[ad_1]

The US market opens later in the present day after a protracted weekend. futures point out a 1.5% acquire to Friday’s closing stage, enjoying off the constructive outperformance on the surface. The foreign money market has additionally swung in direction of shopping for dangerous property, reinforcing hopes of at the least a rebound within the coming days after a 13.5% dip from the highs to the lows of the month within the first two weeks of June.

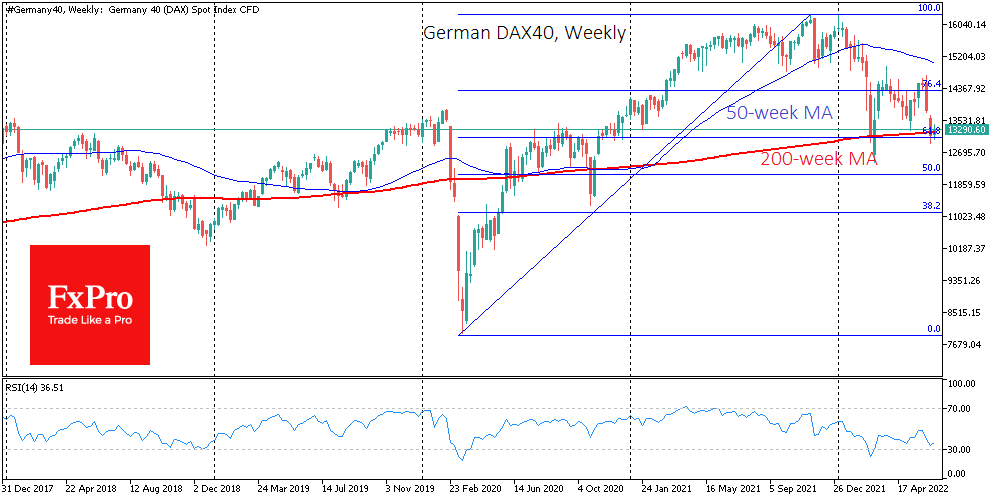

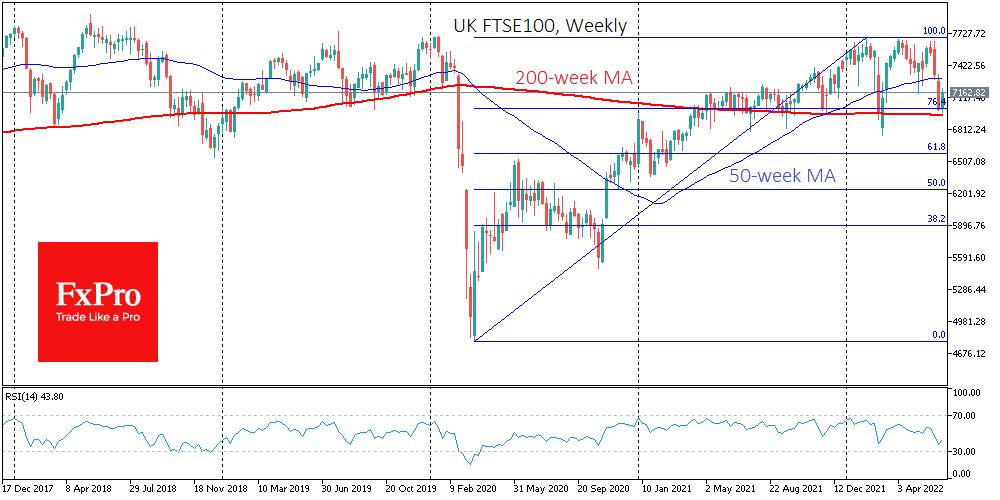

In equities, the constructive tone is about by the efficiency of Asian equities and the restoration of main European indices from oversold territory. The and are recovering from their lows of March. Each indices have caught inside the Fibonacci retracement sample and bought assist at 61.8% for DAX and 76.4% for FTSE from the pandemic amplitude.

The weakening of the standard shelter currencies – , – is setting a constructive tone. The USD/JPY has up to date to a brand new excessive since 1998, above 136, indicating a return of danger urge for food in some monetary market segments. USD/CHF settled close to 0.9660, stopping the decline after final week’s surprising SNB fee hike. The and the are additionally gaining towards the greenback, signaling a restoration in danger urge for food.

Nonetheless, it’s important to notice the fragility of the present rebound. Most probably, we are going to see a corrective bounce after the worst week in equities in additional than two years. Nonetheless, discovering medium-term causes to purchase “danger” continues to be tough. Apart from the BoJ, the primary central banks are tightening coverage or promise to take action as quickly as subsequent month. And up to now, we see no signal that this pattern is about to finish or reverse.

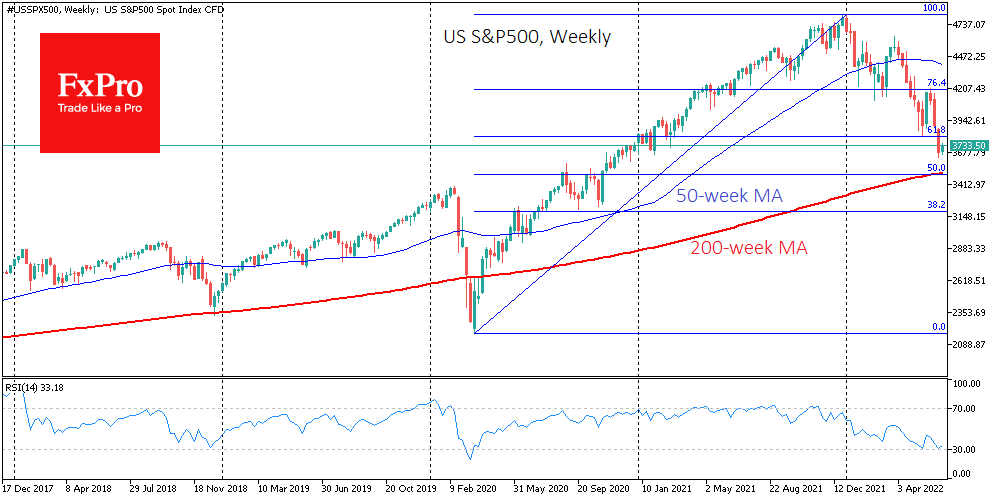

Thus, cautious buyers can nonetheless solely tune in for a short-term bounce however don’t maintain out hope that the markets have bottomed out. The bear market within the USA will seemingly proceed till we hear from the Fed the primary hints of a halt to aggressive coverage tightening. Till then, a bear market with occasional corrective bounces is probably going.

Historical past additionally tells us that after getting into a bear market part and dropping 20%, the market loses about one other 20% on common (about 2900 for the S&P 500) earlier than it finds its footing. This situation appears to be like particularly related when the Fed is by no means involved about markets correcting, because it did at the start of the pandemic.

However it’s too early for the bears to have a good time as a result of they’ve but to interrupt the rising rebound and push the S&P 500 beneath 3500, important psychological assist, the place the 200-week transferring common and demanding assist/resistance ranges of the second half of 2020 are positioned.

Our pessimistic situation might be reversed if the S&P 500 exceeds the 3900 mark through the rising rebound. In that case, a reversal of the fairness market to the upside must be thought of.

[ad_2]