[ad_1]

“If there was an answer, I might have advised you,” finance minister Nirmala Sitharaman stated when requested about an extension.

Income secretary Tarun Bajaj stated there have been 16-17 states that spoke on the problem, with a few of them suggesting that the time had come for them to delink from the present mechanism beneath which the Centre had assured 14% annual development.

“A few of them stated really we have now to work on methods to wean ourselves away and never be dependent solely on the GST compensation cess,” he stated.

Whereas states are arguing for an extension on the grounds that the Covid pandemic has added to their burden, a senior official stated there have been states which had seen over 14% development, whereas there have been some others who have been slightly below the edge. The states have pointed to the precarious place of their public funds and have urged the Centre to increase the compensation interval by as much as 5 years.

A majority of states demanding an extension have been dominated by Opposition events and included Rajasthan, Kerala, Punjab and West Bengal.

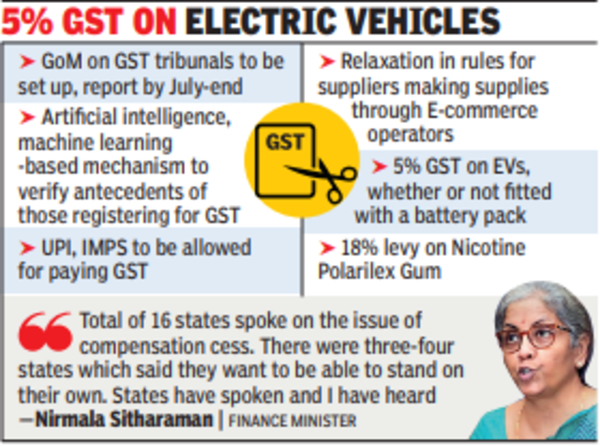

For offering compensation to states, a cess is being levied on sure luxurious and sin items, corresponding to cars and tobacco, and the quantity collected is being credited to the Compensation Fund, from which the cash is transferred to the states.

The Centre has argued that the cess, which was to be levied as much as June, has been prolonged to maintain the extra borrowings that needed to be made to maintain the shortfall throughout Covid. Final week the federal government prolonged the validity of cess as much as March 2026.

Commerce and business is watching the developments. “Business gamers must wait a short while extra to grasp the destiny of compensation cess,” stated Abhishek Jain, oblique tax companion at KPMG India.

[ad_2]