[ad_1]

Ethereum has been experiencing a slowdown in its bullish momentum over the weekend. The cryptocurrency managed to interrupt the vital resistance at $1,700 however might re-test earlier assist ranges earlier than reclaiming increased ranges.

In keeping with Wu Blockchain, Ethereum not too long ago surpassed Bitcoin when it comes to Open Curiosity (OI) for choices contracts. This metric stands at $5.6 billion versus BTC’s $4.3 billion.

For the primary time for the reason that inception of those merchandise, ETH’s worth beat BTC’s open curiosity. As Wu Blockchain famous, many of the OI recorded for Ethereum possibility contracts are calls (purchase) targeting September 30 and December 30.

Each of those dates are post-merge, a extremely anticipated occasion for Ethereum. “The Merge” has been tentatively set for mainnet by September 9th.

This occasion will full ETH migration from a Proof-of-Work (PoW) consensus to a Proof-of-Stake (PoS) consensus. Gamers within the choices market appear to be positioned to the upside or hedging doubtlessly quick positions with different funding merchandise.

A Totally different Perspective On The Worth Of Ethereum

Data from Materials Indicators precisely predicted the short-term promoting stress with the potential for a rise in volatility on yesterday’s important each day, weekly, and month-to-month candle shut. These occasions typically promote sudden strikes in an asset’s worth.

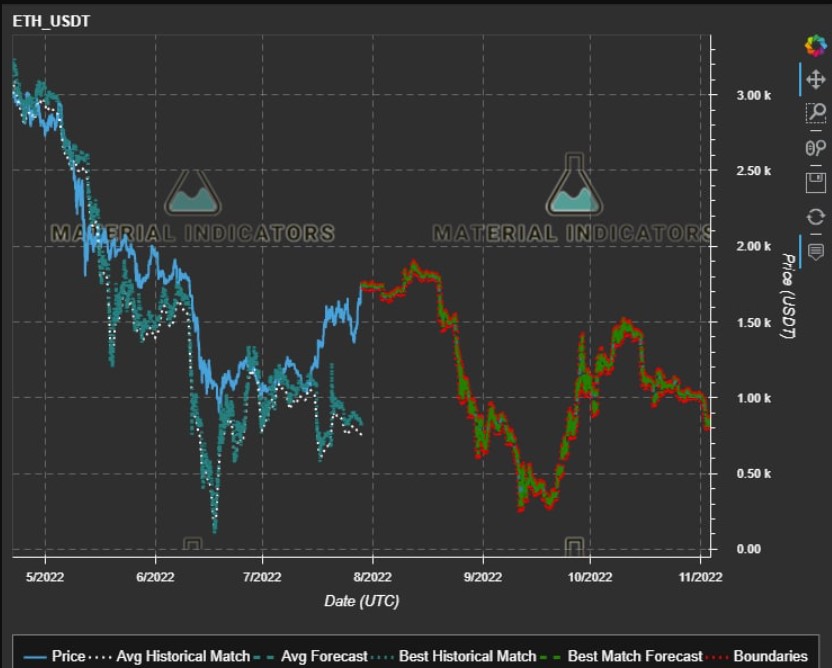

As seen under, Materials Indicators’ Development Precognition Indicator flashed a brief sign at yesterday’s each day shut. This urged that Ethereum had a excessive probability of trending to the draw back.

This short-term promoting stress coincided with technical resistance on the 100-day transferring common (DMA). This degree swelled with a rise in asks orders as the worth of Ethereum trended to the upside over the previous two days.

On the time of writing, ETH’s worth nonetheless data $13 million in asks (promote) orders at $1,700. This implies that this degree will proceed to function as vital resistance in the intervening time.

This shift in momentum for ETH’s worth, as supported by Materials Indicator’s development precognition and asks liquidity, may translate into extra persistent draw back worth motion. As seen under, these analysts offered a attainable bearish situation for Ethereum for the approaching months.

The fractal or worth forecast under reveals ETH’s worth may development downwards till at the very least October 2022. These fashions are extremely unpredictable nevertheless it might present merchants with readability concerning the worth course in excessive time frames.

On the latter, analysts from Materials Indicators stated the next highlighting how this information offers a unique tackle the present ETH’s worth narrative away from the migration to a PoS consensus:

I don’t advocate buying and selling fractals or taking them too actually as they’ll deviate in each worth vary and time or invalidate anytime. That stated… The entire above components paint a really compelling story for #ETH based mostly purely on algos and TA with none of the POW (Proof-of-Work) –> POS (Proof-of-Stake) chatter

[ad_2]