[ad_1]

- GILD is down 16.6% from 12-month excessive shut

- Firm reported sturdy Q1 outcomes on the finish of April

- Earnings development outlook weak

- Wall Road analyst consensus ranking is bullish

- The market-implied outlook is bullish

- Searching for extra top-rated inventory concepts so as to add to your portfolio? Members of InvestingPro+ get unique entry to our analysis instruments, information, and pre-selected screeners. Be taught Extra »

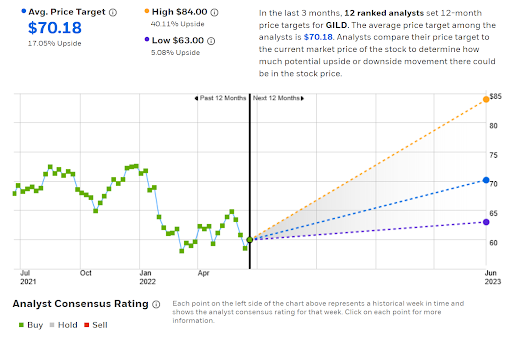

Since hitting a 12-month excessive closing worth of $73.64 on Dec. 29, pharmaceutical drug producer Gilead Sciences (NASDAQ:) has fallen 18.6%, for a complete return (together with dividends) of -16.6%. The decline accelerated after Feb. 2, when the corporate reported This fall earnings that had been lower than half the consensus anticipated worth. GILD has trailing 3- and 5-year complete annualized returns of -0.14% and a couple of.17%, respectively.

GILD 12-Month Worth Historical past.

Supply: Investing.com

It was understood that gross sales of Veklury (aka remdesivir), a drug extensively used to deal with hospitalized COVID sufferers, was prone to decline however the pace and magnitude of the diminished gross sales had been one thing of a shock. Veklury income for This fall of 2021 was down 30% year-on-year. Even with 8% income development throughout all different product traces, the drop in Veklury gross sales was adequate to drive GILD’s YoY gross sales down 2%.

GILD Trailing 4-Yr And Estimated Future Quarterly EPS.

Supply: E-Commerce

Inexperienced (crimson) values are quantities by which EPS beat (missed) the consensus anticipated worth.

, reported on April 28, beat expectations by 17.3%. Complete gross sales had been up 3% YoY. Veklury gross sales had been up YoY, largely due to make use of of the drug outdoors of the U.S. The corporate additionally introduced a considerable variety of new drug trials deliberate for 2022 and 2023.

GILD has a dividend yield of 4.99%, with trailing 3- and 5-year annualized dividend development charges of 6.3% and seven.8% per yr, respectively. The consensus anticipated worth for annualized EPS development is -0.32% per yr over the subsequent three to 5 years, however the low payout ratio of 39% implies that the corporate has the capability to proceed to develop the dividend.

I final wrote about GILD on December 15, 2021, at which period the shares had been buying and selling at $70.45, and I maintained a impartial/maintain ranking. The primary issues at the moment had been just like these at this time. The earnings development outlook was weak and it was onerous to foretell the drop-off in demand for Veklury. The Wall Road analyst consensus at the moment was bullish, with a consensus 12-month worth goal that implied a complete return of 13.2% over the subsequent yr. The consensus outlook implied by choices costs, the market-implied outlook, was impartial to mid-June of 2022 however barely bearish for the total yr. Contemplating the earnings outlook, the bullish Wall Road consensus and the impartial/barely bearish market-implied outlook, I assigned a impartial general ranking for GILD.

Since Dec. 15, GILD has returned a complete of -13.7%, in contrast with -19.2% for the S&P 500 (NYSE:), together with dividends.

For readers who’re unfamiliar with the market-implied outlook, a short rationalization is required. The value of an choice on a inventory is essentially decided by the market’s consensus estimate of the chance that the inventory worth will rise above (name choice) or fall under (put choice) a selected degree (the choice strike worth) between now and when the choice expires. By analyzing the costs of name and put choices at a variety of strike costs, all with the identical expiration date, it’s potential to calculate a probabilistic worth forecast that reconciles the choices costs. That is the market-implied outlook. For a deeper rationalization and background, I like to recommend this monograph printed by the CFA Institute.

With about six months since my final evaluation, I’ve calculated the market-implied outlook for GILD via the top of 2022 and to the center of 2023. I’ve in contrast these with the present Wall Road consensus outlook in revisiting my ranking on GILD.

Wall Road Consensus Outlook For GILD

E-Commerce calculates the Wall Road consensus outlook by aggregating scores and worth targets from 12 ranked analysts who’ve printed their views over the previous three months. The consensus ranking is bullish, because it has been for all the previous yr. The consensus 12-month worth goal is 17.05% above the present share worth.

GILD Analyst Consensus Ranking And 12-Month Worth Goal.

Supply: E-Commerce

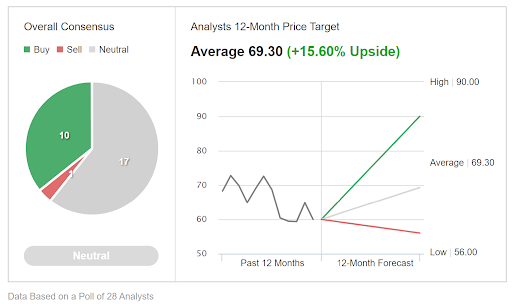

Investing.com’s model of the Wall Road consensus outlook is calculated utilizing scores and worth targets from 28 analysts. The consensus ranking is bullish and the consensus worth goal is 15.6% above the present worth.

GILD Analyst Consensus Ranking And 12-Month Worth Goal.

Supply: Investing.com

Averaging these two consensus worth targets and including the dividend, the anticipated complete return over the subsequent 12 months is 21.3%. Given the anemic anticipated development, the consensus outlook means that the market is undervaluing present earnings.

Market-Implied Outlook For GILD

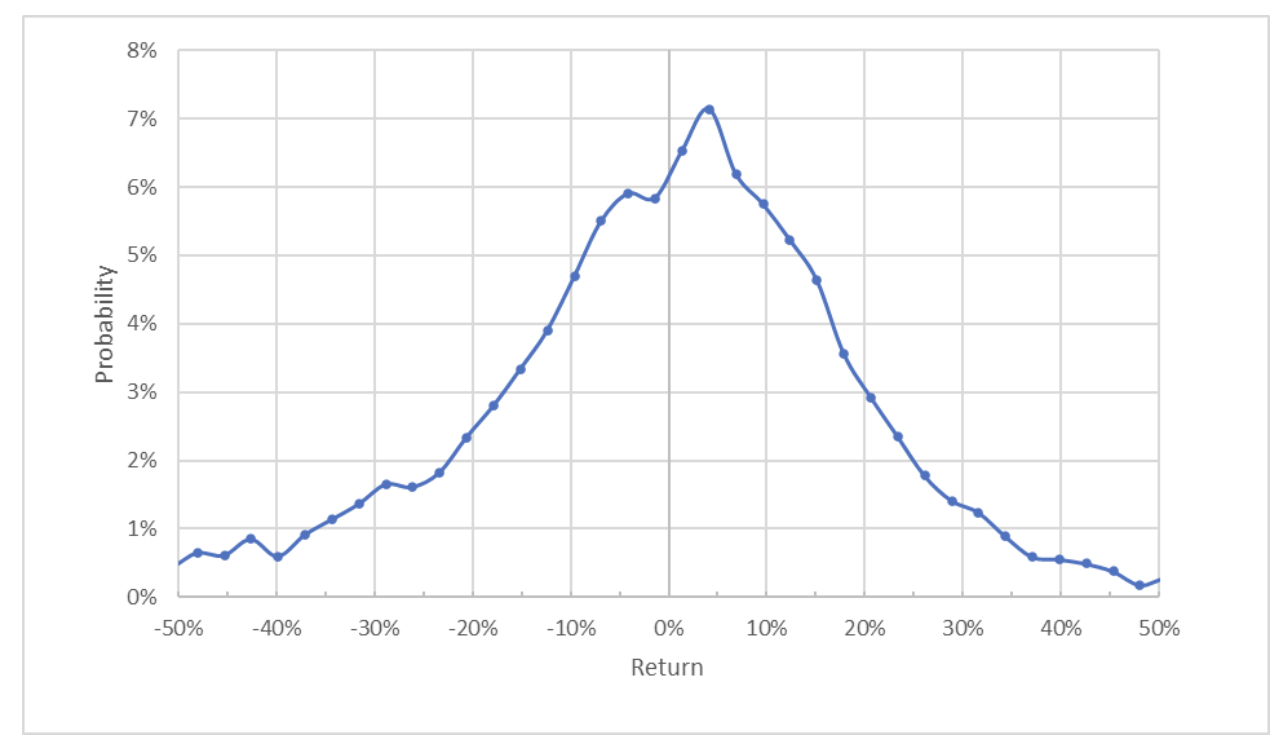

I’ve calculated the market-implied outlook for the 7-month interval from now till Jan. 20, 2023, and for the 11.8-month interval from now till June 16, 2023, utilizing the costs of choices that expire on every of those two dates. I selected these particular expiration dates to offer a view via the top of 2022 and to offer a (roughly) 12-month outlook. The choices buying and selling quantity and open curiosity on the choices expiring in January are significantly greater than for the choices expiring in June of 2023. Because of this, the 7-month outlook carries extra weight in my evaluation.

The usual presentation of the market-implied outlook is a chance distribution of worth return, with chance on the vertical axis and return on the horizontal.

Supply: Creator’s calculations utilizing choices quotes from E-Commerce

The market-implied outlook to Jan. 20 is mostly symmetric, with comparable chances of constructive and adverse returns of the identical magnitude, however the peak in chance is tilted to favor constructive returns. The utmost chance corresponds to a worth return of 4%. The anticipated volatility calculated from this distribution is 27% (annualized).

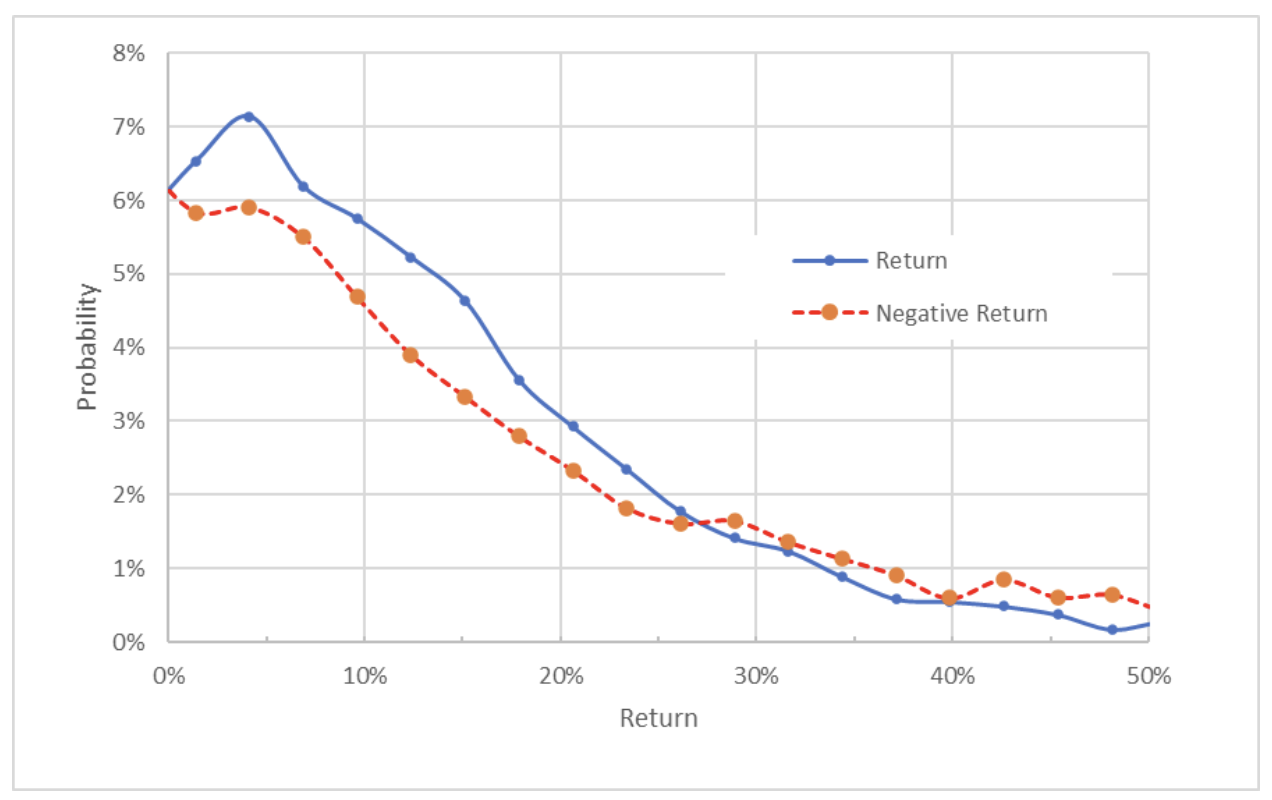

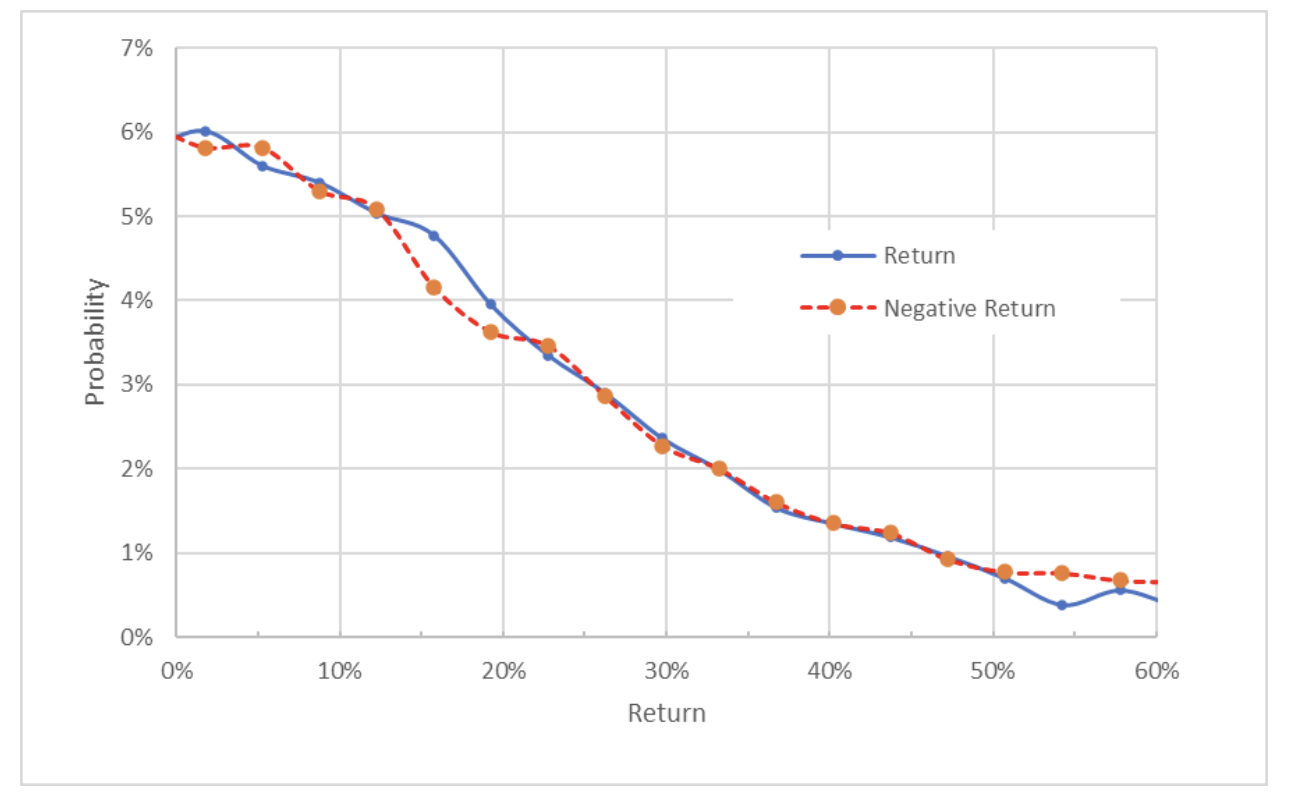

To make it simpler to immediately examine the relative chances of constructive and adverse returns, I rotate the adverse return aspect of the distribution concerning the vertical axis (see chart under).

Supply: Creator’s calculations utilizing choices quotes from E-Commerce

The adverse aspect of the distribution has been rotated concerning the vertical axis

This view reveals the diploma to which the chances of constructive returns are constantly greater than the chances of same-magnitude adverse returns, throughout a variety of probably the most possible outcomes (the stable blue line is constantly above the dashed crimson line over the left half of the chart above). It is a bullish outlook for GILD for the subsequent seven months.

Concept signifies that the market-implied outlook is anticipated to have a adverse bias as a result of buyers, in combination, are danger averse and, thus, are inclined to pay greater than truthful worth for draw back safety. There isn’t any strategy to measure the magnitude of this bias, or whether or not it’s even current, nonetheless. The expectation for a adverse bias strengthens the bullish interpretation of this outlook.

The market-implied outlook for the subsequent 11.8 months reveals carefully matching chances for constructive and adverse returns. Due to the expectation that the market-implied outlook will likely be negatively biased, this market-implied outlook is interpreted as barely bullish. The anticipated volatility calculated from the 11.8-month outlook is 28% (annualized).

Supply: Creator’s calculations utilizing choices quotes from E-Commerce

The adverse aspect of the distribution has been rotated concerning the vertical axis

The market-implied outlook is bullish to early 2023 and barely bullish for the 11.8-month interval from now till June 16, 2023. It is a appreciable enchancment in comparison with the market-implied outlooks on the finish of 2021. The anticipated volatility is steady at 27%-28%.

Abstract

Even with low expectations for earnings development within the coming years, the Wall Road consensus ranking for GILD continues to be bullish, indicating that the shares have been oversold within the present market decline. The Wall Road consensus 12-month worth goal implies a 21% complete return over the subsequent yr. As a rule of thumb for a gorgeous risk-return trade-off, I wish to see an anticipated 12-month return that’s at the least half the anticipated annualized volatility (27%-28%). GILD simply surpasses this threshold. The market-implied outlook for GILD is bullish, albeit solely mildly for 2023 in its entirety. I’m altering my ranking on GILD from impartial/maintain to bullish/purchase.

***

The present market makes it more durable than ever to make the fitting choices. Take into consideration the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive applied sciences

- Rate of interest hikes

To deal with them, you want good information, efficient instruments to kind via the information, and insights into what all of it means. You could take emotion out of investing and deal with the basics.

For that, there’s InvestingPro+, with all of the skilled information and instruments you should make higher investing choices. Be taught Extra »

[ad_2]