[ad_1]

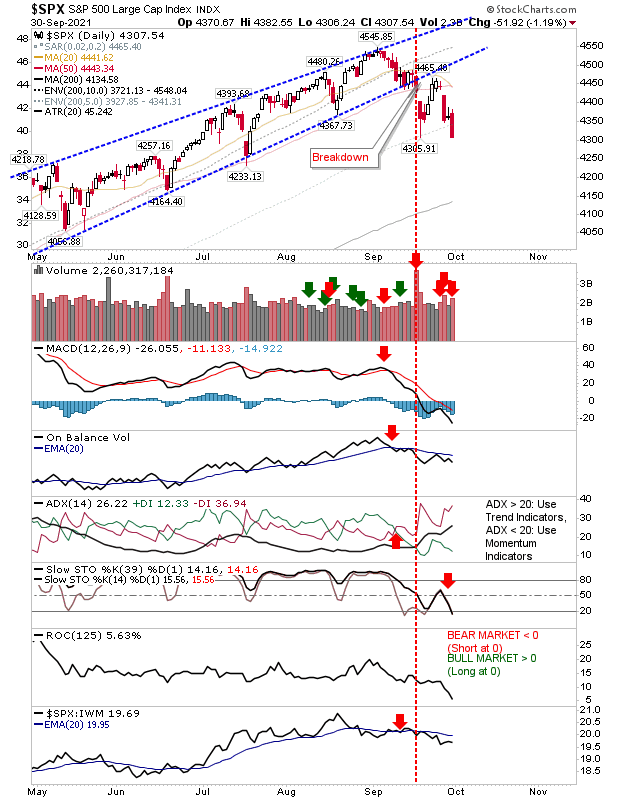

The adopted by way of on its continuation sample by delivering a strong purple candlestick decrease. These huge purple candlesticks have additionally include bearish distribution. Subsequent cease is the 200-day MA on internet bearish technicals.

SPX Every day Chart

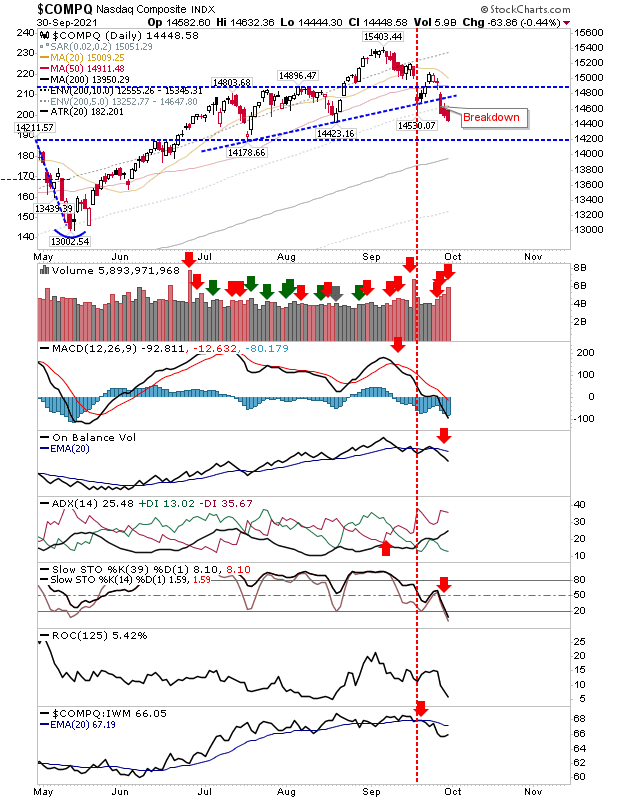

The can be edging in the direction of its 200-day MA on greater quantity distribution. With the index closing at its lows over the previous few days its prone to maintain pushing decrease. Look ahead to a spike low because it will get nearer to its 200-day MA.

COMPQ Every day Chart

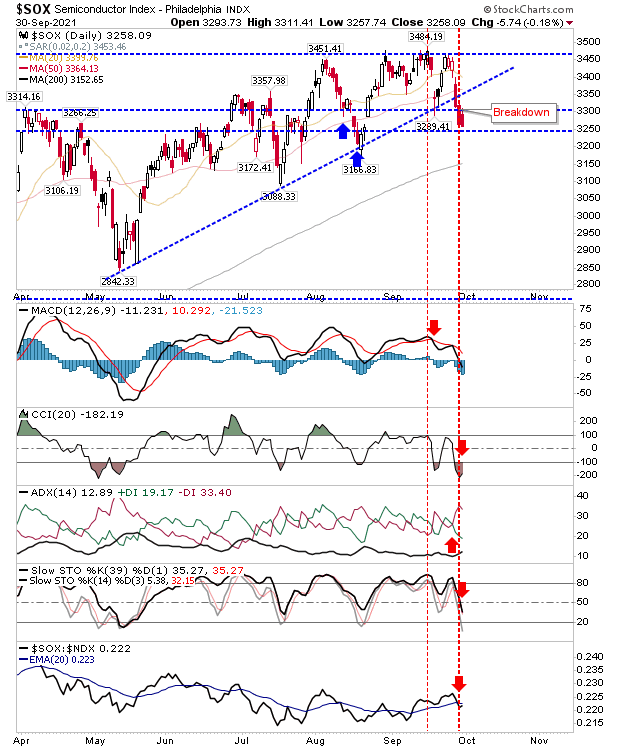

The Semiconductor Index is supporting the transfer decrease in Tech indices because it too has damaged rising trendline assist. As with the NASDAQ it is also gearing for a take a look at of the 200-day MA – however is prone to get there first.

SOX Every day Chart

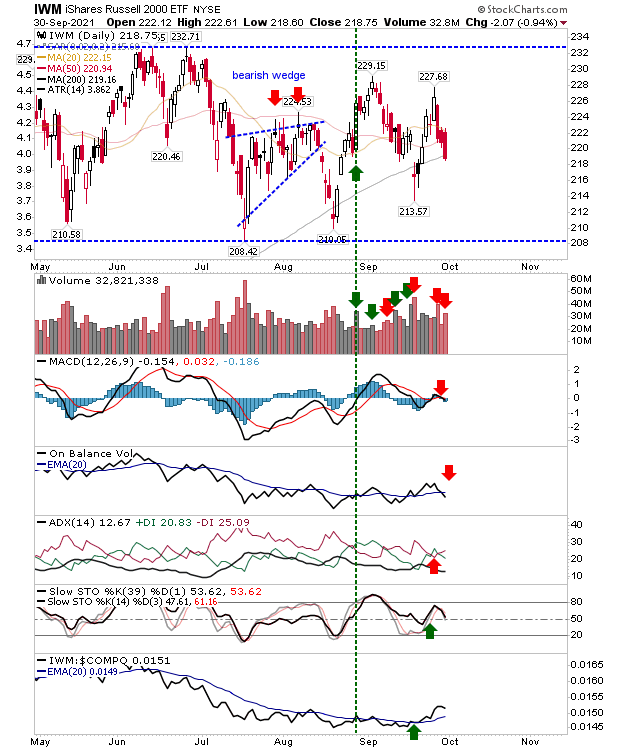

The hit its 200-day MA for a 3rd time within the final two months, however all of this has occurred inside its bigger buying and selling vary. If there may be an undercut then subsequent take a look at can be buying and selling vary assist – opening up the likelihood for bigger losses.

IWM Every day Chart

Immediately’s motion has successfully arrange for additional losses – most probably tomorrow. Bigger losses could emerge later however we probably have not seen the top of the promoting but. The Russell 2000 stays the index of curiosity because it has shifted sideways for many of 2021 as different indices gained. The way it breaks will say a lot about the long run traits for markets.

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or injury because of reliance on the knowledge together with knowledge, quotes, charts and purchase/promote indicators contained inside this web site. Please be totally knowledgeable concerning the dangers and prices related to buying and selling the monetary markets, it is without doubt one of the riskiest funding kinds attainable.

[ad_2]