, income from the NAND phase was up by 19% YoY. Non-GAAP web earnings for the quarter was $2.4 billion, or $2.14 per diluted share, vs.98 cents a 12 months in the past.

On the outcomes, CEO Sanjay Mehrotra commented:

“Micron delivered a wonderful efficiency in fiscal Q2 with outcomes above the excessive finish of our steerage. We grew income and margins sequentially whereas driving favorable combine and price reductions amid ongoing world provide chain challenges… Following a strong first half, we’re on monitor to ship report income and strong profitability in fiscal 2022 and stay nicely positioned to create vital shareholder worth in fiscal 2022 and past.”

Subsequent quarter, the chip large expects to realize $8.7 billion ± $200 million in income in Q3 2022. Diluted EPS is estimated to be round $2.46±$0.10.

Previous to the discharge of those metrics, Micron inventory was round $82. But it surely ended Apr. 29 at $68.19, which means a decline of round 17% in a month.

What To Anticipate From Micron Expertise Inventory

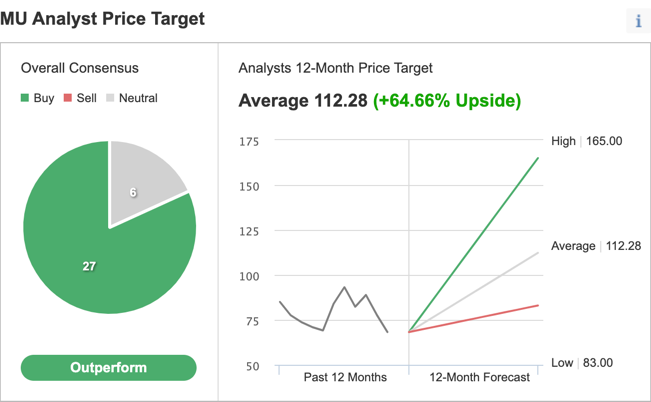

Amongst 33 analysts polled by way of Investing.com, MU inventory has an “outperform” ranking.

Chart: Investing.com

Wall Road additionally has a 12-month median worth goal of $112.28 for the inventory, implying a rise of just about 65% from present ranges. The 12-month worth vary at present stands between $83 and $165.

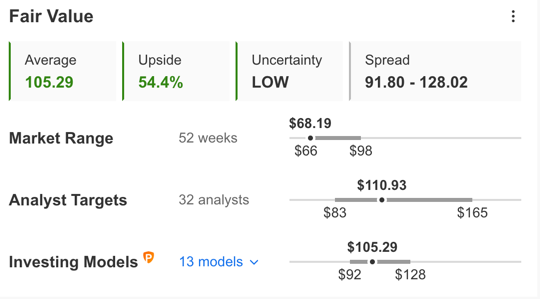

Equally, in response to quite a few valuation fashions corresponding to P/E or P/S multiples or terminal values, the common honest worth for MU inventory at InvestingPro is $105.29.

MU Valuation

Supply: InvestingPro

In different phrases, elementary valuation suggests shares might enhance about 55%.

We are able to additionally take a look at MU’s monetary well being as decided by rating greater than 100 components in opposition to friends within the Info Expertise sector.

As an example, when it comes to money move and revenue, it scores 4 out of 5. Its total rating of 4 factors means an important efficiency rating.

At current, MU’s P/E, P/B and P/S ratios are 8.4x, 1.6x and a pair of.4x, respectively. Comparable metrics for friends stand at 43.9x, 7.3x and seven.8x, respectively. These numbers present that with the current decline in worth, MU affords good worth.

As a part of the short-term sentiment evaluation, it will be necessary to have a look at the implied volatility ranges for MU choices as nicely. Implied volatility sometimes reveals merchants the market’s opinion of potential strikes in a safety, however it doesn’t forecast the path of the transfer.

Micron’s present implied volatility is about 15% greater than the 20-day transferring common. In different phrases, implied volatility is trending greater, whereas choices markets counsel elevated choppiness forward for MU shares.

Readers who watch technical charts may have an interest to know that quite a few Micron’s short- and intermediate-term oscillators are oversold. Though they’ll keep prolonged for weeks—if not months—the decline within the MU share worth is also coming to a halt.

Our expectation is for Micron Expertise inventory to construct a base between $60 and $70 within the coming weeks. Afterwards, shares might doubtlessly begin a brand new leg up.

Including MU Inventory To Portfolios

Micron Expertise bulls who are usually not involved about short-term volatility might contemplate investing now. Their goal worth can be $105.29 as indicated by quantitative fashions.

Alternatively, traders might contemplate shopping for an exchange-traded fund (ETF) that has MU inventory as a holding. Examples embrace:

- First Belief Nasdaq Semiconductor ETF (NASDAQ:)

- iShares Semiconductor ETF (NASDAQ:)

- iShares MSCI USA Worth Issue ETF (NYSE:)

- Guru Favourite Shares ETF (NASDAQ:)

- Innovator Loup Frontier Tech (NYSE:)

Lastly, traders who count on MU inventory to bounce again within the weeks forward might contemplate organising a bull name unfold.

Most choice methods are usually not appropriate for all retail traders. Subsequently, the next dialogue on MU inventory is obtainable for instructional functions and never as an precise technique to be adopted by the common retail investor.

Bull Name Unfold On Micron Expertise Inventory

Intraday Worth At Time Of Writing: $68.19

In a bull name unfold, a dealer has an extended name with a decrease strike worth and a brief name with the next strike worth. Each legs of the commerce have the identical underlying inventory (i.e., Micron Expertise) and the identical expiration date.

The dealer needs MU inventory to extend in worth. In a bull name unfold, each the potential revenue and the potential loss ranges are restricted. This MU commerce is established for a web price (or web debit), which represents the utmost loss.

At present’s bull name unfold commerce entails shopping for the June 17 expiry 70 strike name for $4.35 and promoting the 75 strike name for $2.45.

Shopping for this name unfold prices the investor round $1.90, or $190 per contract, which can also be the utmost threat for this commerce.

We must always word that the dealer might simply lose this quantity if the place is held to expiry and each legs expire nugatory, i.e., if the MU inventory worth at expiration is under the strike worth of the lengthy name (or $70 in our instance).

To calculate the utmost potential acquire, we will subtract the premium paid from the unfold between the 2 strikes, and multiply the consequence by 100. In different phrases: ($5 – $1.90) x 100 = $310.

The dealer will understand this most revenue if the Micron Expertise inventory worth is at or above the strike worth of the brief name (greater strike) at expiration (or $75 in our instance).

Backside Line

In current months, Micron Expertise inventory has come below vital strain. But, the decline has improved the margin of security for buy-and-hold traders who might contemplate investing quickly. Alternatively, skilled merchants might additionally arrange an choices commerce to profit from a possible run-up within the worth of MU inventory.

Serious about discovering your subsequent nice thought? InvestingPro+ provides you the possibility to display screen by means of 135K+ shares to search out the quickest rising or most undervalued shares on this planet, with skilled information, instruments, and insights. Study Extra »

[ad_2]