[ad_1]

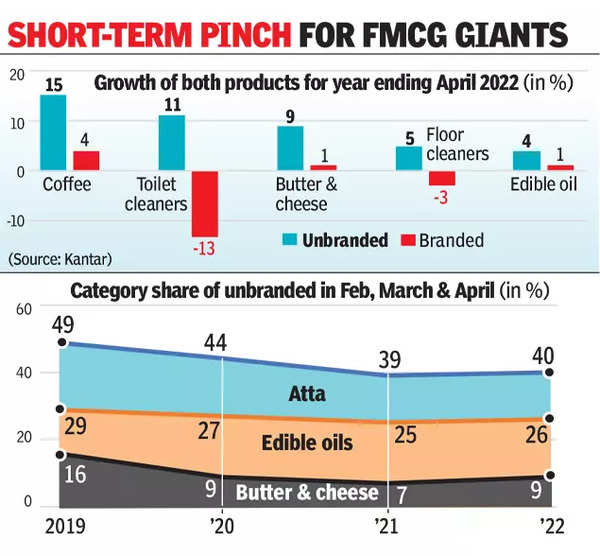

If within the post-Covid interval branded merchandise in fast-moving client items (FMCG) acquired a leg-up as customers selected to stay to buying what they trusted, inflation has clearly spoiled that celebration. Unbranded segments of classes corresponding to rest room & flooring cleaners, espresso, edible oils and sure milk merchandise grew quicker than their branded counterparts, finds analytics agency Kantar (see graphic).

In rest room cleaners, as an example, the unbranded phase grew at 11% within the yr ending April 2022, whereas the branded one shrank by 13%. In flooring cleaners, the unbranded progress was 5% as towards a 3% contraction in branded. In espresso, too, the unbranded grew at 15%, whereas branded at a slower tempo of 4%. In edible oils, the unbranded phase grew at 4% as in comparison with the branded progress of simply 1%, whereas butter & cheese grew at 9% in unbranded versus 1% in branded.

Ok Ramakrishnan, MD – South Asia, Worldpanel Division, Kantar, informed TOI, “The skinny line between branded and unbranded consumption is fascinating. In occasions of uncertainty, customers are inclined to gravitate in direction of identified choices — which means branded. Subsequently, through the peak pandemic intervals, we noticed jumps within the branded elements of many classes like edible oils, salt, biscuits, tea, and so on. Within the absence of a big and looming menace, it’s often a worth play. There is no such thing as a family that may be categorized as purely branded or purely unbranded. Most households have twin play and their share of unbranded goes up once they really feel strain on their wallets. Inflation is one such. Even past inflation, commodities are usually cyclical in pricing and that has its influence on the selection of the buyer as nicely.”

A spokesperson from Hindustan Unilever (HUL) mentioned the long-term development in rest room and flooring cleaners is clearly shifting from unbranded to branded, and the corporate continues to achieve share — each within the lengthy and quick time period. The spokesperson added that HUL’s product portfolio straddles the value profit pyramid and thus caters to the wants of customers seeking to improve to merchandise with larger order advantages and to these making an attempt to handle their family price range in occasions of inflation.

With regard to the expansion numbers for butter & cheese, RS Sodhi, MD of Gujarat Cooperative Milk Advertising Federation, which markets Amul, nevertheless, mentioned, “Which may be some unfastened butter used for making ghee at residence. As, in butter, we’re the primary participant and our quantity elevated by double digits in the identical interval.”

Over time, a development of customers changing to branded merchandise from unbranded was clearly seen for classes like edible oils, atta, and butter & cheese. In keeping with Kantar, the share of the unbranded phase of edible oils had shrunk from 29% within the interval February-March-April of 2019 to 25% in the identical months final yr. Nonetheless, in these three months this yr, it inched as much as 26%. Equally, in butter & cheese throughout the identical three months, the place the share of the unbranded phase had lowered from 16% in 2019 to 7% in 2021, it’s up by two share factors to 9% this yr. Nonetheless, specialists mentioned the motion shouldn’t be but profound as a result of by April customers had began stepping out and, on the identical time, a higher influence of inflation had begun hurting their wallets. The typical worth per kilo of FMCG, mentioned Kantar, has elevated by 10% in comparison with final yr. Contemplating that it is a peculiar inflation, Kantar mentioned it’s certain to have traits which are alien to previous inflationary intervals.

To guard worth factors, FMCG makers resorted to `shrinkflation’ — a course of the place corporations cut back the grammage whereas sustaining the value of a product bundle.

[ad_2]