[ad_1]

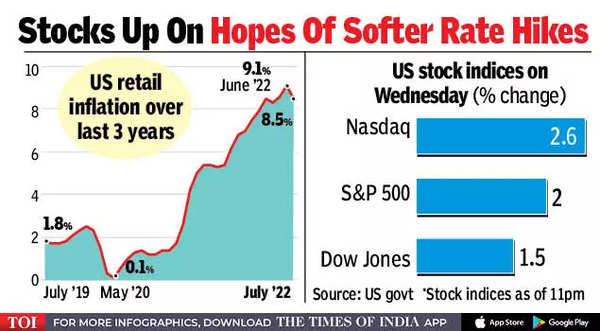

The buyer worth index elevated 8. 5% from a yr earlier, cooling from the 9. 1% June advance that was the most important in 4 many years, Labor Division knowledge confirmed Wednesday. Costs have been unchanged from the prior month. A decline in gasoline offset will increase in meals and shelter prices.

The info might give the Fed some respiratory room, and the cooling in gasoline costs, in addition to used automobiles, gives respite to customers. However annual inflation stays excessive at greater than 8% and meals prices proceed to rise, offering little reduction for US President Joe Biden and the Democrats forward of midterm elections.

Whereas a drop in gasoline costs is nice information for Individuals, their price of dwelling continues to be painfully excessive, forcing many to load up on bank cards and drain financial savings. After knowledge final week confirmed still-robust labour demand and firmer wage development, an additional deceleration in inflation may take a number of the urgency off the Fed to increase outsize interest-rate hikes.

Although inflation decelerated, Fed officers have mentioned they wish to see months of proof that costs are cooling. They’ll have one other spherical of month-to-month CPI and jobs experiences earlier than their subsequent coverage assembly on September 20-21.

Whereas costs are displaying indicators of moderating, there are a number of elements that threat preserving inflation excessive. Housing prices are an enormous one, in addition to surprising provide shocks. And wages are nonetheless climbing at a traditionally quick tempo, regarding some economists of a so-called wage-price spiral. Nevertheless, these positive factors aren’t maintaining with inflation. A separate report confirmed actual common hourly earnings fell 3% in July from a yr earlier, dropping each month since April 2021. The influence of inflation on wages has began to dent spending, with the tempo of private consumption development decelerating between the primary and second quarters.

Shares surged and bond yields fell as softer-than-expected inflation knowledge fuelled bets the Federal Reserve may pivot to a smaller tempo of hikes. Merchants went risk-on Wednesday, with the S&P 500 (up 2%) on tempo for its highest degree since Might. A surge within the Nasdaq (2. 6%) drove the tech-heavy gauge about 20% above its June low. The Cboe Volatility Index slumped under 20, a degree final seen in April.

[ad_2]