[ad_1]

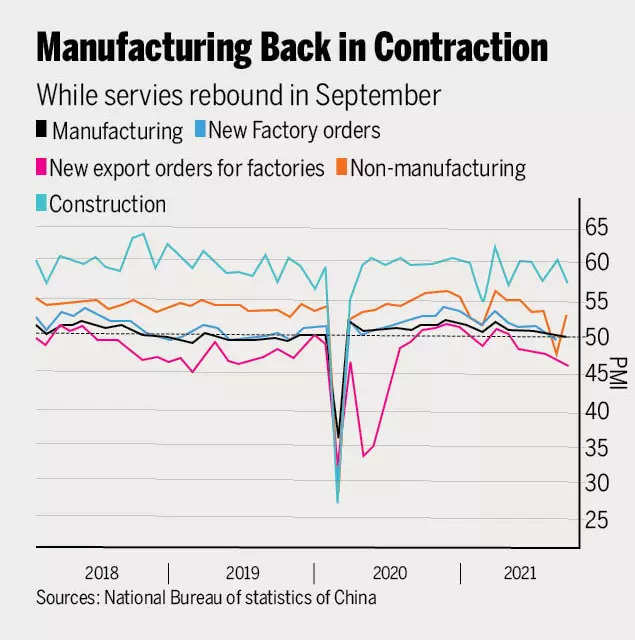

The drop within the official manufacturing buying managers’ index beneath the 50-mark, which indicators a decline in output, reveals the harm a widespread electrical energy crunch is having on progress.

Alongside powerful measures to rein within the property market, the newest developments have led economists to pare again full-year progress predictions beneath 8% and warn that Beijing could possibly be keen to tolerate a sharper slowdown because it tries to reform its financial mannequin.

The issue for the economic system is that manufacturing and property funding have been the primary drivers of progress for the reason that pandemic hit, whereas consumption progress stays comparatively weak with households nonetheless cautious about journey and consuming out.

Electrical energy shortages, which have precipitated energy cuts throughout China this week, mixed with property curbs are “a double whammy on the important thing drivers of progress this yr,” mentioned Bo Zhuang, China economist at Loomis Sayles Investments Asia. “An extra progress slowdown is inevitable.”

Beijing is targeted on stopping instability: the central financial institution informed monetary establishments to stop fallout from the property slowdown which has exacerbated a debt disaster at China Evergrande Group, and focused monetary easing aimed on the manufacturing sector could also be probably.

However economists see little prospect of leisure on powerful coverage, similar to curbs on housing purchases and power use limits, till December, when President Xi Jinping and prime officers meet to set financial priorities.

What Bloomberg economics says

Further coverage help might want to come quickly to avert a pointy deceleration in progress.

The economic system’s near-term outlook is very difficult and unsure. Headwinds embrace softening exterior demand, continued virus dangers and an absence of quick, prepared options for the power shortages. Regulatory tightening can be a major drag.

When the federal government set its progress goal at “above 6%” in March, economists noticed it as modest towards their very own predictions of 8%-plus. Many are actually rethinking their views, with main banks from Goldman Sachs Group Inc to Nomura Holdings Ltd downgrading their forecasts in latest weeks to as little as 7.7%.

Right here’s a deeper have a look at the challenges going through China’s economic system:

Energy crunch

Chinese language factories in 21 provinces have been hit by energy cuts in latest weeks, largely pushed by a spike in coal costs that made it unprofitable for energy vegetation to promote electrical energy at fixed-prices.

The affect was within the official manufacturing buying managers’ index, which declined to 49.6 from 50.1 in August, beneath the 50 median estimate in a Bloomberg survey of economists.

Beijing has scrambled to unravel the issue by permitting energy firms to lift costs and attempting to funnel extra coal to the sector. These efforts may get manufacturing going once more in lots of factories, however that aid won’t come for weeks.

Past that, Beijing is signaling that it needs extremely energy-intensive producers, like metal and chemical factories, to cut back output for the remainder of the yr, because it tries to satisfy environmental targets.

China’s intention to cut back power depth, or how a lot energy is required to drive output, by round 3% in 2021 may drag down full-year progress by 0.3 to 0.6 share factors, in response to Ming Ming, head of mounted earnings analysis at Citic Securities Co.

A rollback of power depth targets earlier than the tip of the yr is unlikely, in response to Chen Lengthy, a companion at consulting agency Plenum.

“This yr’s goal is above 6%, so progress shouldn’t be actually a priority,” he mentioned, including that the economic system may develop by lower than 4% within the fourth quarter.

Property slowdown

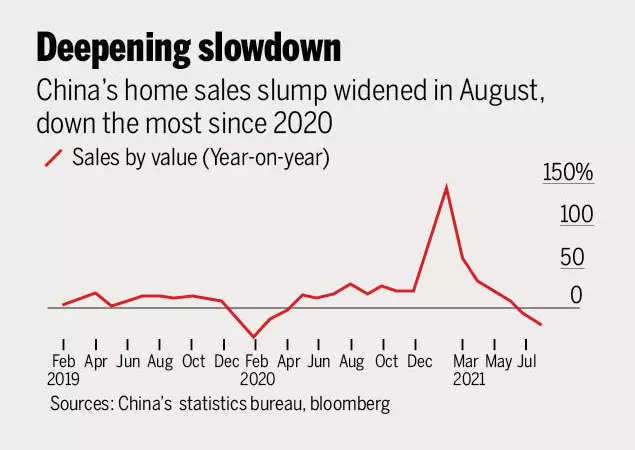

Evergrande is going through a debt disaster that’s roiled monetary markets and drawn world consideration. The corporate solely accounts for about 4% of China’s property gross sales, so economists are extra apprehensive a couple of broader slowdown in real-estate funding prompted by the federal government’s efforts to sluggish the tempo of mortgage lending and curb financing for property builders.

China’s central financial institution informed monetary establishments this week to cooperate with governments to stabilize the property market, repeating a name for “wholesome improvement” of the real-estate sector.

Which will sign a “marginal adjustment” of real-estate credit score coverage to make sure individuals who want housing can entry loans, in response to a report Thursday on a social media account of the official Securities Occasions.

Deepening slowdown

Beijing needs to keep away from a crash available in the market, however has vowed to not use the property sector to stimulate progress and so is unlikely to shift to easing restrictions considerably.

Actual-estate funding may fall by 2% to three% year-on-year within the second half of the yr, in response to a baseline estimate by UBS Group AG.

Within the worst-case state of affairs, property funding may plunge by 10%, dragging down China’s financial progress by 1 to 2 share factors within the subsequent few months, in response to UBS economists led by Wang Tao.

Weak consumption

China has been examined by coronavirus clusters in southeastern and northern areas in latest weeks. The nation’s zero-tolerance strategy to the virus means stringent curbs will impede an already-slow restoration in consumption. The slowdown is most seen in China’s automotive gross sales, which fell practically 15% year-on-year in August.

Sightseeing stoop

The newest outbreaks led to lackluster tourism income over a nationwide vacation interval final week. That’s prone to be repeated over the seven-day Nationwide Day vacation initially of October, with Chinese language well being authorities advising the general public to keep away from pointless journey.

Commodity costs

Surging costs of coal and different commodities have strangled revenue progress for downstream producers in sectors like electronics and vehicles, who had been already coping with challenges similar to file delivery prices and a microchip scarcity.

Industrial revenue progress already decelerated to its slowest degree in virtually a yr in August.

Some factories are reducing again on manufacturing, assembly solely essentially the most worthwhile orders. Elevating electrical energy costs is perhaps the answer to energy cuts, however will add to their price burden.

Whereas the disruption must be cleared in some unspecified time in the future, “excessive power costs will nonetheless weigh on exercise,” Craig Botham, chief China economist at Pantheon Macroeconomics, mentioned in a report Wednesday.

[ad_2]