[ad_1]

- UPST inventory is up greater than 1,100% since going public in December 2020

- Upstart has to this point been profitable in utilizing know-how to streamline the lending course of within the private mortgage area

- Potential buy-and-hold buyers may regard a short-term decline towards $275 as a greater entry level

Buyers within the lending platform Upstart (NASDAQ:) have seen mouth-watering returns for the reason that firm that employs synthetic intelligence to think about non-traditional components to find out credit-worthiness went public in December 2020. On that day, UPST inventory started buying and selling at a gap worth of $26.

Now, the shares are round $316.50, representing a returned of greater than 1,100% in lower than 10 months. To offer added perspective, that kind of return would have remodeled the proverbial $1,000 invested in UPST inventory on the finish of 2020 into nicely over $12,000. It’s laborious to argue with that sort of success.

UPST shares hit an all-time excessive of $346.54 on Sept. 23. Since then they’ve misplaced about 7%. The 52-week vary has been $22.61 – $346.54, whereas the corporate’s market capitalization stands at $24.7 billion.

California-based Upstart was based in 2012. It companions with banks to originate private loans on the Upstart platform. Administration claims its AI-platform is useful for each debtors, who get higher mortgage phrases, and lenders, who see decrease lending dangers.

As soon as the mortgage is permitted, the originating monetary establishment would possibly retain it on its stability sheet. Alternatively, a portion of those loans get bought to institutional buyers. When it comes to income, Upstart will get a charge from the origination of a private mortgage in addition to a charge to service that mortgage whereas amassing funds from debtors.

Latest metrics counsel:

“Complete excellent private mortgage debt in america is $143 billion. There are 21.1 million excellent private loans within the US… In complete, private loans quantity to lower than 1% of complete client debt, a fraction of bank card debt’s 7.27% share. The common debt per borrower is $8,402.”

The monetary know-how group launched sturdy Q2 on Aug. 10. Income was $194 million, up 1,018% year-over-year. Adjusted internet revenue of $58.5 million translated into diluted adjusted earnings per share of 62 cents. Put one other means, the corporate is worthwhile, separating it from many different younger high-growth shares.

Wall Road was happy to see Upstart’s financial institution companions that use the platform originated 286,864 loans, totalling $2.80 billion, up 1,605% YoY. For FY21, administration now expects revenues of roughly $750 million versus the prior steering of $600 million.

On the outcomes, CEO Dave Girouard mentioned:

“Our second quarter outcomes proceed to point out why Upstart has the potential to be among the many world’s largest and most impactful FinTechs…. Lending is the middle beam of income and income in monetary providers, and synthetic intelligence would be the most transformational change to return to this trade in its 5,000-year historical past.”

Given the scale of Upstart’s addressable market within the US, buyers are optimistic that the fintech will enhance mortgage originations considerably within the quarters forward. Moreover, it’s within the strategy of coming into the auto mortgage market, too.

On Aug. 9, UPST shares have been round $135. Now, they hover at $316.50. That could be a return of greater than 130% in lower than two months. Subsequently, analysts debate whether or not there might be profit-taking within the shares within the close to future.

What To Anticipate From UPST Inventory

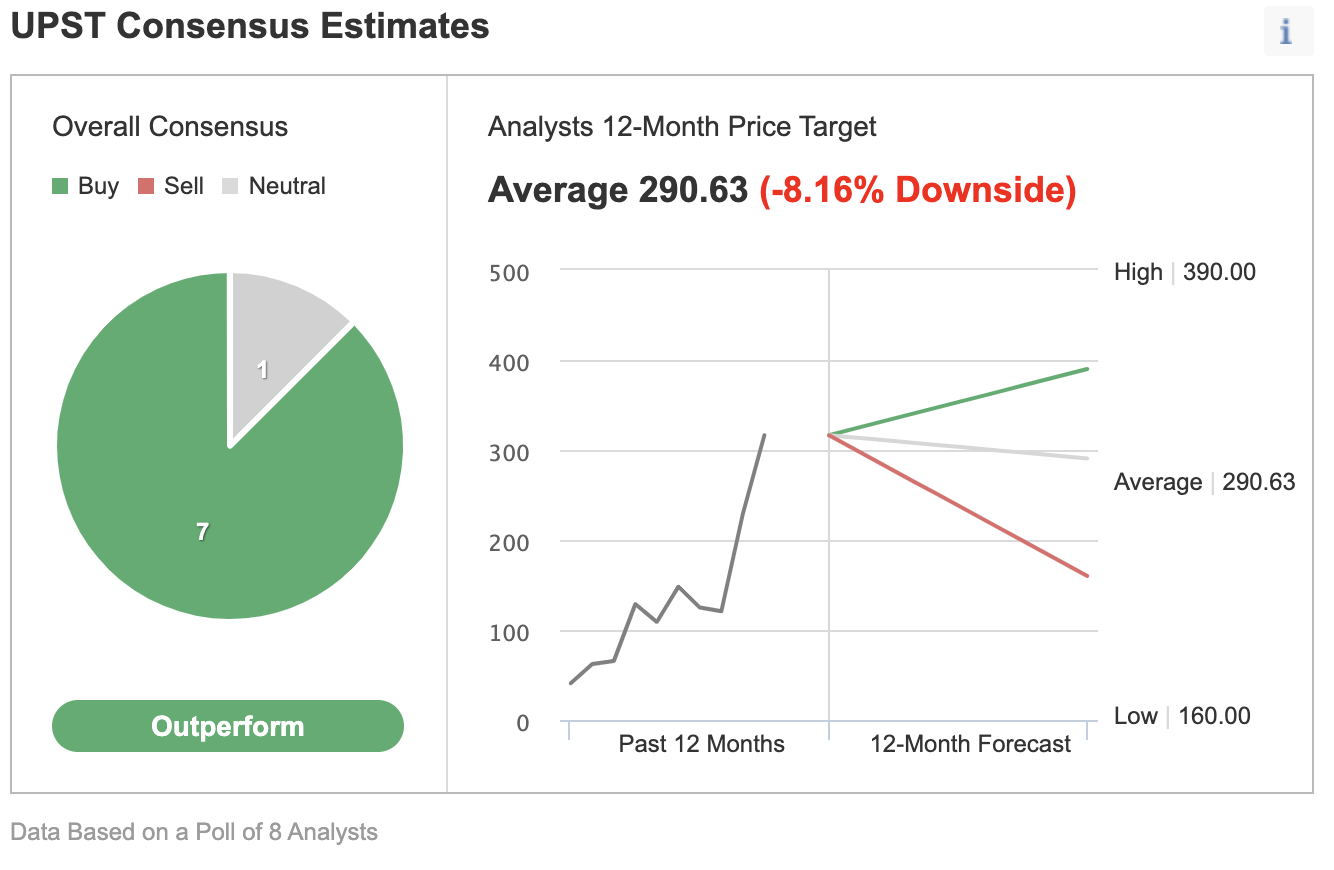

Amongst eight analysts polled by way of Investing.com, Upstart inventory has an ‘outperform’ score. The shares have a 12-month worth goal of $290.63, implying a decline of about 8.5% from present ranges.

In different phrases, the Road’s believes all obtainable info and excellent news have already been nicely factored into the value. The 12-month worth vary at present stands between $78 and $109.30.

The trailing P/E, P/S and P/B ratios for UPST inventory stand at 491.45x, 55.21x and 32.67x, respectively. Upstart is exclusive in its AI-platform providing.

Nevertheless, to check, have a look at the metrics for Coinbase World (NASDAQ:), one other younger finance group. Its P/E, P/S and P/B ratios, are 28.24x, 9.64x and 10.23x. In the meantime, P/S and P/B ratios for LendingClub (NYSE:) are 5.07x and three.46x. This exhibits that many on Wall Road discover the present valuation degree for Upstart inventory to be extraordinarily excessive and, thus, untenable.

Buyers who watch technical charts is perhaps to know that numerous UPST inventory intermediate-term oscillators are overbought. Though they will keep prolonged for weeks, if not months, potential profit-taking may be across the nook.

If broader markets, or high-growth tech shares, have been to return below stress in October, we may doubtlessly see Upstart inventory decline first towards $300, after which $275, after which it may commerce sideways whereas it establishes a brand new base.

Our expectation is for the inventory worth to return below stress quickly and decline round 10%-15% from these ranges. Such a possible drop would provide new UPST buyers a greater entry level.

As a high-growth disruptor within the fintech area, any potential decline in Upstart shares are prone to be quick lived. Towards the top of the yr, we may presumably see a brand new leg up emerge in UPST inventory that may ultimately result in a brand new ATH. In the meantime, the corporate may additionally discover itself a takeover candidate.

3 Potential Trades

1. Purchase Upstart Inventory At Present Ranges

Buyers who aren’t involved with day by day strikes in worth and who imagine within the long-term potential of the corporate may contemplate investing in Upstart shares now.

On Sept. 30, UPST inventory is at $316.50. Purchase-and-hold buyers ought to count on to maintain this lengthy place for a number of months whereas the inventory makes one other try on the file excessive of $346.55. Such a transfer would result in a return of greater than 9%.

In the meantime, buyers who’re involved about giant declines may also contemplate putting a stop-loss at about 3-5% beneath their entry level.

2. Purchase An ETF With UPST As A Primary Holding

Many readers are accustomed to the truth that we frequently cowl exchange-traded funds (ETFs) that is perhaps appropriate for buy-and-hold buyers. Thus, readers who don’t need to commit capital to Upstart inventory however would nonetheless prefer to have substantial publicity to the shares may contemplate researching a fund that holds the corporate as a high holding.

Examples of those ETFs embody:

- World X Robotics & Synthetic Intelligence ETF (NASDAQ:): This fund is up 10.5% YTD, and UPST inventory’s weighting is 10.74%;

- World X FinTech ETF (NASDAQ:): The fund is up 2.6% YTD, and UPST inventory’s weighting is 5.13%;

- World X Guru™ Index ETF (NYSE:): The fund is up 11.2% YTD, and UPST inventory’s weighting is 2.22%;

- WisdomTree Development Leaders Fund (NYSE:): The fund is up 5.3% YTD, and UPST inventory’s weighting is 1.72%.

3. Bear Put Unfold

Readers who imagine there might be extra profit-taking in UPST inventory within the quick run would possibly contemplate initiating a bear put unfold technique. Because it includes choices, this arrange is not going to be acceptable for all buyers.

It may also be acceptable for long-term UPST buyers to make use of this technique together with their lengthy inventory possibility. The set-up would provide some short-term safety towards a decline in worth within the coming weeks.

This method requires a dealer to have one lengthy Upstart put with the next strike worth and one quick Upstart put with a decrease strike worth. Each places may have the identical expiration date.

Such a bear put unfold could be established for a internet debit (or internet price). It should revenue if Upstart shares decline in worth.

As an example, the dealer would possibly purchase an out-of-the-money (OTM) put possibility, just like the UPST 21 Jan. 2022 310-strike put possibility. This selection is at present provided at $48.00. Thus, it could price the dealer $4,800 to personal this put possibility, which expires in about 4 months.

On the similar time, the dealer would promote one other put possibility with a decrease strike, just like the UPST 21 Jan. 2022 290-strike put possibility. This selection is at present provided at $37.75. Thus, the dealer would obtain $3,775 to promote this put possibility, which additionally expires in about 4 months.

The utmost danger of this commerce could be equal to the price of the put unfold (plus commissions). In our instance, the utmost loss could be ($48.00 – $37.75) X 100 = $1,025.00 (plus commissions).

This most lack of $1,000 may simply be realized if the place is held to expiry and each UPST places expire nugatory. Each places will expire nugatory if the UPST share worth at expiration is above the strike worth of the lengthy put (greater strike), which is $310 at this level.

This commerce’s potential revenue is proscribed to the distinction between the strike costs (i.e, ($310.00 – $290.00) X 100) minus the online price of the unfold (i.e., $1,025.00) plus commissions.

In our instance, the distinction between the strike costs is $20.00. Subsequently, the revenue potential is $2,000 – $1,025 = $975.

This commerce would break even at $299.75 on the day of the expiry (excluding brokerage commissions).

[ad_2]