[ad_1]

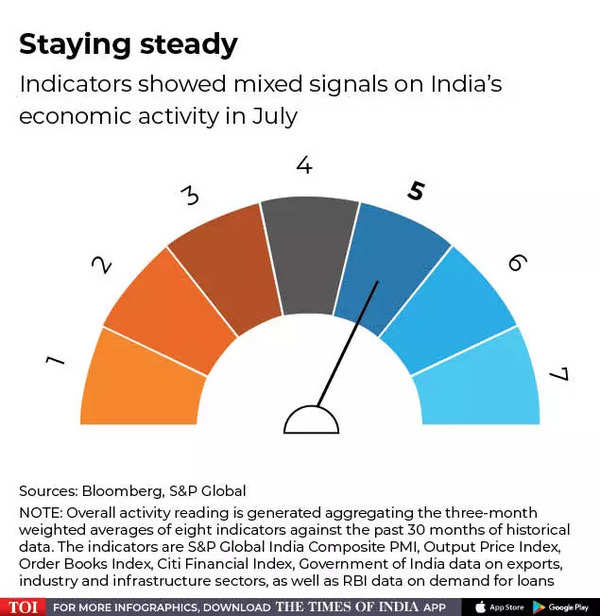

Demand for items and companies softened, a cross-section of high-frequency indicators compiled by Bloomberg Information confirmed. The needle on a dial measuring so-called animal spirits, nonetheless, remained regular at 5 final month because the gauge makes use of a three-month weighted common to easy out volatility within the single month readings.

The Reserve Financial institution of India, which has raised rates of interest by a complete of 140 foundation factors in three strikes this yr, has signaled future tightening could be calibrated to make sure there isn’t a large slowdown within the financial system, and sees worth pressures moderating from its latest peak.

A pulse-check of the financial system is due subsequent week, with gross home product information for the April-June quarter prone to present a double-digit development, reflecting demand due to a wider reopening from the pandemic.

Beneath are particulars:

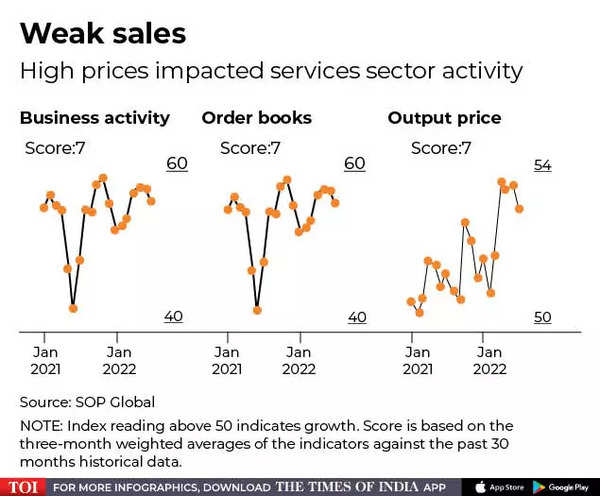

Enterprise exercise

Buying managers’ surveys confirmed India’s companies exercise in July falling to the bottom degree in 4 months on weaker gross sales development and elevated inflation.

Whereas home demand for Indian companies remained regular, worldwide demand worsened, offsetting positive factors within the manufacturing sector that expanded to the very best degree in eight months.

Moderation in enterprise outlook in companies pulled down the S&P International India Composite PMI Index to 56.6 in July, from 58.2 a month earlier.

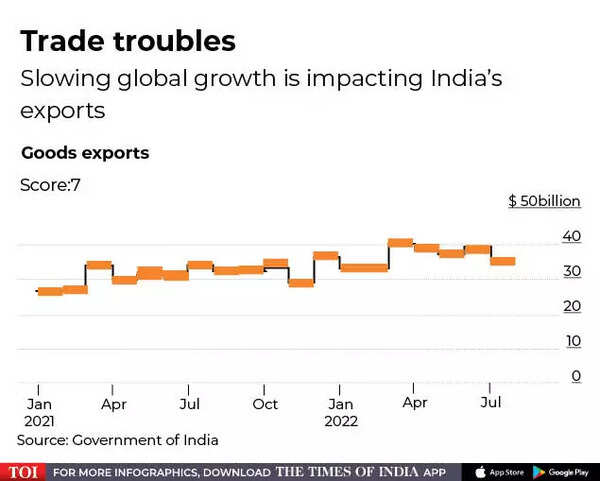

Exports

Commerce deficit widened to a contemporary report of just about $30 billion as exports development slowed to a 17-month low led by weak international demand and a levy on outbound shipments of gas, which makes up greater than 15% of India’s exports.

Imports stayed close to record-high ranges attributable to a weaker rupee, which was one of many worst performing Asian currencies within the final three months.

Crude, which includes about one-third of India’s imports, and coal with an 8% share, primarily contributed to the rise in inbound shipments.

Client exercise

Passenger car gross sales rose for a second-straight month helped by a broad-based restoration in all segments, together with two-wheelers. Whereas provide points attributable to semiconductor scarcity are easing, automakers cautioned that costlier loans might crimp demand for brand new automobiles.

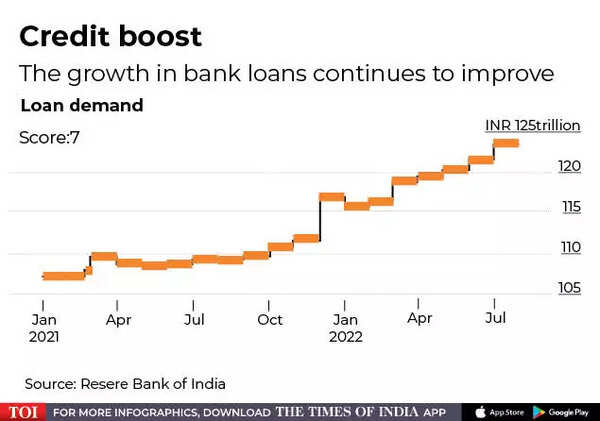

Financial institution credit score continued to develop regardless of increased rates of interest, rising probably the most in additional than three years to 14.5% on the finish of July. Liquidity within the banking system continued to stay in surplus.

Industrial exercise

Amongst indicators of business exercise, manufacturing unit output in addition to core sector signaled moderation in June as electrical energy consumption and coal manufacturing slowed down with the onset of monsoons.

The year-on-year development in Index of Industrial Manufacturing eased to 12.3% from a one-year excessive in Might.

The expansion of eight key infrastructure industries additionally dropped to 12.8 from 19.3% within the earlier month. Each the information are printed with a one-month lag.

[ad_2]