[ad_1]

Government Abstract

-

Wall Road Horizon launched Interim Calendar that includes key dates and knowledge between earnings bulletins – we take a look at two companies with upcoming interim occasions

-

Dividend coverage modifications are optimistic this yr, however there’s a warning flag waving

-

A shopper discretionary identify with a sputtering share worth is profiled as an earnings outlier

Wall Road Horizon launched Interim Calendar on September 14. This expansive new dataset comprises dates and details about recurring bulletins made by firms between their quarterly or semiannual earnings stories. Figures reminiscent of gross sales, manufacturing, providers ranges, and monetary situation updates are contained within the interim calendar.

Upcoming Interim Occasions

Fastenal Co (NASDAQ:) is a $30-billion market cap industrials firm primarily based in Minnesota. It’s a powerful proxy for what’s occurring within the essential manufacturing sector of the U.S. economic system, however its enterprise abroad additionally sheds gentle on world exercise. FAST gives month-to-month gross sales updates between its quarterly earnings stories—September income figures can be launched on the morning of October 12. The next month’s gross sales replace posts November 4 earlier than the Baird 2021 International Industrial Convention the place Holden Lewis, EVP & CFO is scheduled to talk.

Getlink SE (PA:) is a number one transport firm headquartered in France. Interim updates are arguably extra very important for worldwide companies since many of those firms report earnings simply twice a yr. Interim calendar has two notable occasions in October: month-to-month Shuttle Site visitors info Unconfirmed on October 7 (primarily based on reporting historical past) and semi-annual income and visitors figures Confirmed on October 21. Unconfirmed occasions can be Confirmed as soon as the corporate broadcasts the occasion or can be confirmed on the date of the occasion.

The interim calendar gives priceless company occasion info that drives inventory worth volatility in markets world wide. Amid an unsure macroeconomic setting, company executives are shortly pivoting to evolving traits. Quick-term enterprise updates are extra essential than ever.

A Examine On Dividend Developments

Given this uncertainty, what indicators are we getting from companies by the use of dividend coverage? Dividend bulletins and funds are among the many greater than 40 company occasion sorts Wall Road Horizon covers, due to this fact, preserving our fingers on the heartbeat of company sentiment. When companies are optimistic, they have a tendency to lift dividends. When robust instances lie forward, we see dividend cuts.

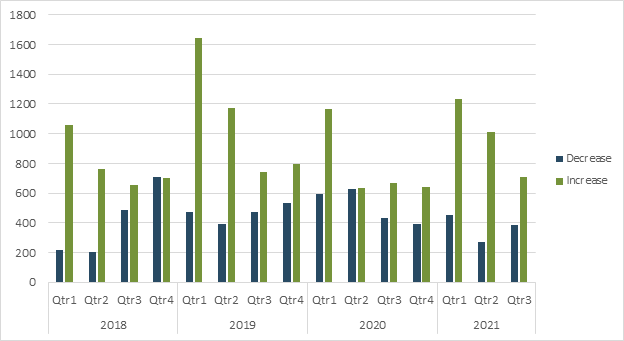

How is 2021 shaping up? It’s a yr of rebound and optimism regardless of ongoing challenges reminiscent of COVID-19 lingering and inflation capturing to multi-decade highs. Our information present extra dividend will increase introduced this quarter versus Q3 2020. It continues a powerful pattern that started final summer time. This can be a metric market individuals ought to proceed to watch as there was an uptick in dividend decreases quarter-on-quarter. That might be a warning signal as we head towards 2022.

Determine 1: Dividend Modifications Amongst International Corporations (Q1 2018-Q3 2021)

Earnings Outlier: Herman Miller (NASDAQ:)

MLHR is a Michigan-based $3 billion market cap shopper discretionary inventory. This small cap agency designs, manufactures, and distributes furnishings for places of work, instructional, and residential settings. MLHR gross sales are barely damaging year-on-year. The corporate isn’t a pure-play return-to-office identify because it covers each residence and workplace, however price-action in 2021 suggests the agency stands to profit from companies reinventing and refurnishing workplace life.

After a powerful rally to begin 2021, shares of the patron firm went south beginning in early June. The reopening theme petered out about that point when issues across the Delta variant hampered excessive beta and consumer-related industries.

Determine 2: MLHR Inventory Value Historical past (1-Yr)

Merger Particulars

The massive information with Herman Miller got here on April 19 when a merger with Knoll (NYSE:) was introduced. The brand new entity can be named MillerKnoll. Wall Road Horizon notified purchasers on the morning of the merger. MLHR inventory initially dropped greater than 10% with heavy quantity on the announcement date, however patrons stepped in aggressively to melt the blow. The bulls have been again in cost weeks later because the inventory climbed to contemporary highs.

Outlier Evaluation

MLHR has traditionally reported Q1 outcomes between Sept, 16 – 19 with a powerful Wednesday pattern.

- June 29 – Wall Road Horizon set an Unconfirmed earnings date of September 15 After Market primarily based on reporting traits

- Sept. 7 – MLHR introduced it will report Q1 2022 outcomes on Sept. 29 After Market. WSH modified the earnings date and standing to Confirmed. A convention name webcast takes place following the earnings announcement. In July, MLHR finalized its merger with Knoll Inc and adjusted its identify—these occasions possible pushed out its reporting sample.

MLHR has been extraordinarily constant in its earnings report schedule for the previous 5 years, so this excessive Z-score earns an “A” confidence ranking. Merchants ought to monitor the upcoming report for extra merger-related information.

Conclusion

Assembly season and company conferences are at all times on the September agenda. This yr, like a yr in the past, many firms made the robust option to go digital. We highlighted three shares dealing with essential macro and firm-specific points. Buyers ought to monitor upcoming shareholder conferences for a gauge of company optimism and easy methods to traverse rising challenges. Wall Road Horizon tracks key company occasions reminiscent of shareholder conferences and conferences, inventory splits, and earnings dates for purchasers to allow them to successfully handle threat.

[ad_2]