[ad_1]

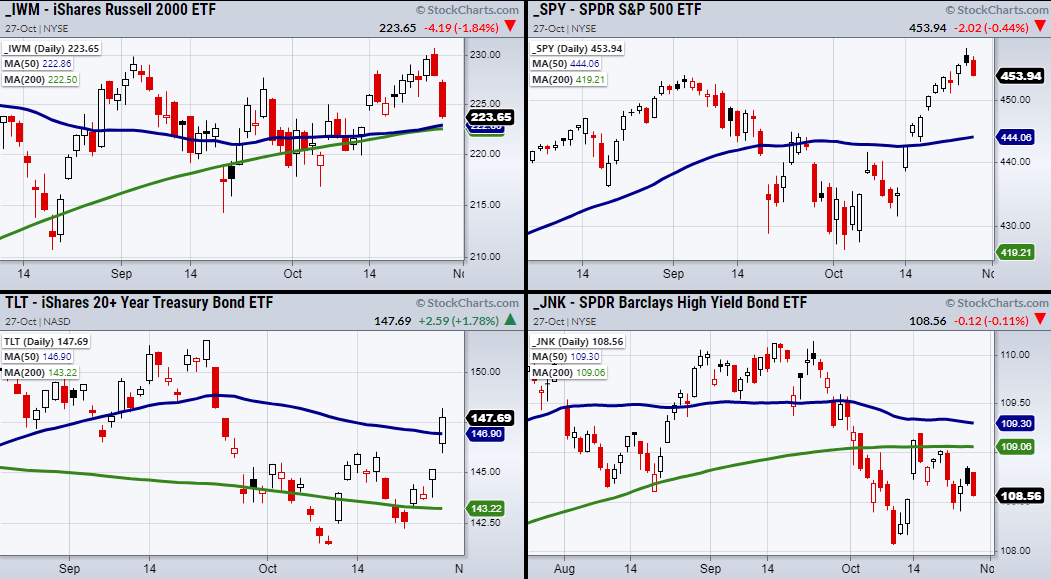

Each the tech-heavy Invesco QQQ Belief (NASDAQ:) and the SPDR® S&P 500 (NYSE:) sit close to their latest breakout ranges. It is a pivotal place for large-cap firms because the small-cap iShares Russell 2000 ETF (NYSE:) has already given up nearly two weeks’ of progress.

Now IWM will search for help from each its 50 and 200-Day transferring averages sitting close to $222.60. Though it’s no shock IWM was operating into main resistance, the latest 2-day selloff exhibits how massive the divergence between massive and small-cap firms actually are.

With that stated, different symbols we watch as danger indictors may very well be flipping together with IWM.

Wednesday, the 20+ 12 months Treasury Bonds ETF by way of iShares 20+ 12 months Treasury Bond ETF (NASDAQ:) made an enormous improve gapping in the marketplace open and clearing over its 50-DMA at $147.06. Now TLT seems to realize a bullish part if it will possibly maintain over its main transferring common on Thursday.

Alternatively, dangerous Excessive Yield Company Debt by way of SPDR® Bloomberg Barclays Excessive Yield Bond ETF (NYSE:) had a small selloff exhibiting that whereas yesterday’s worth motion was weaker than anticipated, traders weren’t operating for the exits.

So, what does this imply?

Massive-cap and tech shares regular themselves close to highs whereas small caps retreat into uneven territory dropping their upward momentum. Moreover, traders are shopping for into the protection of long-term bonds however have but to fully hand over on dangerous investments with JNK.

Taking a look at different security performs reminiscent of (NYSE:) and (NYSE:), we are able to see that every is holding over pivotal transferring averages. SLV—the 10-DMA is at $22.16 and GLD is over the 200-DMA at $167.97.

The remainder of the week will doubtless have increased volatility as traders are posed with contradictory data. Nevertheless, since we’re close to highs in QQQ and SPY, we’ve got clear ranges to from which to observe for both a breakout or breakdown.

ETF Abstract

- S&P 500 (SPY) 454.05 pivotal space.

- Russell 2000 (IWM) 222.60 help space.

- () 10-DMA minor help at 354.78.

- NASDAQ (QQQ) 382.78 resistance space.

- (Regional Banks) Subsequent help space 67.14.

- (Semiconductors) 262.60 fundamental help space.

- (Transportation) 263.82 subsequent help space.

- (Biotechnology) Failed to carry the 200-DMA at 160.30.

- (Retail) 90.86 subsequent help.

- Junk Bonds (JNK) 108.40 help.

- SLV (Silver) 22.16 help.

- (US Fund) Broke the 10-DMA at 57.51.

- TLT (iShares 20+ 12 months Treasuries) Looking ahead to a second shut over the 50-DMA at 147.06.

- (Agriculture) 18.93 help.

Fusion Media or anybody concerned with Fusion Media is not going to settle for any legal responsibility for loss or harm because of reliance on the knowledge together with information, quotes, charts and purchase/promote indicators contained inside this web site. Please be absolutely knowledgeable concerning the dangers and prices related to buying and selling the monetary markets, it is likely one of the riskiest funding types potential.

[ad_2]