[ad_1]

The administration raised import taxes on gold, whereas growing levies on exports of gasoline and diesel because it sought to manage a fast-widening forex deficit. The measures despatched Reliance Industries Ltd. and different vitality exporters tumbling, bringing down the benchmark index by as a lot as 1.7%. The forex fell once more.

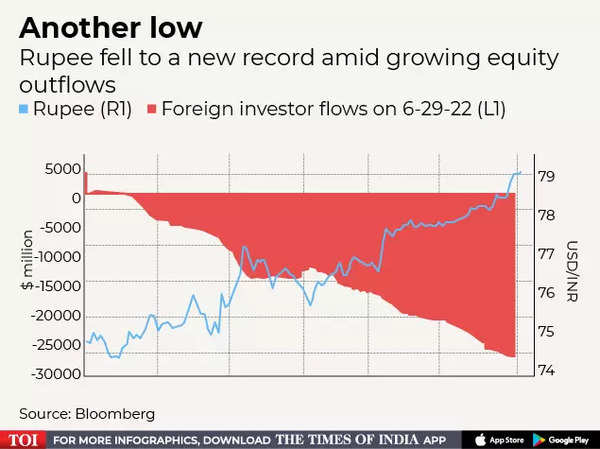

The rupee has examined a collection of report lows, underscoring the financial challenges confronted by Prime Minister Narendra Modi’s authorities as inflation accelerates and exterior funds worsen. The central financial institution has been battling to gradual the forex’s decline, and runaway rupee depreciation will worsen value pressures, and will spur extra price hikes that weigh on development.

“The most important close to time period problem for policymakers is to anchor inflationary expectation” stated Upasna Bhardwaj, chief economist at Kotak Mahindra Financial institution. “Inflationary pressures wouldn’t subside with out ample fiscal response in tandem with financial tightening.”

A shortfall in India’s present account — the broadest measure of commerce — will in all probability widen to 2.9% of gross home product within the fiscal yr ending March 31, in response to a Bloomberg survey in late June, almost double the extent seen within the earlier yr.

Whereas the Reserve Financial institution of India has been looking for to easy out the forex’s decline, banks have reported greenback shortages as everyone from traders to corporations rushed to swap the rupee. The forex has fallen 6% this yr in opposition to the greenback, as price hikes by the Federal Reserve pulled capital from creating markets.

Coverage makers in lots of rising markets all face stark decisions: forcefully elevate borrowing prices to defend currencies and danger hurting development, spend reserves that took years to construct to intervene in international change markets, or just step away and let the market run its course.

Commodity pressures

The federal government on Friday raised the import obligation on gold to 12.5% from 7.5%, in response to a discover dated June 30, reversing a minimize final yr. The upper taxes on the export of gasoline and diesel despatched shares of Reliance Industries Ltd. down by as a lot as 8.7%.

“In the meanwhile, the challenges are emanating from the identical supply, which is larger commodity costs,” stated Rahul Bajoira, senior economist, Barclays Financial institution Plc. “India can neither discover provide onshore nor we will reduce the consumption of oil. That makes the entire state of affairs much more unpredictable each when it comes to how this performs out and the way lengthy this continues for.”

For the broader gasoline market, India’s transfer to tax petroleum exports could additional tighten gasoline provides at a time rising markets are going through shortages and contours are forming at pump stations in these nations.

Reserve Financial institution of India governor Shaktikanta Das has stated the central financial institution makes use of a multi-pronged intervention method to attenuate precise outflows of {dollars} and received’t permit a runaway rupee depreciation. The RBI has near $600 billion of foreign-exchange reserves, which it has been deploying to curb any sharp volatility within the forex.

[ad_2]