[ad_1]

The brand new norms permit for a look-in interval, throughout which the borrower can change his thoughts and resolve to not proceed with the mortgage by paying the proportionate rate of interest with none penalty. Digital lenders gathering private information will now must get prospects’ consent and may solely get hold of need-based information. Additionally, there have to be clear audit trails and an choice to delete the information collected from debtors.

For entities outdoors the purview of central financial institution’s regulatory provisions — together with unauthorised Chinese language mortgage apps — an RBI group prompt particular legislative and institutional interventions for consideration by the central authorities to curb the illegitimate lending exercise being carried out by such entities.

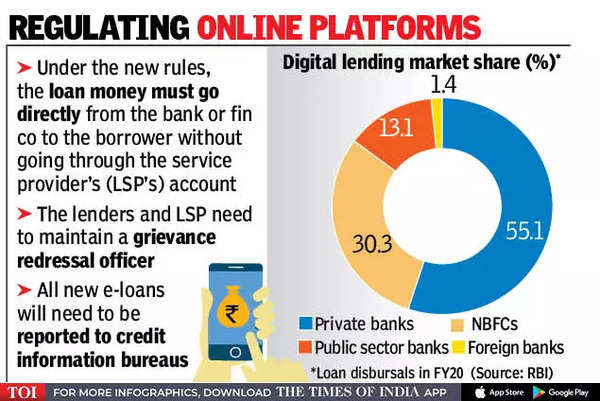

Beneath the brand new guidelines, the mortgage cash should go immediately from the financial institution or finance firm to the borrower with out going via the LSP’s acco- unt. Additionally, banks and NBFCs should make sure that charges paid to the LSP for distribution usually are not handed on to the borrower. This directive might be contentious as some small client loans have cash routed via sellers/distributors. The RBI has, nevertheless, mentioned there could be exceptions to this.

The lenders and the LSP might want to preserve a grievance redressal officer to take care of fintech/digital lending-related complaints. The banks and finance firms that lend should make sure that any buyer who takes a mortgage digitally receives a key reality assertion earlier than the mortgage contract is executed.

The place a digital associate or an LSP disburses the mortgage, the lenders should publish an inventory of LSPs and digital lending apps on their web site. Henceforth, all new digital loans, together with these for short-term credit score, must be reported to credit score info bureaus.

The Digital Lenders Affiliation of India (DLAI) mentioned the brand new norms would assist the digital ecosystem develop responsibly and sustainably. “We at DLAI have all the time welcomed collaboration between the monetary and fintech ecosystems as a result of we recognise this as the easiest way to scale and maintain impactful and inclusive monetary companies,” the affiliation mentioned.

[ad_2]