[ad_1]

- Reviews Q3 2021 outcomes on Thursday, Oct. 28, after the market shut

- Income Expectation: $111.6 billion

- EPS Expectation: $8.91

In the latest market rally Amazon.com (NASDAQ:) is nowhere to be seen. Shares of the e-commerce juggernaut have been lagging far behind different prime US know-how companies this yr, on issues that the revenue-boom that began throughout the pandemic has run its course. As well as, for this e-tail big, there aren’t any near-term catalysts to get enthusiastic about.

Amazon inventory, which closed yesterday at $3,392.49, has hardly budged this yr, whereas the surged about 20%. Amid this underperformance, traders don’t count on a large earnings beat when the Seattle-based firm stories its third quarter earnings following the Wall Road session.

Amazon Weekly Chart.

In keeping with analysts’ consensus forecast, Amazon will report $8.91 a share revenue, about 27% decrease than the final yr, on gross sales of $111.6 billion. The corporate additionally made it clear in its earlier steering that gross sales will in the end return to a extra regular trajectory.

The corporate’s core e-commerce enterprise started to sluggish on the similar time that founder Jeff Bezos handed over the chief function to a long-time lieutenant Brian Olsavsky. In a convention name in July, the brand new CEO didn’t mince phrases relating to the scenario, telling analysts the slowdown in gross sales will proceed by means of the rest of the yr.

Price Escalations

Different headwinds impacting the worldwide financial system are surging prices and supply-chain disruptions. Amazon continues to rent at a speedy tempo, including 64,000 employees within the second quarter in what has been a good labor market. The current wage will increase the corporate has applied signify “one of many greater components of inflation in our enterprise proper now,’’ in keeping with Olsavsky.

Although the present surroundings doesn’t look too favorable for getting Amazon inventory—which surged 78% in 2020—there may be additionally little purpose to promote this identify, in our view.

Buyers shouldn’t ignore the highly effective momentum within the firm’s different companies, together with its promoting phase in addition to from Amazon Internet Companies, the corporate’s cloud unit. AWS income jumped 37% within the second quarter—the most important year-over-year gross sales leap in two years. The corporate’s “different” income class, primarily promoting gross sales, gained 87%.

That’s the principle purpose nearly all of Wall Road analysts stay bullish on the corporate’s long-term prospects and its main place in e-commerce. Although some have adjusted their value targets on the inventory as gross sales sluggish, many consider any lingering weak spot presents a shopping for alternative.

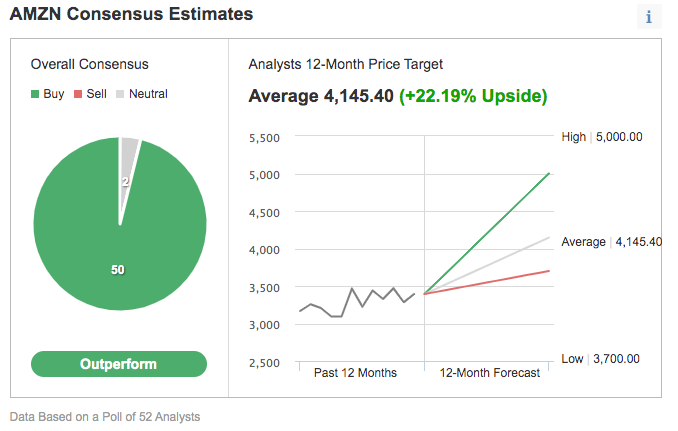

Of 52 analysts polled by Investing.com, 50 had a purchase score on AMZN, labelling it a inventory that may ‘outperform.’ The typical 12-month value goal supplied by respondents was $4,145, or a +23% upside potential.

Chart: Investing.com

Backside Line

The perfect days of Amazon’s e-commerce gross sales are within the rearview mirror after they exploded throughout the pandemic’s on-line shopping for spree. This development is more likely to be mirrored in as we speak’s earnings, which might additionally present strain coming from value escalations and the supply-chain points.

That being stated, any post-earnings weak spot in its shares presents an entry level for traders sitting on the sidelines, given the corporate’s quickly increasing income from its cloud and advert companies, together with its still-dominant place within the e-commerce enviornment.

[ad_2]