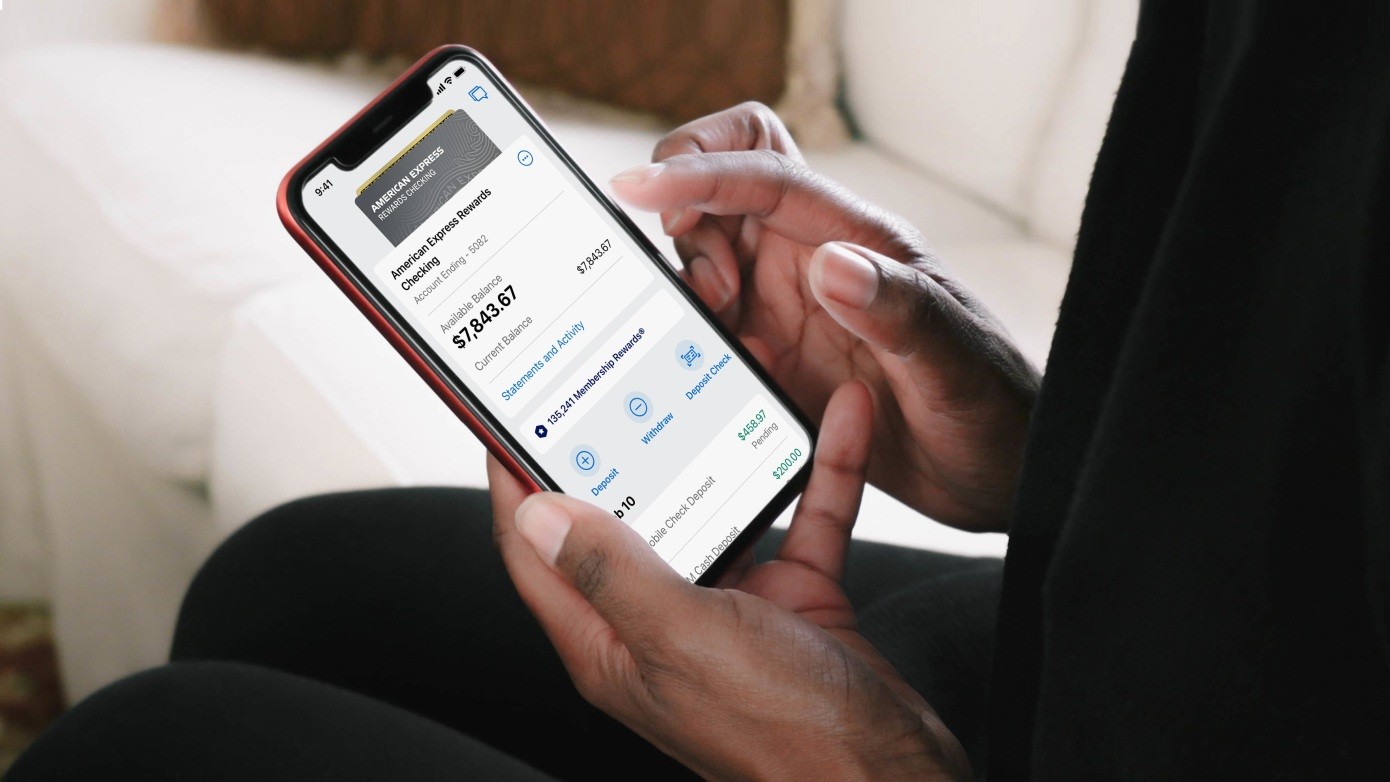

American Specific has launched its first all-digital client checking account, the corporate introduced on Tuesday. The brand new providing, American Specific Rewards Checking, is at present accessible for eligible U.S. Shopper Card Members. The launch comes because the emergence of digital banking companies is inflicting conventional banks to boost their digital methods and supply extra aggressive banking choices.

American Specific says the brand new account gives Membership Rewards factors for eligible debit card purchases, an annual proportion yield price that’s 10 instances larger than the nationwide price and buy safety for eligible purchases. The brand new providing additionally doesn’t have month-to-month upkeep charges or minimal steadiness charges. Amex Rewards Checking incorporates a 0.50% APY and comes with a debit card that earns members one Membership Rewards level for each $2 spent on eligible purchases, which may be redeemed for deposits into clients’ Amex Rewards Checking accounts. Members can even entry and handle their checking accounts on the American Specific app and might deposit checks by way of the app.

“Our Members need extra banking services from us,” mentioned Eva Reda, the chief vp and common supervisor of client banking at American Specific, in a press release. “They usually need extra from their checking account, with out giving up the advantages which might be essential to them. That’s why we constructed Amex Rewards Checking to ship extra worth for Members with the highly effective and trusted backing of American Specific. It’s digital checking with out compromises.”

The account additionally comes with fraud safety and monitoring, together with entry to customer support by way of cellphone or chat. The brand new checking providing provides to the corporate’s current client deposits merchandise, together with the American Specific Financial savings account (HYSA) and Certificates of Deposits (CDs).

Picture Credit: American Specific

Digital banking is evolving the normal banking sector because of the rise in demand for digital companies and the rising recognition of recent startups and neobanks. Startups like Varo Financial institution, Chime, Present and plenty of others are disrupting the normal banking sector and inflicting monetary corporations, like American Specific, to launch extra choices to draw and retain members.

At the moment’s announcement follows the corporate’s plans to companion with Opy, the U.S. subsidiary of Australian fintech Openpay, to permit all of its U.S. cardmembers to pay in installments for qualifying purchases within the healthcare and automotive segments. American Specific already gives its personal BNPL choices below its “Pay it Plan it” program launched in 2017 for purchases above $100, which additionally gives a set rate of interest. The Opy partnership will assist Amex meet the demand for choices to finance giant purchases over longer intervals of time.

Final July, American Specific additionally tapped startup BodesWell to department out into monetary planning. The bank card large launched a pilot of its first self-service digital monetary planning software, dubbed “My Monetary Plan (MFP).” The product is designed to offer customers a whole image of their monetary well being and assist them make and obtain main life targets, reminiscent of shopping for a home or retirement