[ad_1]

In saying the plan Wednesday, the White Home flagged that the transfer would have competing impacts. On the one hand, it’d scale back general family debt and probably present extra spending energy. On the opposite, it affords a timeline to restart funds which have been suspended for greater than two years.

General, the mix of upper financial savings and decrease debt may drive inflation up by 0.1 to 0.3 share factors, in keeping with Michael Pugliese, an economist at Wells Fargo & Co. Bloomberg Economics sees the potential so as to add as a lot 0.2 share factors subsequent 12 months, with danger to the upside. Headline inflation final month, as measured by the patron value index, was 8.5%, close to a 40-year excessive.

“Within the grand scheme of issues, that’s not large,” Pugliese stated of the recent pressures, including that there are excellent particulars that can nonetheless affect his estimate. “However inflation proper now’s at fairly alarming charges. At a time when the financial system is already operating too scorching, it simply threatens placing extra gas on the fireplace.”

Whereas Biden and the Democrats are utilizing the debt reduction to court docket youthful and progressive voters forward of the midterms in November, because the get together dangers dropping management of Congress, the choice has additionally powered criticism that his administration is accountable for a consumer-powered surge in costs, notably from the $1.9 trillion Covid-19 reduction stimulus invoice.

The consequences of the reduction shall be felt broadly. Of the 43 million federal scholar mortgage debtors eligible to learn, about 20 million can have their debt fully eradicated, in keeping with White Home estimates, with 90% of assist going to those that earn lower than $75,000 a 12 months.

The mortgage forgiveness will possible counter any deflationary affect from the lately handed Inflation Discount Act, Beth Akers, a senior fellow on the American Enterprise Institute, stated on Bloomberg Radio’s Stability of Energy.

“It’s really not vastly inflationary,” stated Akers, a former workers economist within the Council of Financial Advisers below George W. Bush. “It will enhance the inflationary stress, but it surely’s nonetheless not a sport changer by way of the inflation debate.”

The Committee for a Accountable Federal Finances, a fiscally conservative group that lobbies for deficit discount, additionally flagged that the debt reduction may undermine the IRA’s disinflationary affect. It stated Biden’s plan will possible value as much as $600 billion, and will add 0.15 share factors to the Federal Reserve’s most popular inflation gauge upfront, with extra stress over time.

The larger drivers for shopper costs within the coming months will stay “the interaction between the robust labor market and rising rates of interest,” stated Blerina Uruci, US economist at T. Rowe Worth Associates. “On the margin the mortgage forgiveness will assist a subset of the US shopper.”

As for the broader affect on the financial system, the prolonged pause on repayments and general lightened debt load will assist consumption, however “it nonetheless comes right down to how keen folks shall be to spend within the present setting of excessive inflation and rising rates of interest,” stated Sal Guatieri, senior economist at BMO Capital Markets. “The actions will mood the draw back dangers to the US financial outlook.”

Whereas Biden’s plan to forgive a portion of scholar loans will scale back the burden for tens of millions of households, it additionally pegs January as the tip to the forbearance interval. Which means that tens of millions of debt holders with greater than $10,000 of loans or earnings ranges exterior of the federal government plan’s parameters must resume funds for the primary time since March 2020, leaving much less leftover for discretionary spending.

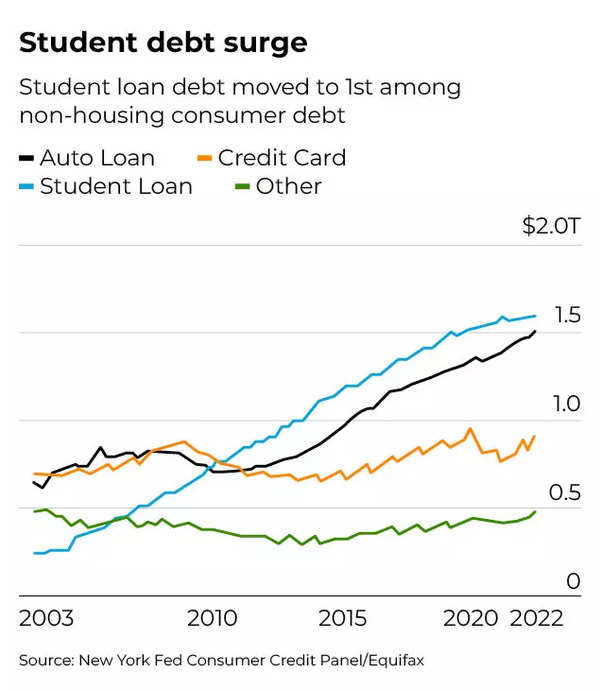

Scholar mortgage debt exceeds $1.7 trillion, in keeping with the Fed, and is second solely to mortgage balances as the most important part of US family debt.

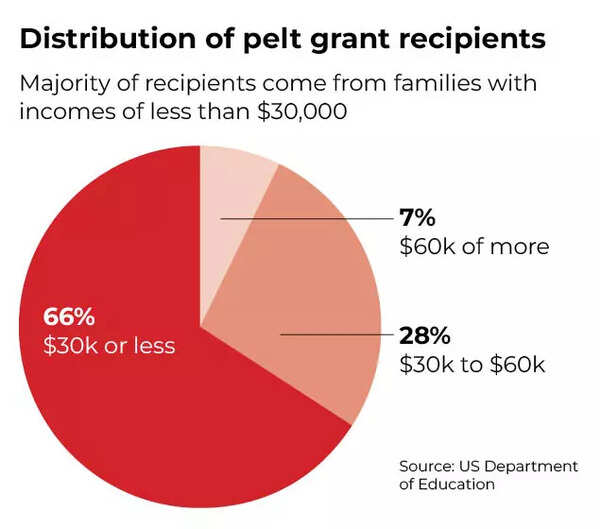

Biden careworn that the plan is focused towards working and center class households. The $10,000 in debt reduction for many student-loan holders shall be doubled for individuals who acquired Pell Grants. Greater than 90% of these grants have gone to households with incomes lower than $60,000 a 12 months.

The mortgage forgiveness can have extra of a long-term impact on family wealth, fairly than a direct impact on spending, stated economist Arin Dube, professor on the College of Massachusetts Amherst. College debt typically restrains first-time homebuyers, so eliminating the debt may liberate spending sooner or later, he stated.

“There are strong causes to oppose the coverage or assist the coverage,” he stated. “However inflation to me shouldn’t be an enormous a part of the problem. That is switch of debt from non-public to authorities basically, and that is going to be unfold out.”

[ad_2]