[ad_1]

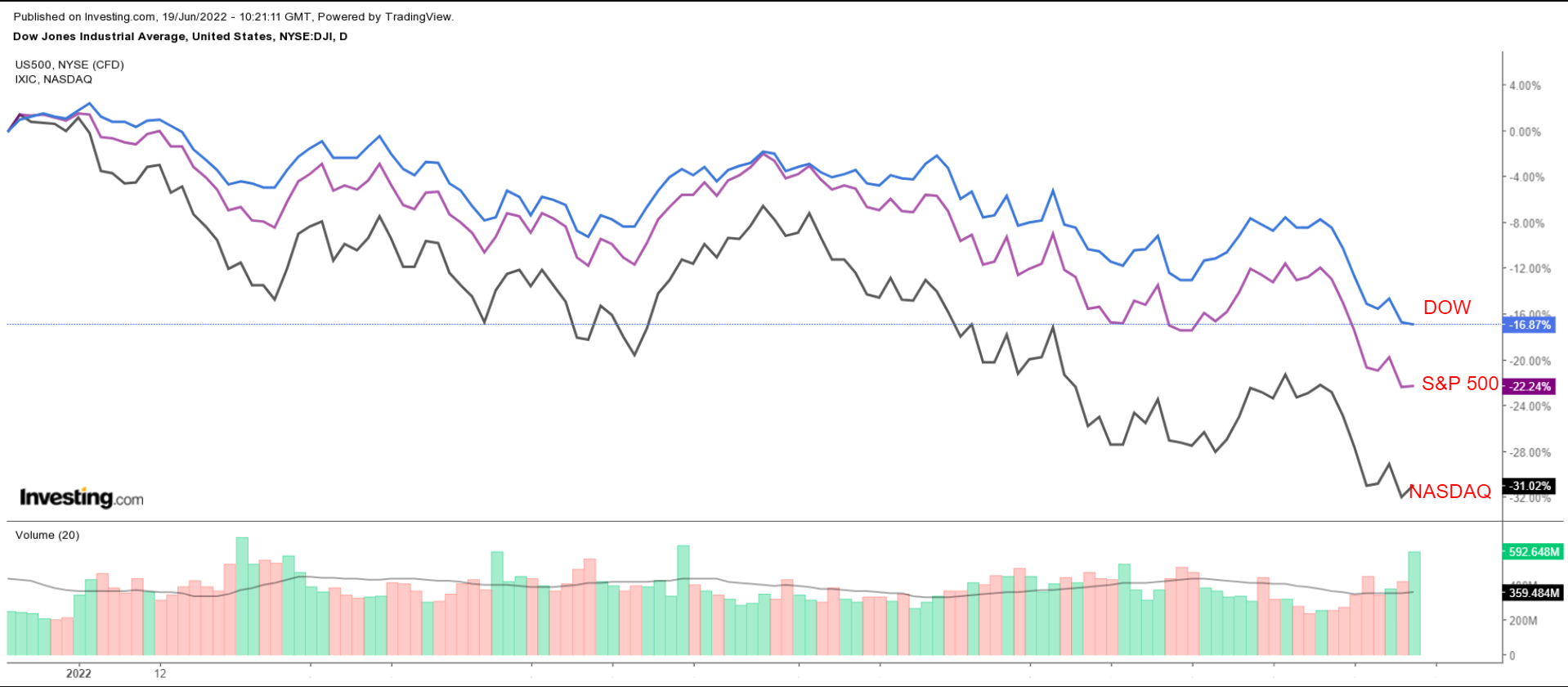

Shares on Wall Avenue ended modestly greater on Friday, however the main averages—, , and —nonetheless suffered their worst weekly loss since 2020 as buyers grew more and more anxious a couple of potential financial .

Markets worry that the Federal Reserve must be far more aggressive in its efforts to tame , elevating the dangers of a recession.

The vacation-shortened week forward will function key Congressional from Fed Chair Jerome Powell as buyers search for extra clues on the dimensions and tempo of .

U.S. inventory markets might be closed on Monday in observance of Juneteenth Nationwide Independence Day.

The four-day week forward may even embody necessary financial information, comparable to the newest U.S. report due on Friday.

In the meantime, on the earnings docket, there are only a handful of company outcomes due, FedEx (NYSE:), Ceremony Support (NYSE:), KB House (NYSE:), Lennar (NYSE:), and Darden Eating places (NYSE:).

No matter which course the market goes, beneath we spotlight one inventory prone to be in demand and one other which might see additional draw back.

Keep in mind although, our timeframe is simply for the upcoming week.

Inventory To Purchase: Greenback Common

As fears mount that the U.S. financial system will hit a tough patch quickly, Greenback Common (NYSE:), which operates greater than 18,000 shops in 44 states, is a stable alternative for buyers seeking to hedge within the face of additional within the days forward.

The most important low cost retailer within the U.S., which describes its core prospects as households incomes lower than $35,000, largely sells groceries, family provides, and private care merchandise at rock-bottom costs.

The corporate earns its recession-proof standing as low-income households and cash-strapped shoppers in search of thriftier-priced options throughout powerful financial occasions store extra at greenback shops.

Shares of DG ended at $230.80 on Friday, close by of their latest all-time excessive of $262.20 touched on Apr. 21. At present ranges, the Goodlettsville, Tennessee-based low cost retailer has a market cap of $52.4 billion.

Greenback Common shares have held up higher than a few of its bigger rivals within the battered retail sector, falling simply 2.1% year-to-date to simply outperform business bellwethers Walmart (NYSE:), Costco (NASDAQ:), and Goal (NYSE:).

In an indication of how properly its enterprise has carried out amid the present macro backdrop of slowing progress and accelerating inflation, Greenback Common reported first quarter revenue and gross sales which on Could 26.

The earnings beat was pushed by booming demand from prospects stocking up on groceries and family necessities as People in the reduction of spending on discretionary objects and divert extra spending into fundamental wants and companies.

The low cost chain additionally supplied an upbeat outlook, lifting its full-year steerage for income and same-store gross sales progress, as bargain-hunting People are more and more procuring at discounters.

Inventory To Dump: MicroStrategy

Shares of MicroStrategy (NASDAQ:)—the enterprise software program firm which is the most important company investor in Bitcoin on this planet and has more and more change into a proxy for investing in —are anticipated to undergo one other difficult week as buyers react to the continued turmoil within the cryptocurrency market.

The worth of Bitcoin dropped sharply in a single day Saturday, briefly falling beneath $18,000 to achieve its lowest stage since November 2020. It staged a light restoration in Sunday motion, hovering across the $19,500 mark.

The digital forex’s relentless selloff has seen it lose greater than half of its worth for the reason that begin of 2022, down 60% year-to-date and roughly 75% beneath its all-time excessive of $68,925.

Taking that into consideration, MicroStrategy inventory, which has already declined by 37% in June, might sink additional within the days forward because it faces a doable “margin name” towards a Bitcoin-backed mortgage that buyers worry might power the corporate to liquidate a few of its BTC holdings.

The enterprise intelligence and software program companies supplier borrowed $205 million from crypto financial institution Silvergate Capital (NYSE:) in March to purchase extra Bitcoin, with the three-year mortgage largely secured towards 19,466 Bitcoins of the corporate’s personal holdings.

MicroStrategy’s president and chief monetary officer, Phong Le, beforehand highlighted in Could that if the value of Bitcoin falls beneath $21,000, it will set off a margin name.

Often, a margin name is met by both offering extra capital or liquidating the mortgage’s collateral.

MSTR inventory fell to its lowest stage since August 2020 at $134.09 on Could 12; it closed Friday’s session at $167.60.

Yr-to-date, shares of the Tysons Nook, Virginia-based software program firm are down 69.2% and are virtually 88% away from their report peak of $1,315.00 reached in February 2021.

The Michael Saylor-led firm held 129,218 Bitcoins as of Mar. 31, acquired at a mean buy value of $30,700 per BTC, in response to an organization submitting.

At present costs, MicroStrategy, which spent $4 billion on its Bitcoin funding, is down greater than $1 billion, with its whole BTC holdings final valued at $2.9 billion.

[ad_2]