To conduct sophisticated technical analyses, modern online traders make use of various digital tools. Some of the most widely used tools were invented long before the advent of online trading. We mean candlestick patterns. They have been around since at least the 18th century. They were invented in Japan and have remained the same since. Their primary function is to predict and identify price movements on financial markets. This brief overview will explain how candlestick patterns could be used to reveal bullish or bearish indicators. Let’s get on with the business!

Introduction

These charts are very popular with both beginners and more experienced users. They provide valuable and very useful information. These data are also easy to access. This is how they view charts.

- Candles that have a closing value greater than the opening are considered green or white.

- Candles that have an opening value greater than the closing value are considered red or black.

- Parts called “shadows” and “wicks indicate rising or falling prices. These are the parts of candles which are located above and beneath the actual body.

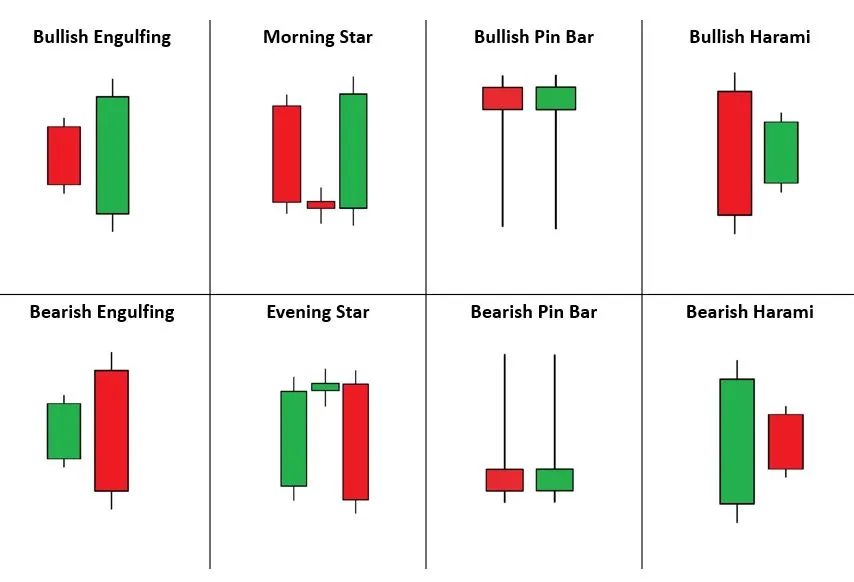

These patterns serve the most common purpose of giving traders a hint – whether indicator suggests buying or trading. There are many kinds of candlesticks. They are all used for different purposes.

- Bearish candles indicate that the upward trend is over.

- Bullish candles signal that the downward trend will end.

- Some candles reflect market participants’ indecisiveness.

- Certain bullish and/or bearish patterns can only be identified by using several candles.

This charting style is very popular as it can be used in all time periods. This allows for efficient technical research that can be done with a variety of instruments. These patterns can be applied to different markets. They can be used to forecast future price movements for trading stocks, currency pairs or indices. Their principle of use is the exact same for all trading markets and platforms. This is why traders combine them with sophisticated technical instruments. This strategy can increase your chances of making profitable deals, even though no one can guarantee you a profit.

Why is a chart important for trading online

This design is extremely useful and informative. Candlestick charts provide information about the open, close, high, low and close times for each period, rather than line charts. It’s much easier to understand current conditions and predict future trends with this data. We’ve already mentioned that all of this information is contained in only two components of a candle: its body (wicks) and its head. The candle’s body is formed between the closing and open prices of the bar. If indicators indicate a falling price of your asset, it will be colored red. If the trend is upward, it will be colored green. Charting can be used to simply inform traders of the current price trends.

Also, it is important to note the wicks on the candle for analysis. The extensions of these wicks indicate the highest or lowest price between opening and close. These prices will be identical so the candle will not have any wicks. There are many options for the body. It is dependent on the trend in the product’s value fluctuations. The candle’s body will look flat if you have the open and the close equal.

Identifying Candlestick Patterns

This is the part of our review that teaches you how to recognize bullish or bearish indicators by the shape, color, and shadows in a candle. These are the most common shapes: “morning star”, ‘hammer’ and ” Doji candle “. The more information a pattern contains, the more complex it is. You might not need to know all the intricate variations of candles if you’re a beginner in online trades. For identifying bullish and bearish patterns, you can use the simplest candlestick patterns like inverted, hangingman, and shooting start.