[ad_1]

Look, I’m as prepared for this selloff to finish as you might be. And when shares drop—sending dividend yields skyward—I so badly need to again up the truck.

As value-focused dividend buyers, shopping for dips is what we stay to do. Sitting in money is agonizing to me, as I’m positive it’s to you, too.

But it surely simply isn’t time but. Which is why I’ve really useful only one inventory this 12 months in my Contrarian Revenue Report service, whereas urging my readers to stockpile money. And after final Thursday’s dumpster hearth, we’re positive glad we did!

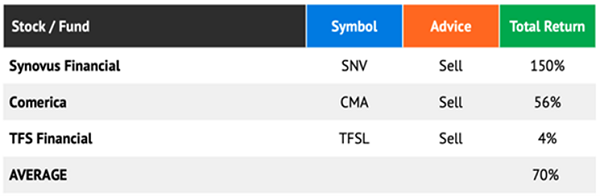

We’ve additionally lightened up our portfolio over these previous couple of months, together with taking some good income on three financial institution shares we offered in Might:

Promoting Financial institution Shares

There was nothing incorrect with these three: they had been simply benefiting from the Fed’s injection of money into the markets, and the hole between the Treasury (at which they lend to shoppers) and the Fed’s coverage fee (at which they lend to one another).

Now that Powell has overdone issues and is letting the Fed fee , banks’ revenue margins are being squeezed, so it was time to bid adieu. And we took some good income off the desk by doing so.

Closed-Finish Funds Are At The Prime Of Our Listing

Among the finest issues we’ll be very considering shopping for when the smoke clears is high-yielding closed-end funds (CEFs). These automobiles are perfect as a result of they typically commerce on the open market at completely different ranges (and normally reductions!) than the per-share worth of their portfolios, or web asset values (NAVs) in CEF-speak.

CEFs are low cost now, however I count on them to be even cheaper in a pair months. Then, when their “low cost home windows” slam shut (or revert to extra regular ranges), they’ll catapult our CEF costs larger.

That can be a very good payoff for our persistence right this moment, on prime of the 7%+ dividends CEFs repeatedly pay.

Let’s begin to look towards these brighter days now, by beginning our CEF buying record. Listed here are three to place close to the highest:

“Purchasing record” CEF No. 1: A Megatrend-Powered 6.3% Dividend

On the subject of CEF investing, we demand yet one more factor, past reductions and dividends: megatrends! And there’s merely no extra predictable megatrend than the growing older of the US inhabitants. Certain, it’s been completely overshadowed by COVID, nevertheless it’s nonetheless there—and it’s accelerating.

In keeping with a current Reuters report, about 16.5% of the US inhabitants, or roughly 54 million individuals, are over 65. By 2040—simply 18 years from now—that quantity will leap to 74 million, a 37% improve.

That’s going to guide straight to larger healthcare spending, and our first “buying record” choose is properly positioned to revenue: the BlackRock Well being Sciences Fund (NYSE:), which yields 6.3% and sports activities a 2% premium to NAV that I count on to be taken out within the subsequent few weeks, organising a pleasant low cost for us.

BME additionally helps ease again our threat by sticking with large pharma shares like Johnson & Johnson (NYSE:), Pfizer (NYSE:), and AbbVie (NYSE:).

Lastly, this fund not solely pays a excessive yield however is rising its payout, too, with a 6.5% improve introduced final October. With the favorable traits we’ve obtained organising for healthcare within the coming years, extra hikes are probably on the way in which.

“Purchasing Listing” CEF No. 2: A ten% Dividend From the Rise of “Rental Nation”

Certain, housing demand is softening, however with now round 6%, shopping for a house remains to be dear. That’s inflicting many people to alter their home hunt to an condo hunt.

Heck, there at the moment are bidding wars for residences—in Philadelphia, for instance, renters are providing $500 or extra a month above the marketed lease, in accordance with current stories.

A CEF that’s well-suited to this development is the CBRE Clarion International Actual Property Revenue Fund (NYSE:), which devotes 16% of its portfolio to residential REITs, its second-biggest allotment.

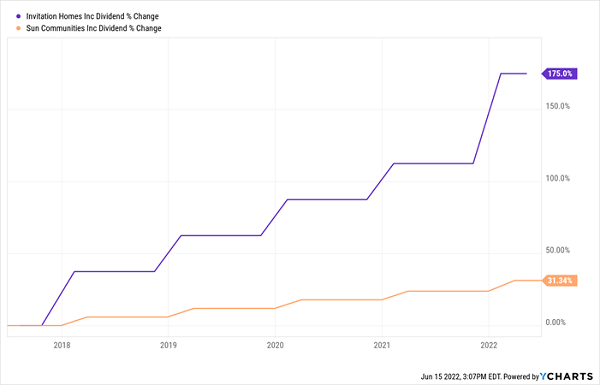

Solar Communities (NYSE:), which has cellular and manufactured-home parks throughout the south, is amongst its top-10 holdings, as is Invitation Houses (NYSE:), which holds single-family properties within the west and Florida.

Each shares have been rolling out wholesome dividend hikes, together with comparatively giant will increase late final 12 months:

IGR’s Prime Residential Holdings Drop Regular Payout Raises

Rental-Dwelling Shares Dividends Development

We love IGR’s diversification, too: its top-10 holdings embody different REITs providing in-demand properties, like cell-tower REIT Crown Fort Worldwide (NYSE:) and self-storage corporations ExtraSpace Storage and CubeSmart (NYSE:).

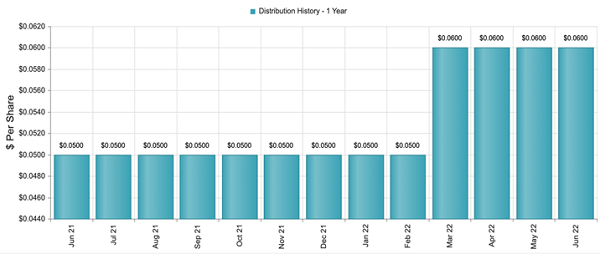

IGR’s administration workforce is doing an awesome job of handing the rising lease checks its portfolio firms are amassing over to us: it’s not typically that you simply hear of a ten% dividend that’s rising (particularly as of late), however that’s precisely what’s taking place with IGR:

IGR’s (Month-to-month) Dividend Yields 10% and Is Rising Rapidly

IGR-Dividend Development

Supply: CEF Join

IGR is a textbook case of why we’re holding off on shopping for now: regardless of the market carnage, it trades at a 0.85% premium. As is the case with our first choose, I count on that premium to be taken out within the coming weeks, organising a reduction alternative (and a probably even larger yield).

“Purchasing Listing” CEF No. 3: A 93-Yr-Previous Fund That’s Seen All the pieces

Tri Continental Closed Fund (NYSE:)) isn’t going to interrupt data for its dividend: it yields 4.6%, low by CEF requirements. However given the selection between TY and an index fund, I’ll take TY each time.

I’m making that comparability, by the way in which, as a result of TY owns the identical stuff because the benchmark SPDR® S&P 500 (NYSE:), together with Apple (NASDAQ:), Pfizer (PFE), Exxon Mobil (NYSE:), and Dow Inc. (NYSE:). It cobbles collectively this blue-chip inventory portfolio for a dividend that’s triple the 1.5% SPY pays.

Plus you get a deep low cost, which clocks in at 12.4%, under the 8.3% TY has averaged previously 12 months, and I believe we’re going to get a chance to purchase for even much less.

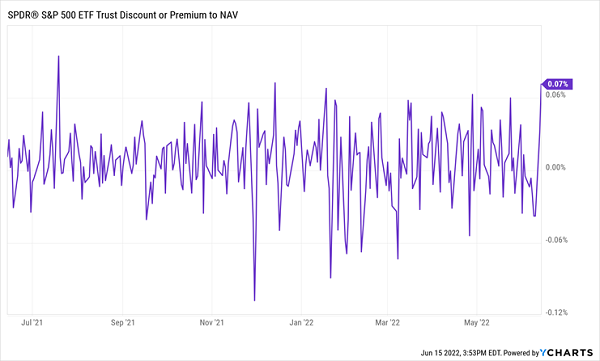

I don’t find out about you, however I’d slightly get publicity with extra of my return in dividend money and at a reduction! Which, by the way in which, is one thing ETFs like SPY by no means supply:

SPY Is By no means Low cost

No-Low cost SPY Chart

Lastly, we’ll get a ton of institutional reminiscence with this one: TY was launched in 1929, simply earlier than the Nice Despair, so it’s handled all the things the economic system can throw at it, together with rising charges. Which may be why, not like most different CEFs, TY makes use of virtually no leverage—simply 3% of the portfolio ultimately verify.

Disclosure: Brett Owens and Michael Foster are contrarian earnings buyers who search for undervalued shares/funds throughout the U.S. markets. Click on right here to learn to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”

[ad_2]