[ad_1]

This publish is a part of a collection sponsored by TransUnion.

Unprecedented financial disruption places credit-based scoring to the take a look at — and it handed with flying colours.

With the Coronavirus Help, Aid and Financial Safety (CARES) Act in 2020, america Congress acted to make sure that People who discovered themselves in monetary misery because of the results of the pandemic might shield their credit score from financial circumstances outdoors their management. The CARES Act helped shield these most in want throughout an unprecedented disaster.

Offering credit score reporting lodging to shoppers in monetary hardship just isn’t a brand new apply. Throughout COVID-19, information furnishers leveraged long-standing lodging practices to supply reduction to shoppers going through monetary hardship from occasions corresponding to catastrophic climate occasions and different declared emergencies.

However the mixture of these protections, the pandemic itself and its influence on the economic system all raised considerations within the insurance coverage business. One essential variable within the insurance coverage underwriting course of is a credit-based insurance coverage danger rating (hereinafter known as insurance coverage danger rating. That’s not the identical factor as a credit score rating. Though it attracts on a lot of the identical information, it’s designed to foretell insurance coverage losses, not monetary potential. Nonetheless, these scores draw from a lot of the identical nicely of knowledge as conventional credit score scores, and are coated by a few of the similar rules.

The general query was: Did CARES Act lodging cut back the standard of the analytics insurers depend on for decision-making? In actual fact, we now have sufficient hindsight to know that each the CARES Act and insurance coverage danger scores labored as meant over the worst phases of the COVID-19 pandemic and the related financial fallout.

Total, most shoppers who skilled hardship because of misplaced or lowered employment by no fault of their very own have been capable of safe lodging with lenders so their credit score rating wasn’t negatively affected. Individually, however on the similar time, insurance coverage danger scores remained secure and predictive. Let’s take a look at a few examples so to see how this performed out in apply.

A research in stability

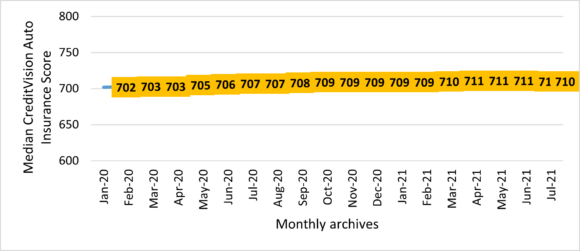

TransUnion CreditVision® Auto, an insurance coverage danger rating for auto insurance coverage, gives a powerful instance of this stability. Determine 1 compares the month-to-month median rating over the course of 2020 and into 2021 for the overall credit-active inhabitants. The next rating signifies a decrease insurance coverage danger.

Determine 1. CreditVision Auto Insurance coverage Rating month-to-month median rating.

As you possibly can see, this rating confirmed robust stability all through 2020 and into 2021. This stability displays an underlying stability within the economic system, cushioned by the post-lockdown recoveries and the stimulus offered by the CARES Act and different legislative interventions.

As of September 30, 2021 the variety of shoppers with at the very least one non-student mortgage lodging on file has declined 67% for the reason that peak of lodging exercise within the second quarter of 2020. TransUnion analysis has proven that the massive majority of shoppers continued to make funds on accounts in lodging, and that 89% of lodging have now been eliminated. The CARES Act’s credit score reporting provisions helped preserve stability in insurance coverage danger scores, in order that insurance coverage suppliers and shoppers weren’t negatively affected by the preliminary sharp pandemic financial shock.

The CARES Act’s client protections proceed to use after an lodging ends. In June 2020, the Client Monetary Safety Bureau (CFPB) printed CARES Act client reporting steering, outlining post-accommodation protections. The steering specified {that a} client who had a “present” account standing when an lodging was entered can’t be reported as delinquent based mostly upon the accommodation-covered interval as soon as the lodging ends, assuming funds weren’t required, or the patron met any cost necessities of the lodging. Moreover, the accommodation-covered interval can’t be used to advance, or speed up, a delinquency as soon as the lodging ends.

The place we stand, and a glance forward

The credit score lodging constructed into the CARES Act have been unprecedented in scale, however not in variety: Legislatively mandated lodging are usually not new, and we are able to count on them to stay essential sooner or later. The final 18 months have proven us that insurers can depend on the integrity of insurance coverage danger scores even in a regulatory atmosphere when sure derogatory info can’t be taken under consideration.

Nonetheless, there are considerations among the many public and within the regulatory realm concerning the equity of utilizing credit-based scoring for insurance coverage underwriting functions. In future blogs, we’ll be having a look at equity testing and the necessity for the business to align on finest practices, and see how insurers can share these optimistic messages with their public and authorities companions.

How one can study extra

If in case you have questions on TransUnion, please go to transunion.com/business/insurance coverage or e-mail inssupt@transunion.com.

An important insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage business’s trusted e-newsletter

[ad_2]