[ad_1]

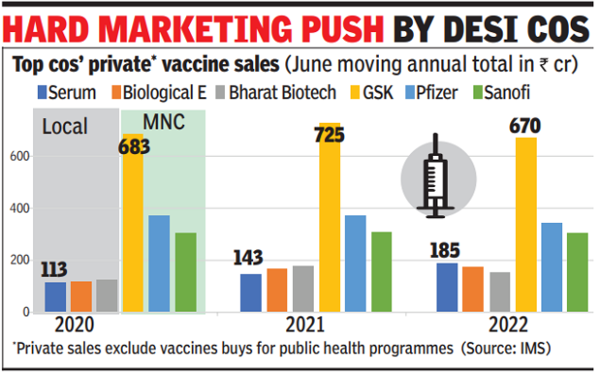

Considerably, for the primary time maybe, indigenously-manufactured vaccines have began snatching share from MNCs in sure illnesses even because the Rs 3,000 crore non-public )market plummeted sharply by 15% in June month-on-month, one of many sharpest such declines in recent times.

Vaccination in India is basically targeted on the pediatric inhabitants, with grownup immunization principally non-existent. The federal government-run `Common Immunization Programme’ targets round 27 million newborns and 29 million pregnant ladies yearly, providing jabs freed from value in opposition to a dozen vaccine-preventable illnesses as a part of the general public market. The general public market refers to government-run programmes.

The expansion in home vaccines is because of a number of causes together with the shift of personal sector demand to the general public well being supply system. This has been aided by the enlargement within the basket of vaccines provided below the nationwide immunization programme (NIP).

Through the years, UIP has been widening the portfolio by together with even “high-value’’ vaccines, and people which have been earlier the unique area of MNCs. As an illustration, the programme affords vaccines in opposition to rota-virus diarrhoea and pneumococcal illness, whereas the HPV vaccine is predicted to be added quickly.

“Initially, MNCs had the first-mover benefit and a monopoly in sure vaccines. Having invested in high quality and analysis, home gamers strengthened the pipeline and at the moment are choosing up steam and launching variations”, an trade observer advised TOI.

Earlier, Rotavirus, Pneumococcal and HPV vaccines have been provided solely by MNCs. With home gamers like SII, Bio E and Bharat Biotech upgrading their pipelines and launching variations, the nationwide immunization programme has been capable of widen the basket.

Sometimes, home gamers are capable of bag authorities orders as a result of inherent value benefit as they’re indigenously manufactured, whereas MNCs import their vaccines.

“Because of the rising recognition of the nationwide immunization programme, the non-public market demand is shrinking, which has impacted gross sales of Synflorix (GSK) and Prevnar (Pfizer), given to forestall invasive illnesses brought on by pneumococcal micro organism comparable to pneumonia and meningitis’’, an government with a home participant stated.

As an illustration, the shift is noticeable within the pneumococcal conjugate vaccine (PCV), accessible within the non-public marketplace for round Rs 3500, whereas it’s free at public well being centres throughout the nation since 2021. An analogous shift was witnessed within the rotavirus a couple of years again, when the market moved from the non-public clinics to public immunization centres.

[ad_2]