[ad_1]

- FuboTV has not too long ago issued strong Q2 metrics

- Buyers are happy in regards to the upcoming launch of the Fubo Sportsbook app

- We’re bullish on FUBO inventory, which may transfer towards $35 within the coming weeks

Buyers within the sports-focused streaming platform FuboTv (NYSE:) have had a uneven yr to date. 12 months-to-date, FUBO inventory is up about 4%. Nevertheless, the shares have misplaced greater than 53% since December 2020, once they hit an all-time excessive of $62.29. FuboTV’s market capitalization stands at $4.1 billion.

The New York-based FuboTV was launched in 2015 to stream primarily soccer video games (soccer for non-U.S. readers). It went public in October 2020.

Subscribers to the platform have entry to stay sports activities occasions in addition to leisure and information content material. The corporate’s promoting section has additionally been rising. As well as, Wall Avenue is anticipating the corporate to launch its sports activities ebook app, which might mix streaming providers with on-line gaming and betting.

The corporate introduced strong on Aug. 10. Complete income elevated 196% year-over-year to $130.9 million. Administration stories income in two most important segments:

- Promoting – income of $16.5 million, up 281% YoY;

- Subscription – income of $114.4 million, up 189%.

As well as, the month-to-month common income per person (ARPU) went up by 30% to $71.43. Buyers have been happy that FuboTV added 91,291 web subscribers within the earlier quarter.

On the outcomes, CEO David Gandler stated:

“FuboTV delivered a robust second quarter of 2021 throughout all of our key monetary and operational metrics: subscribers, complete income and promoting income.”

Lastly, administration raised steerage. For the complete yr, FuboTV now expects to generate $565 million in income, a rise of 116% YOY.

What To Anticipate From FUBO Inventory

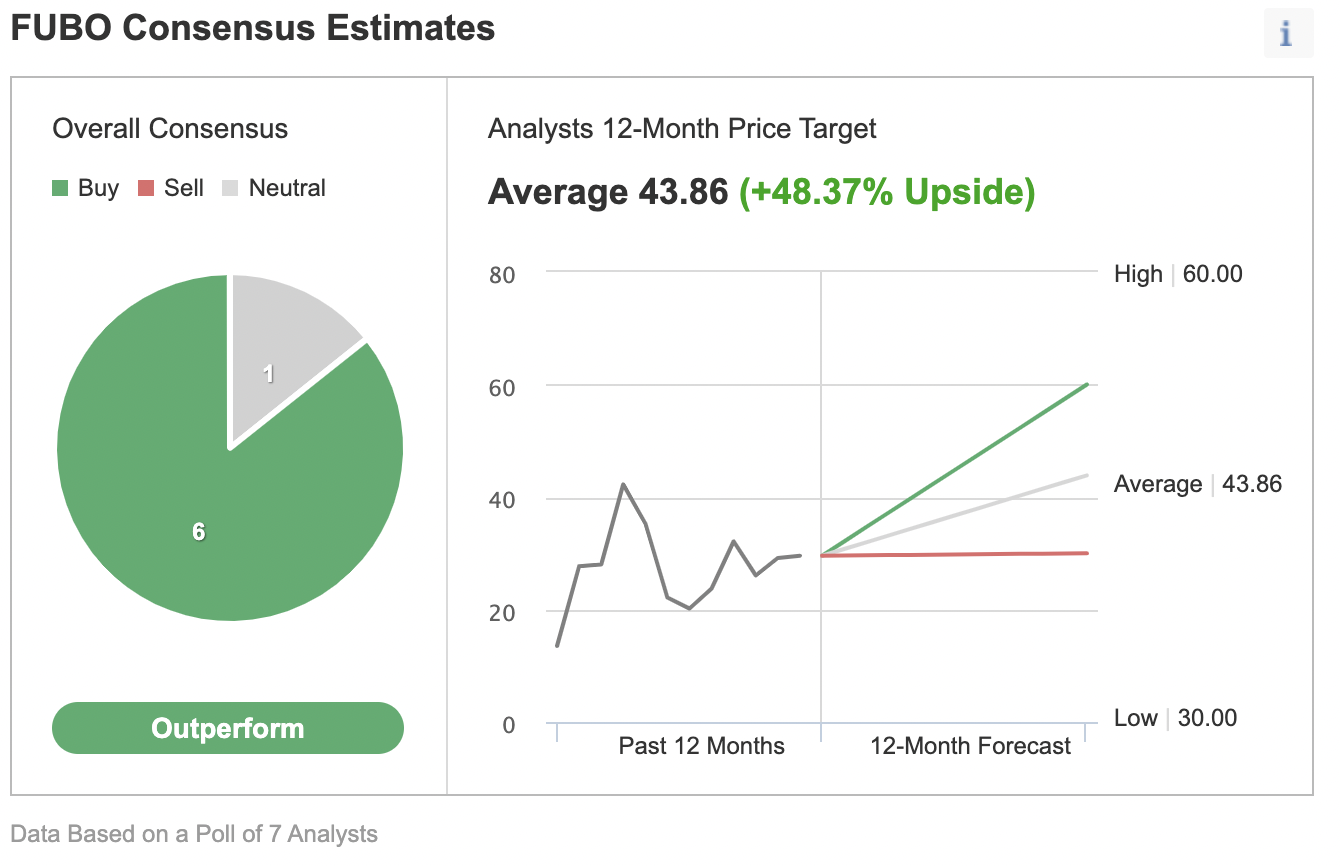

Amongst seven analysts polled by way of Investing.com, FuboTV inventory has an ‘outperform’ score. The shares have a 12-month worth goal of $43.86, implying a return of about 50% from present ranges.

Chart: Investing.com

The inventory’s P/S and P/B ratios stand at 9.91x and 6.65x, respectively. By comparability, the P/S and P/B ratios of the streaming large Netflix (NASDAQ:) are 9.13x and 18.17x.

Buyers who watch technical charts may be to know that an up transfer towards the $31 to $35 degree is probably going. In that case, FUBO inventory might hit resistance between $34-$35 after which it may commerce sideways between $30 and $35.

We must also be aware that the beta (β) of FUBO inventory is 2.93. Beta is a measure of a safety’s volatility in relation to the general market.

An organization whose β is larger than 1, means it is extra risky than the market. With a beta of two.93, the inventory will seemingly be about thrice as risky as the general market. In different phrases, count on swings within the FUBO share worth, particularly within the brief run.

Though our expectation is for the inventory worth to extend within the coming weeks, it isn’t prone to be a straight transfer larger. There may even be an extra decline towards $28 earlier than a brand new upleg begins. In case of such a decline, potential FuboTV traders would then discover higher worth within the inventory.

4 Potential Trades

1. Purchase FUBO Inventory At Present Ranges

Buyers who are usually not involved with every day strikes in worth and who consider within the long-term potential of the corporate may think about investing in FuboTV shares now.

FUBO inventory closed yesterday at $29.56. Purchase-and-hold traders ought to count on to maintain this lengthy place for a number of months whereas the inventory probably makes an try, first towards $35, after which $40, resulting in a return of about 35%.

Nevertheless, traders who’re involved about giant declines may also think about putting a stop-loss about 3-5% beneath their entry level. We must also be aware that it’s going to presumably take a number of quarters earlier than the shares may attain the earlier ATH of $62.29.

2. Promote A Money-Secured Put Choice On FUBO Inventory

Our second commerce entails a cash-secured put technique. We’ve got not too long ago coated this feature in quite a few articles. Right here is one .

Bullish FuboTV inventory merchants may now promote a Nov. 19, 28-strike put possibility, which is at present being supplied at $3.58.

Assuming merchants would enter this put-selling technique on the present worth, the upside is holding this premium of $358 so long as FUBO inventory closes above $28, when the choice expires. A complete of $358 could be the utmost return for this commerce (excluding buying and selling prices and taxes).

The draw back is that if FuboTV inventory trades beneath $28.00 forward of expiration. Ought to that happen, merchants could possibly be assigned 100 shares for every bought put at a value of $28.00 per share.

At expiry, this commerce would break even at a inventory worth of $24.42 (i.e., $28-$3.58).

3. Purchase An ETF That Has FuboTV As A Holding

Many readers are acquainted with the truth that we frequently cowl exchange-traded funds (ETFs) that may be appropriate for buy-and-hold traders. Thus, readers who don’t wish to commit capital to FUBO inventory however would nonetheless wish to have publicity to the shares may think about researching a fund that holds the corporate.

Nevertheless, since FuboTV is a small, younger firm, it isn’t but a number one holding in an ETF. This implies such an funding would supply solely a restricted publicity to FuboTV shares.

Nonetheless, examples of ETFs which have FUBO inventory embrace:

- Roundhill Streaming Providers & Know-how ETF (NYSE:): This new fund is flat since inception in February 2021. FUBO inventory’s weighting is 3.60%;

- SPDR® S&P Web ETF (NYSE:): The fund is up 9.1% YTD, and FUBO inventory’s weighting is 1.89%;

- iShares Digital Work and Life Multisector ETF (NYSE:): The fund is down 6.3% YTD, and FUBO inventory’s weighting is 0.88%.

4. Purchase Shares In One other Streaming Firm

Potential traders who’re within the streaming area, together with audio and video leisure, and wish to put money into FUBO inventory may think about investing in different extra established names within the sector.

The pandemic has pushed streaming service subscriptions in lots of corporations to data highs. Nevertheless, as economies open up, various these shares have come below strain and, thus, their share costs are off their 52-week, and even ATH highs.

A number of names with streaming revenues that would enchantment to readers are (in alphabetical order):

Apple (NASDAQ:): up 16.5% YTD;

AT&T (NYSE:): down 5.2% YTD;

Comcast (NASDAQ:): up 16.6% YTD;

Curiositystream (NASDAQ:): down 9.9% YTD;

Netflix (NASDAQ:): up 5.2% YTD;

Roku (NASDAQ:): up 12.1% YTD;

Sirius XM (NASDAQ:): down 0.87% YTD;

Spotify (NYSE:) : down 24.8% YTD;

ViacomCBS (NASDAQ:): up 11.2% YTD

Walt Disney (NYSE:): up 1.3%.

Because the returns above spotlight, the fortunes of those firms have various considerably in 2021. Due to this fact, potential traders would wish to analysis them nicely earlier than committing capital into the shares.

Backside Line

Since going public in late 2020, FUBO inventory has been within the limelight. Though the file excessive share worth of $62.29 appears fairly distant now, the corporate is prone to create higher shareholder worth within the months forward. Rising subscriber numbers and the expansion within the promoting section, in addition to the upcoming sports activities ebook app will seemingly present tailwinds for FuboTV shares. In the meantime, the corporate may even discover itself a takeover candidate.

[ad_2]