[ad_1]

- ABNB has fallen greater than 40% up to now in 2022

- The valuation remains to be excessive, with 12-month P/E of 84.7 and ahead P/E of 51.7

- The Wall Road consensus outlook is bullish

- The market-implied outlook continues to be bearish, with excessive volatility

- For instruments, information, and content material that can assist you make higher investing selections, strive InvestingPro+

As considerations a couple of potential recession develop, the journey and leisure trade has offered off. This comes at a very making an attempt time for Airbnb (NASDAQ:), which can be experiencing downward stress attributable to rising rates of interest.

Shares with excessive price-to-earnings (P/E) ratios are usually significantly delicate to rates of interest as a result of the low cost issue utilized to future earnings has a bigger impression when valuations are primarily based on earnings which are anticipated to happen additional out in time.

One other threat issue with rising charges is that the economics of trip leases turn out to be much less enticing. With rising mortgage charges, ABNB hosts could must cost greater charges, decreasing the relative attractiveness of this sort of lodging.

As well as, the potential default charges for non-owner leases in occasions of monetary stress are anticipated to be significantly greater than for owner-occupied properties (see earlier hyperlink). Defaults amongst hosts don’t immediately impression ABNB however would have a tendency to lift rental charges and cut back the variety of hosts.

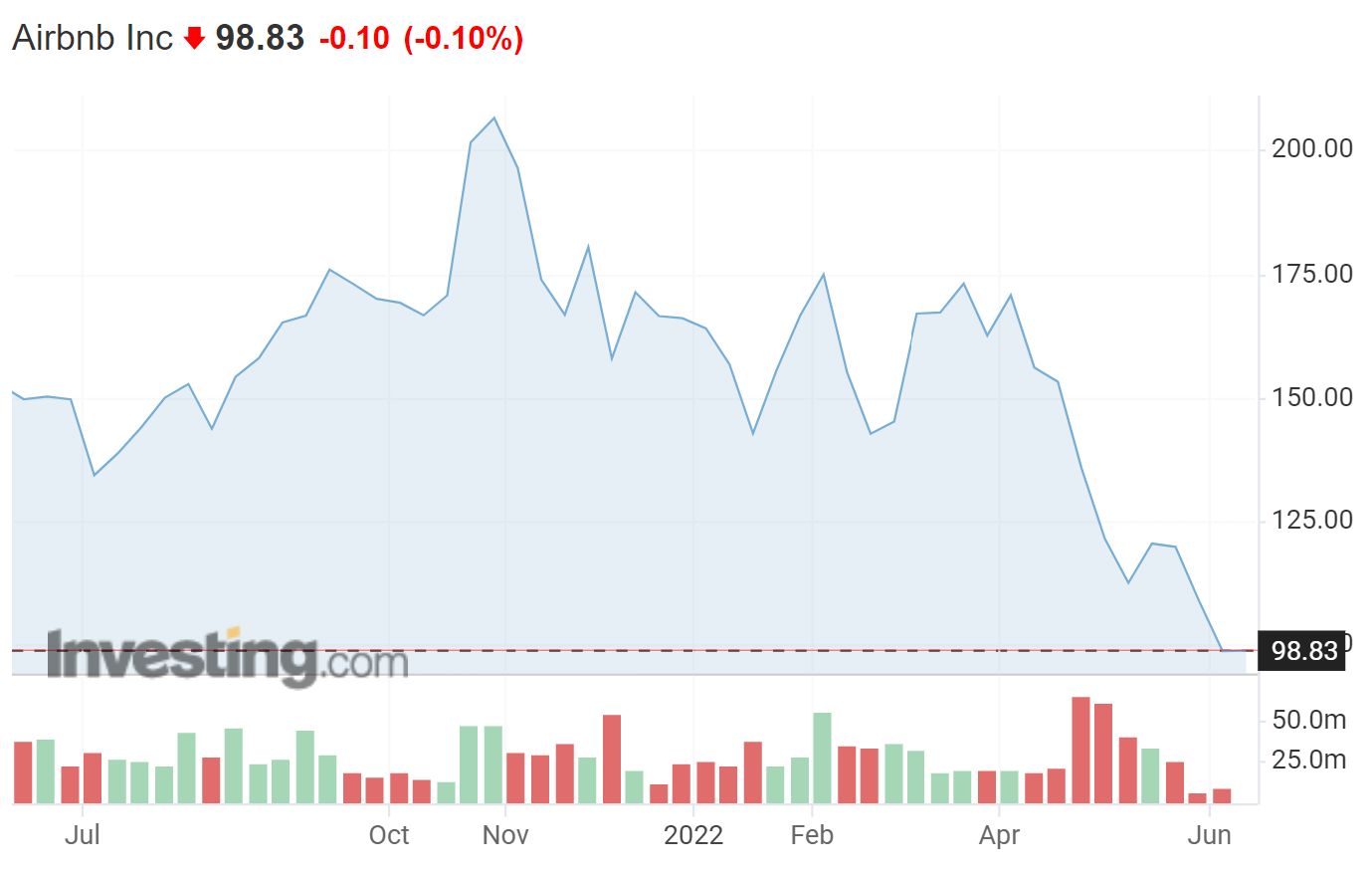

Supply: Investing.com

Shares within the journey and expertise platform are at present buying and selling 52% under the 12-month excessive closing worth of $207.04 on Nov. 6, 2021. The shares are down 33.4% over the previous 12 months, with a barely smaller decline than the journey providers trade, as outlined by Morningstar.

The San Francisco-based tech big reported Q1 on Might 6, beating expectations on earnings and income. Income elevated by an enormous 70% over the previous 12 months, however, after all, that is largely attributable to depressed journey ranges from final 12 months.

By any measure, ABNB is rising at a sturdy price, with greater than 100 million bookings in Q1, an all-time excessive for a single quarter. As well as, folks are usually staying longer in Airbnb lodging and paying extra per evening. There are at present 6 million energetic Airbnb listings.

ABNB’s trailing 12-month (TTM) P/E ratio is 84.7 and the ahead P/E (calculated utilizing estimated earnings over the subsequent 12 months) is 51.7. This can be a wealthy valuation in market situations during which traders have gotten extra skeptical about ‘progress at any worth’.

On , shares had been buying and selling at $183 and I assigned a impartial ranking. With a high-growth inventory, the valuation relies upon virtually solely on the expansion outlook. In December, the Wall Road analyst consensus ranking was bullish, with a 12-month worth goal that was 9%-10% above the share worth at the moment.

In contrast, the consensus view implied by choices costs, the market-implied outlook, was considerably bearish, and indicated that the most-probable outcomes had been vital declines. In compromising between the outlooks from the Wall Road analysts and the patrons and sellers of choices, I compromised with a impartial ranking.

For readers who’re unfamiliar with the market-implied outlook, a short rationalization is required. The worth of an possibility on a inventory is essentially decided by the market’s consensus estimate of the likelihood that the inventory worth will rise above (name possibility) or fall under (put possibility) a selected degree (the choice strike worth) between now and when the choice expires. By analyzing the costs of name and put choices at a variety of strike costs, all with the identical expiration date, it’s potential to calculate a probabilistic worth forecast that reconciles the choices costs. That is the market-implied outlook. For a deeper rationalization and background, I like to recommend this monograph revealed by the CFA Institute.

With about six months since my final evaluation, and the shares buying and selling at a considerable low cost to their ranges on the finish of 2021, I’ve calculated a market-implied outlook by the tip of 2022 and in contrast this with the present Wall Road consensus outlook, in revisiting my ranking on ABNB.

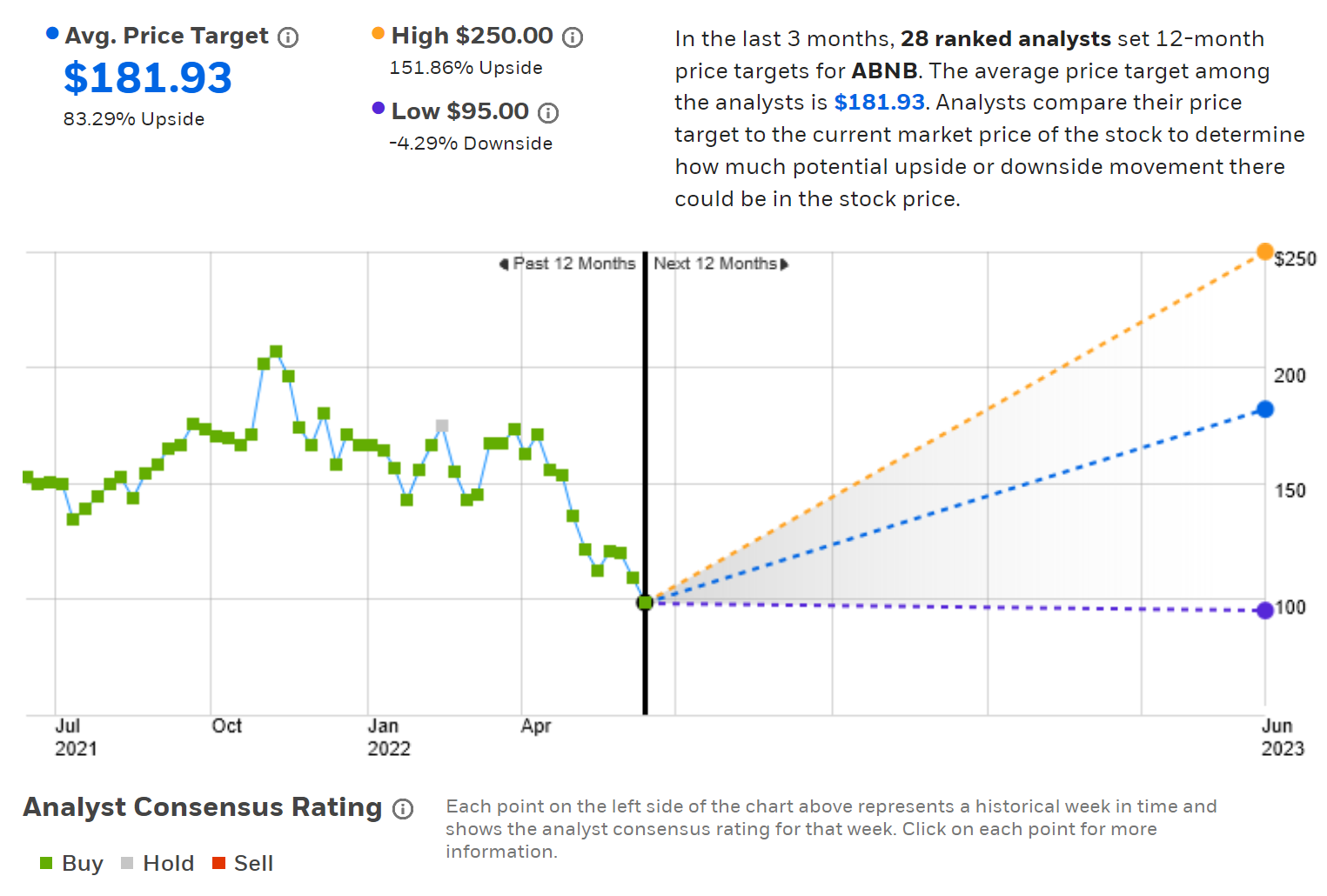

Wall Road Consensus Outlook For ABNB

E-Commerce calculates the Wall Road consensus outlook by combining the views of 28 ranked analysts who’ve revealed scores and worth targets for ABNB over the past three months. The consensus ranking for ABNB is bullish, with a consensus 12-month worth goal that’s 83% above the present share worth. The 12-month worth goal is decrease than the worth in early December, however the substantial drop within the shares worth since then leads to the very excessive anticipated worth appreciation over the subsequent 12 months.

One purple flag within the consensus is that there’s very excessive dispersion among the many particular person worth targets, with the best ($250) greater than 2.5 occasions the bottom ($95). Analysis reveals that the predictive worth of the consensus worth goal will get decrease because the dispersion among the many particular person worth targets will increase. At very excessive dispersion, the correlation between the exact appreciation implied by the consensus worth goal and subsequent returns is adverse.

Supply: E-Commerce

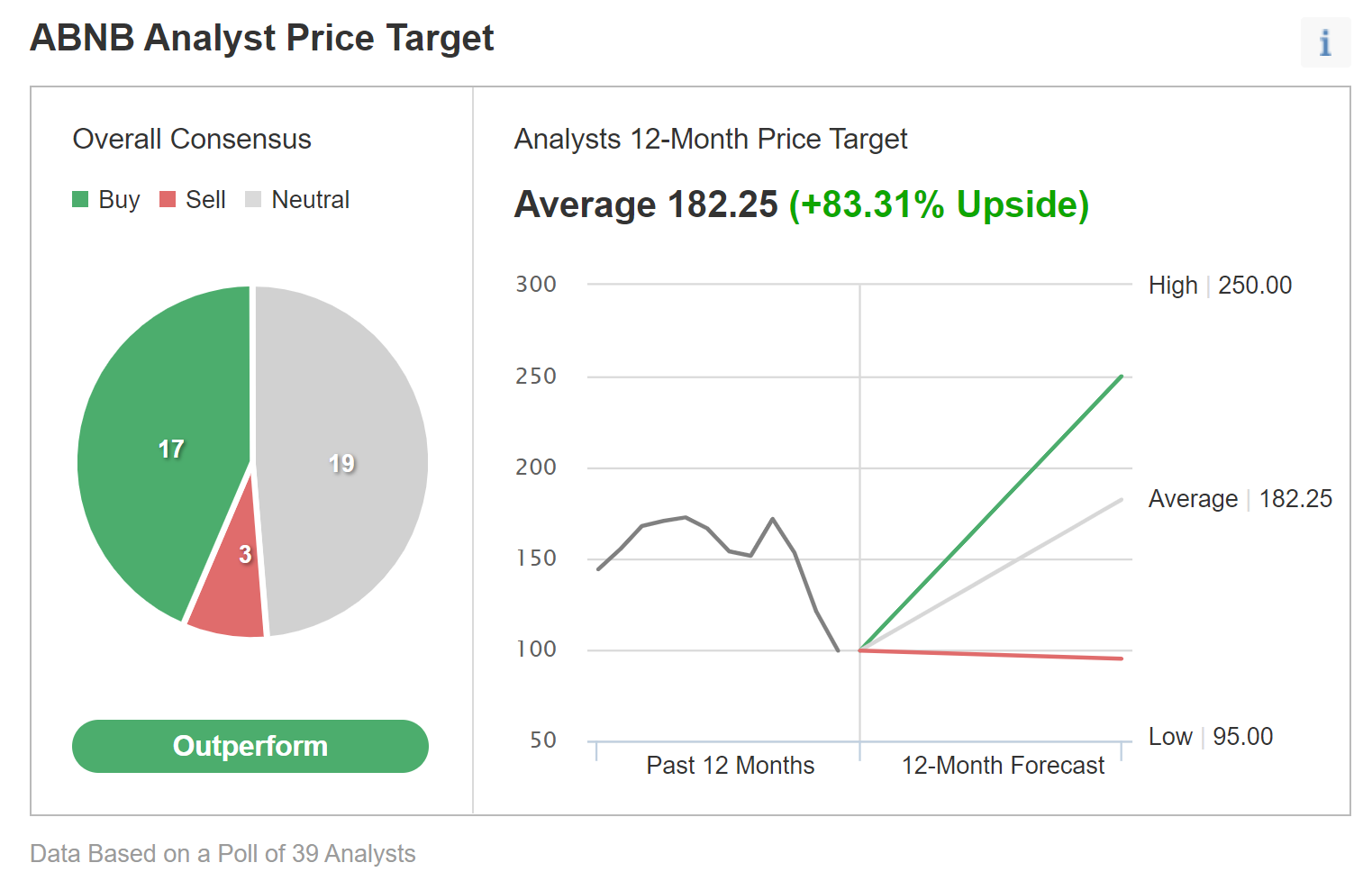

Investing.com’s model of the Wall Road consensus outlook is calculated utilizing scores and worth targets from 39 analysts. The outcomes are similar to these from E-Commerce.

Supply: Investing.com

The present Wall Road consensus outlook implies monumental return expectations for ABNB over the subsequent 12 months, significantly as in contrast with the consensus outlook from December. What’s much less encouraging is that the dispersion among the many particular person worth targets could be very massive, decreasing confidence within the meaningfulness of the consensus as a predictor.

Market-Implied Outlook For ABNB

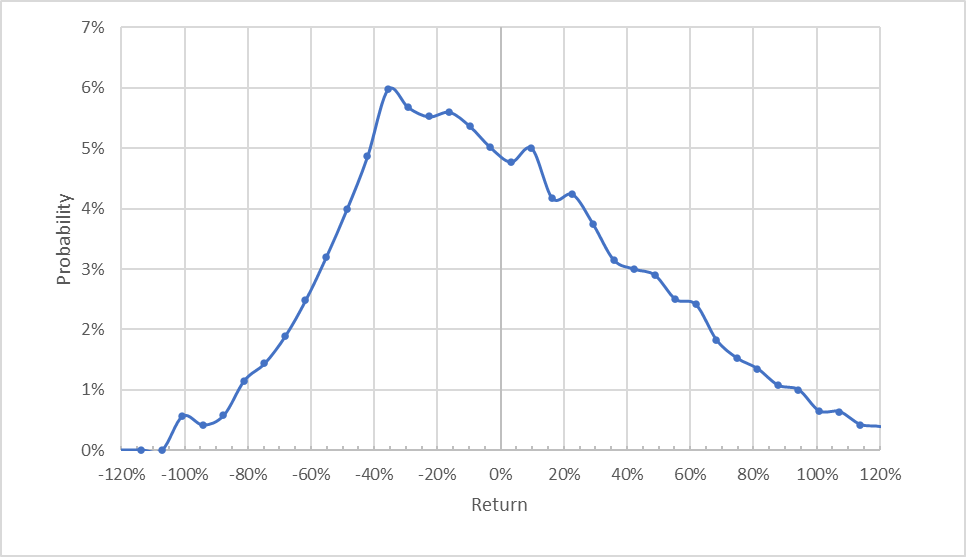

I’ve calculated the market-implied outlook for ABNB for the 7.2-month interval from now till Jan. 20, 2023, utilizing the costs of name and put choices that expire on this date. I selected this particular expiration date to supply a view by the tip of 2022 and since the choices expiring in January are significantly actively traded.

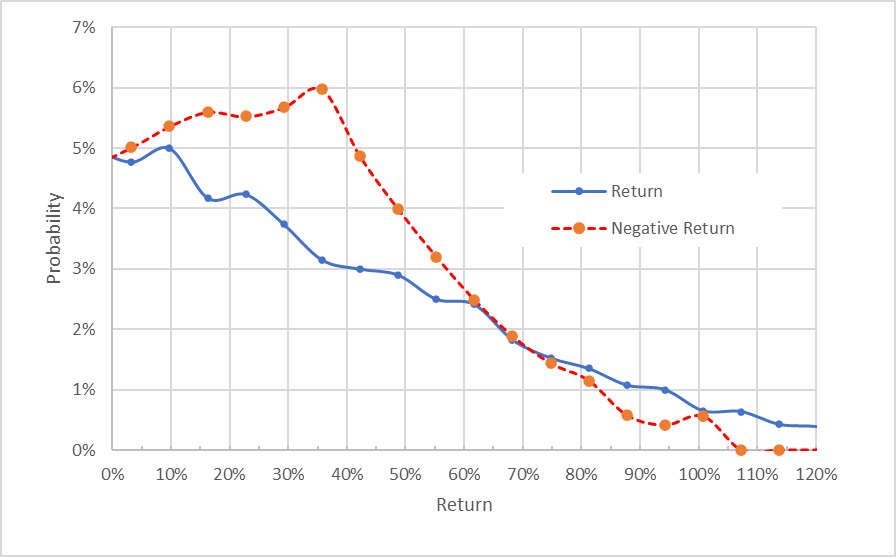

The usual presentation of the market-implied outlook is a likelihood distribution of worth return, with likelihood on the vertical axis and return on the horizontal axis.

Supply: Creator’s calculations utilizing choices quotes from E-Commerce

Essentially the most notable function of the outlook for ABNB to early 2023 is the optimistic skewness, with the height in likelihood considerably tilted to favor adverse returns. The utmost likelihood corresponds to a worth return of -35% over this era. The anticipated volatility calculated from this outlook is 63% (annualized). This market-implied outlook is qualitatively similar to the outcomes again in December. Analysis has discovered that shares with optimistic skewness within the market-implied outlook are likely to underperform.

To make it simpler to immediately evaluate the relative possibilities of optimistic and adverse returns, I rotate the adverse return facet of the distribution concerning the vertical axis (see chart under).

Supply: Creator’s calculations utilizing choices quotes from E-Commerce. The adverse return facet of the distribution has been rotated concerning the vertical axis.

This view emphasizes that the chances of adverse returns are a lot greater than for optimistic returns of the identical magnitude, throughout a variety of probably the most possible outcomes (the dashed purple line is nicely above the stable blue line over many of the left half of the chart above). The possibilities of very massive optimistic returns are greater than for same-size adverse returns, however these outcomes happen at very low total likelihood.

Principle signifies that the market-implied outlook is anticipated to have a adverse bias as a result of traders, in combination, are threat averse and thus are likely to overpay for draw back safety (e.g. put choices), though there is no such thing as a method to immediately measure the magnitude of this impact. Even contemplating the potential for a adverse bias, the adverse orientation of this outlook is massive. This can be a bearish outlook for ABNB from the choices market.

Abstract

ABNB has dropped greater than 40% up to now in 2022 on recession fears and rising rates of interest, though it’s rising at a wholesome clip. Even at present ranges, the valuation stays fairly excessive.

The Wall Road consensus ranking is bullish, because it has been over virtually the entire previous 12 months. The consensus 12-month worth goal is barely decrease than on the finish of 2021 however the massive share worth declines have resulted within the consensus worth goal being greater than 80% above the present share worth.

The market-implied outlook is strongly bearish, because it was again in early December after I final ran this evaluation. The estimated maximum-probability consequence for the interval from now till January of 2023 is -35% and the anticipated volatility is 63% (annualized).

In balancing the bullish Wall Road consensus outlook with the bearish market-implied outlook, and contemplating the corporate’s stable execution throughout a really making an attempt interval for journey and leisure shares, I’m sustaining my impartial ranking on ABNB.

***

Serious about discovering your subsequent nice concept? InvestingPro+ provides you the possibility to display by 135K+ shares to seek out the quickest rising or most undervalued shares on this planet, with skilled information, instruments, and insights. Be taught Extra »

[ad_2]