[ad_1]

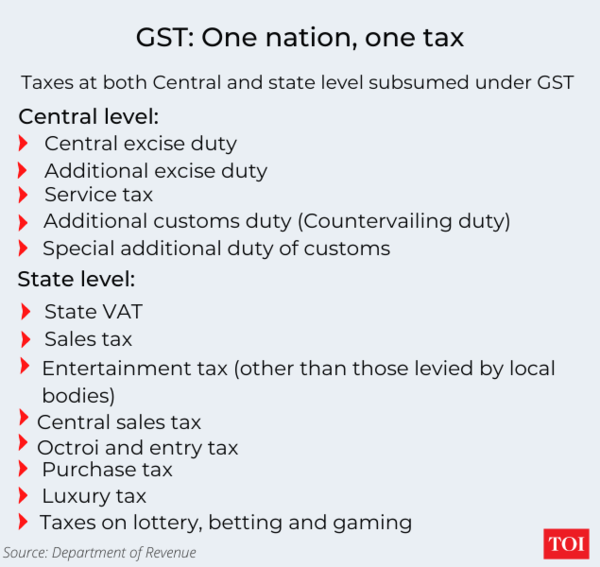

5 years later, the tax regime is alleged to have performed a key function in defining India’s financial construction and empowering companies by subsuming 17 taxes and 13 cesses right into a ‘one nation, one tax’ construction.

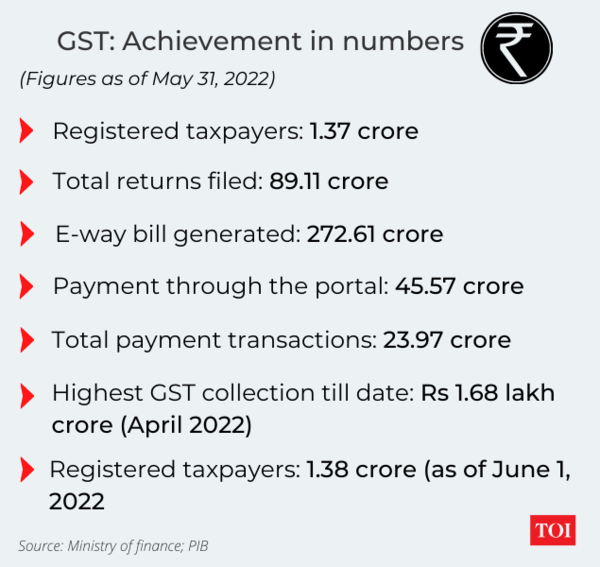

Centre’s GST income assortment is considerably excessive at present, as in comparison with what it was initially. At Rs 1.44 lakh crore, the gross GST assortment in June is the second-highest after April when it was about Rs 1.68 lakh crore.

That is the fifth time that the month-to-month GST collections crossed the Rs 1.40 lakh crore-mark since its inception and the fourth month at a stretch since March 2022.

Talking on the GST Day celebrations on Friday, finance minister Nirmala Sitharaman stated inside 5 years of its implementation, GST is exhibiting its potential and Rs 1.40 lakh crore is now the “tough backside line” for month-to-month income collections.

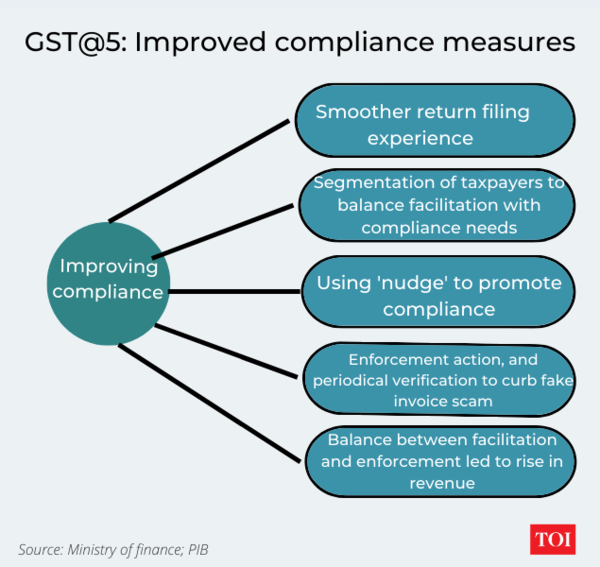

Nonetheless, the construction confronted many challenges within the final 5 years and remains to be evolving, attempting to be extra clear and straightforward for taxpayers.

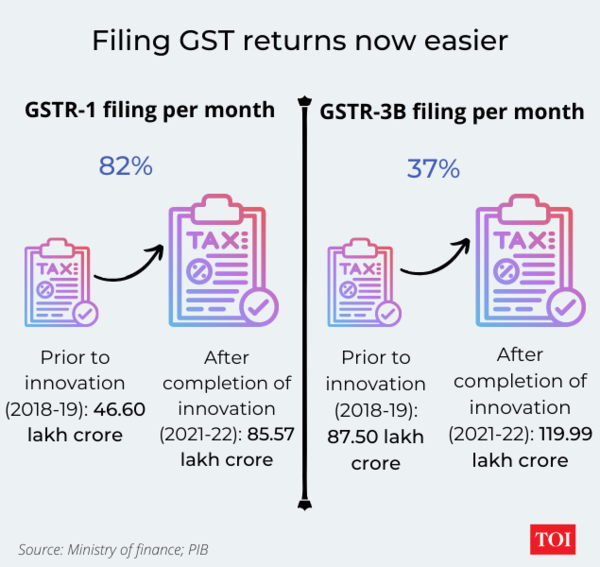

Though the tax has led to a paradigm shift in use of know-how to make sure tax compliance, there have been many hits and misses within the final 5 years.

In different phrases, it’s nonetheless a piece in progress. There is a lengthy method to go to attain the complete potential of GST and make it a real ‘good and easy tax’.

Journey of implementing India’s largest tax reform

The GST was first introduced within the Union Price range 2006-07. Since then the Empowered Committee of Ministers labored on making ready the background materials and the draft Acts.

Lastly, the implementation materialised with the passing of the Constitutional Modification Act in September 2016, adopted by state legislatures. GST was then rolled out with impact from July 1, 2017.

The GST Council was constituted as a constitutional physique for making suggestions to the Union and state governments. It has met 47 occasions until now.

The then finance minister Arun Jaitley, who performed a key function in introducing GST in India had said that the brand new regime will show to be each shopper and assessee pleasant.

The finance ministry had claimed that each minute element of each merchandise offered will must be digitally uploaded in a central tax database for all companies.

Within the pre-GST period, the Centre might tax items as much as the manufacturing or manufacturing stage, whereas states collected taxes on sale or distribution of products. Providers might be taxed solely by Central authorities.

Nonetheless, GST supplied provision to each Centre and states to tax your entire provide chain in items in addition to companies, from manufacturing to distribution. A centralised system for submitting returns and importing invoices additionally meant discount in tax evasion.

Though this eradicated the necessity for companies to recollect, preserve observe and pay for every separate taxes, the regime had its personal challenges for taxpayers.

The web site of GST crashed a number of occasions, making it tough for taxpayers to file returns on time. As well as, the advanced construction of compliances made it much more difficult for enterprise house owners.

Small companies and the micro, small and medium enterprises (MSME) suffered probably the most as transitioning to the brand new system proved to be an costly affair. From adoption of laptop techniques for submitting returns, to hiring a Chartered Accountant (CA) to grasp the process concerned and file returns, which led to a surge in bills.

Over the previous years the federal government has been proactively issuing circulars and clarifications to clear doubts concerning taxation underneath GST and guarantee ease of doing enterprise. The Centre has achieved its goal of 1 nation, one tax to a big extent.

Extra not too long ago, the GST Council, in its forty seventh assembly in Chandigarh, determined to ease compliance for small taxpayers who provide by means of the e-commerce platform.

The Centre-state relationship

Underneath this regime, each Centre and states come collectively within the GST Council to thrash out modalities for clean functioning.

When GST was rolled out, states have been promised a compensation, from the cess fund, for 5 years if their GST assortment falls wanting the 14 per cent compounded income development. This shortfall was to be funded by means of extra taxation (compensation cess) on sin/luxurious items.

Nonetheless, the slowdown in financial actions that set in because of Covid-19 pandemic led to a shortfall in cess assortment in FY20, and this elevated additional in FY21.

In October 2020, the federal government borrowed Rs 1.10 lakh crore from the market in lieu of compensation cess for shortfall of their income in FY21.

Other than Rs 1.10 lakh crore compensation, the Centre had additionally supplied Rs 0.91 lakh crore to states out of the GST compensation fund in FY21.

The states now need the federal government to pay GST compensation for a further 5 years (put up June 2022).

A latest report by SBI Analysis said that for some states GST compensation as share of state’s tax income is greater than 20 per cent. Nonetheless, lots of them are providing freebies like farm mortgage waiver, restoring outdated pension system, and so on, that are economically unsustainable given the financially unhealthy form of many states.

“Clearly, states appear to be presently residing past their means and it’s crucial that states rationalize their spending priorities in accordance with income receipts,” the report added.

The place it stands at present

Underneath GST, a four-rate construction that exempts or imposes a low price of tax of 5 per cent on important objects and prime price of 28 per cent on automobiles is levied. The opposite slabs of tax are 12 and 18 per cent.

Within the pre-GST period, the overall of VAT, excise, CST and their cascading impact led to 31 per cent as tax payable, on a median, for a shopper.

Apart from, there’s a particular 3 per cent price for gold, jewelry and valuable stones and 1.5 per cent on minimize and polished diamonds.

A cess can also be levied on the best tax slab of 28 per cent on luxurious, sin and demerit items. The gathering from the cess goes to a separate corpus — Compensation fund — which is used to make up for income loss suffered by the state on account of GST rollout.

The GST council additionally determined to ease the method for intra-state provides made by means of e-commerce portals. Now such suppliers won’t need to get hold of GST registration, if their turnover is decrease than Rs 40 lakh and Rs 20 lakh for items and companies, respectively. This could come into impact from January 1, 2023.

The council has additionally determined to represent a bunch of ministers to deal with varied issues raised by the states in relation to structure of the GST Appellate Tribunal and make suggestions for acceptable amendments in CGST Act.

Affect on GDP

The latest surge in GST collections is alleged to be a superb signal of financial restoration in addition to of the nation’s tax efficiency.

Nonetheless, if we have a look at India’s gross home product (GDP), the comparability reveals that rise in GST collections aren’t that vital.

In reality, India’s annual GDP was rising at a gentle tempo till FY2017, when it was at 8.26 per cent. From that 12 months onwards, financial development began to fall.

It’s to be famous right here that fall in GDP was not solely on account of implementation of GST, but in addition brought on by one more shock transfer by the Centre, referred to as demonetisation in 2016. Because of this, with 2 back-to-back reforms introduced with the GDP development fell to as little as 3.74 per cent by FY20.

The subsequent 2 years have been marred by the Covid pandemic. GST collections have been at their document low and so was India’s GDP. Nonetheless, with gradual resumption of financial actions, the tempo of development gained stream and now India is poised to emerge because the quickest rising main financial system.

What’s costlier, what’s cheaper

Within the not too long ago concluded GST Council meet, headed by finance minister Nirmala Sitharaman and attended by state finance ministers as members, it was determined to finish exemptions and proper the inverted obligation construction for a number of objects. The tax price modifications will come into impact from July 18.

In different phrases, price rationalisation request by a bunch of sure states was authorized, leading to tax modifications, the identical request by one other panel of state FMs was prolonged by one other 3 months.

Pre-packed and labelled wheat flour, papad, paneer, curd and buttermilk will probably be taxed at 5 per cent.

The ending of exemption would imply pre-packed and labelled meat (besides frozen), fish, paneer, lassi, honey, dried leguminous greens, dried makhana, wheat and different cereals and puffed rice (muri) will now appeal to a 5 per cent tax.

Equally, an 18 per cent GST will probably be levied on Tetra Packs and charges charged by banks for the difficulty of cheques (free or in e-book kind). Maps and charts together with atlases will appeal to a 12 per cent levy. Items which can be unpacked, unlabelled and unbranded will proceed to stay exempt from GST.

Apart from, a 12 per cent tax will probably be levied on resort rooms costing lower than Rs 1,000 a day. At current, this falls underneath the exempted class.

A 5 per cent GST will probably be levied on hospital room hire above Rs 5,000 per day (excluding ICU).

Tax charges have been raised to 18 per cent on merchandise resembling printing, writing or drawing ink; knives with slicing blades, paper knives and pencil sharpeners; LED lamps, drawing and marking out devices.

Photo voltaic water heater will now appeal to 12 per cent GST as in comparison with 5 per cent earlier.

Some companies resembling work contracts for roads, bridges, railways, metro, effluent remedy vegetation and crematoriums too will see tax going as much as 18 per cent from the present 12 per cent.

Tax has, nevertheless, been minimize on the transport of products and passengers by ropeways to five per cent and on ostomy home equipment to five per cent from 12 per cent.

Renting of truck, items carriage the place the price of gasoline is included will now appeal to a decrease 12 per cent price as in opposition to 18 per cent.

[ad_2]