[ad_1]

Many of us see dividends as simply a supply of earnings. However they’re a lot extra! The 2 high-yield buys I’ll present you right now, for instance, are what I prefer to name “dividend Swiss Military knives.”

(One among these stealth funds pays an unheard-of 9.4% payout right now, so that you’d be pulling in a cool $9,400 in dividends for each $100K invested—sufficient to recoup your total funding in dividends alone in a bit greater than 10 years! It doesn’t get a lot safer than that.)

And sure, I do know full properly how corny “dividend Swiss Military knife” sounds. However the title works! As a result of other than merely paying you an enormous earnings stream, these two funds—closed-end funds (CEFs), to be particular—additionally:

- Fade your portfolio’s volatility (a key power within the overbought market we’re dealing with right now).

- Lower your tax invoice. It’s true! One of many funds we’ll dive into pays a 4.8% dividend that’s tax-free—so it may very well be value as much as 7.5% to you, relying in your tax bracket.

- Construct your nest egg quick, as a result of their large dividends provide the possibility of reinvesting some (or all) of your payout, ballooning the worth of your portfolio as you do.

Inventory-Market Forecast Sees a Storm Forward

I put “low volatility” on the prime of the listing above as a result of most of the market indicators I watch are pointing to a uneven interval forward—so we earnings buyers must lock down our payouts now, then get set to pounce when the following selloff overshoots on some investments (as they at all times do!), giving us a transparent shot at some “snap-back prepared” positive factors.

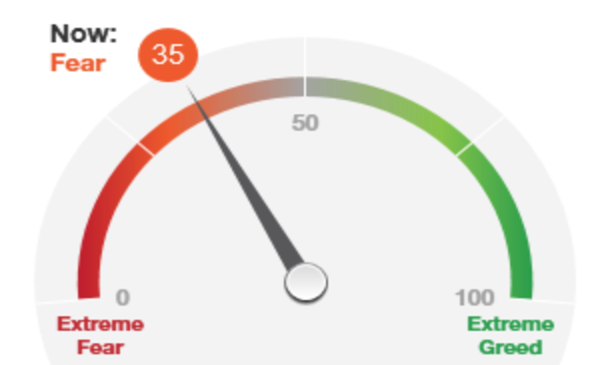

Heck, even the mainstream media’s caught on to the selloff fear—and so they’re normally the final to know. Working example: CNN’s Worry & Greed Index, which has been inexperienced for months however simply turned purple.

Fashionable Market Alarm Goes Off

Worry/Greed Index Studying

Worry/Greed Index Studying

Supply: CNN.com

It is a fairly easy indicator: over 50, the market is grasping. Lower than that, it’s fearful. The indicator has stayed above 50, apart from a pair current dips into the 40s, however now it’s properly beneath 40—and falling.

To be trustworthy, there’s ample purpose to be cautious about shares as of late, beginning, in fact, with the rocket trip the market’s been on since April 2020. We’re undoubtedly due for a breather, and with September traditionally being the worst month of the 12 months for stock-market efficiency, we may very well be in for one quickly (we’ve already seen the pull again some 2% because the begin of the month as of this writing).

Then there’s the delta variant, which threatens to hamper client spending, and worries about consumers pulling again might set off a selloff on their very own, even when such a spending slowdown doesn’t finally seem.

So what can we do? In fact, we do not wish to promote—we’d lose our dividends if we did that! As a substitute, we’ll look to the 2 CEFs beneath. They’ve key strengths that may see you thru a crash, maintain your earnings as they do, and get you to the opposite aspect, the place bargains shall be ready!

1. Immediate Diversification and a Tax-Free Dividend

One factor you don’t wish to do when the market is that this dear is to have 100% of your portfolio in shares. At occasions like this, you’ll wish to make sure you have got publicity to property like municipal bonds, or “munis,” that are issued by states, cities and different authorities organizations to pay for infrastructure tasks.

A CEF just like the Blackrock MuniHoldings NJ High quality Fund (NYSE:) is an effective approach to get that publicity.

MUJ boasts one of many largest yields of any muni-bond CEF, at 4.8%, and its portfolio is rated extra extremely than these of comparable funds, too. MUJ additionally trades at a 1.7% low cost to web asset worth (NAV, or the worth of the bonds in its portfolio), so that you’re paying beneath market worth right here.

Right here’s the true difference-maker: MUJ’s 4.8% dividend may very well be value much more to you—as talked about earlier, presumably as much as 7.5%, relying in your tax bracket—as its payout is tax-free for many Individuals.

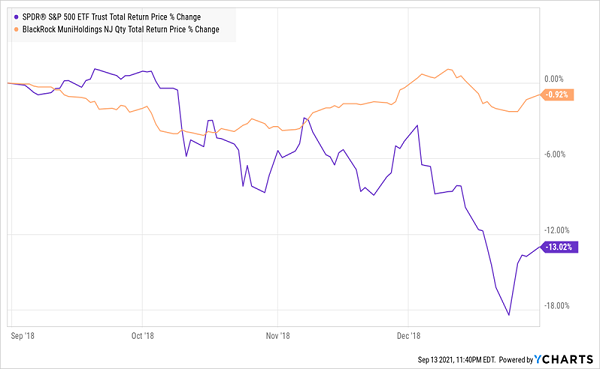

That earnings stream is essential, as I’ll clarify in a bit, however what’s actually essential is that municipal bonds are typically a lot much less unstable than shares. Take, as an illustration, the fear-driven selloff of late 2018. MUJ buyers little question questioned what all of the fuss was about!

MUJ’s Asset Safety Absolutely in Place

MUJ-Complete Returns

MUJ-Complete Returns

MUJ did pull again in the course of the March 2020 crash (together with all the pieces else), however it’s greater than eclipsed its pre-crisis highs now, and “munis” are safer than they’ve ever been, as a result of they hardly ever default (they boast a mean five-year default price of simply 0.13% since 2010) and the Fed has stepped in to backstop the muni market all through the pandemic.

In different phrases, the cash you put money into MUJ has strong safety from the market’s broader losses—a really engaging function right now.

2. An All-American Fund Throwing Off a 9.4% Payout

Now let’s flip to stock-focused CEFs, the place you’ll discover loads of choices yielding 7% or extra. Inventory publicity continues to be key, in fact, despite the fact that we do wish to be certain we’re diversified, as a result of no different asset class can match shares for long-term returns. And shopping for by a CEF additionally will get you earnings to tide you over in a downturn (and, importantly, money that you should utilize to reinvest throughout these unpredictable, fear-driven dips).

The Liberty All-Star Fairness Fund (NYSE:) is a good instrument for simply this. It provides you publicity to blue chip shares like PayPal (NASDAQ:), Amazon (NASDAQ:), Fb (NASDAQ:), Adobe (NASDAQ:) and Google (NASDAQ:) however with a key distinction: as an alternative of the low (or no!) dividends these companies pay, USA throws off an enormous 9.4% payout!

Once you consider that dividend, you see that USA buyers have pocketed a complete return that’s crushed that of the SPDR S&P 500 ETF Belief (NYSE:), most individuals’s go-to S&P 500 index fund, within the final 5 years.

USA Rides Its Dividend Previous the Market

USA Complete Returns

USA Complete Returns

USA actually is providing the very best of all worlds for earnings buyers: outperformance and massive dividends we will use to pay our payments and/or reinvest when the market takes a short-term dip as concern overrides greed.

Disclosure: Brett Owens and Michael Foster are contrarian earnings buyers who search for undervalued shares/funds throughout the U.S. markets. Click on right here to discover ways to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”

[ad_2]