[ad_1]

So as we speak will probably be an thrilling day. In a number of hours we’ll discover out if the will elevate charges by 50 or 75 bps.

I feel the market could also be getting this one mistaken on the 75 bps price hike. I preserve serious about the story from yesterday and this concept that the WSJ story was a leak: Fed More likely to Take into account 0.75-Proportion-Level Charge Rise This Week.

Perhaps I’ve an excessive amount of time on my palms to consider these things, however in the event you keep in mind, in Might, on the final FOMC press convention, Powell principally stated the Fed was not actively contemplating a 75 bps price hike at coming conferences.

Many buyers appeared to take the message from the Might assembly that as a result of Powell stated they weren’t contemplating a 75 bps hike, it meant the Fed would NOT elevate charges by greater than 50 bps. I feel the story from the WSJ was simply an try to provide the Fed the flexibleness again and undo what had been stated in Might.

Now, why undergo this effort in the event that they weren’t intending on elevating charges in June by 75 bps? Maybe they didn’t wish to shock the market with a sign for a 75 bps price hike in July. So I’m of this mindset that the Fed will elevate charges by 50 bps after which sign the for a 75 bps price hike in July.

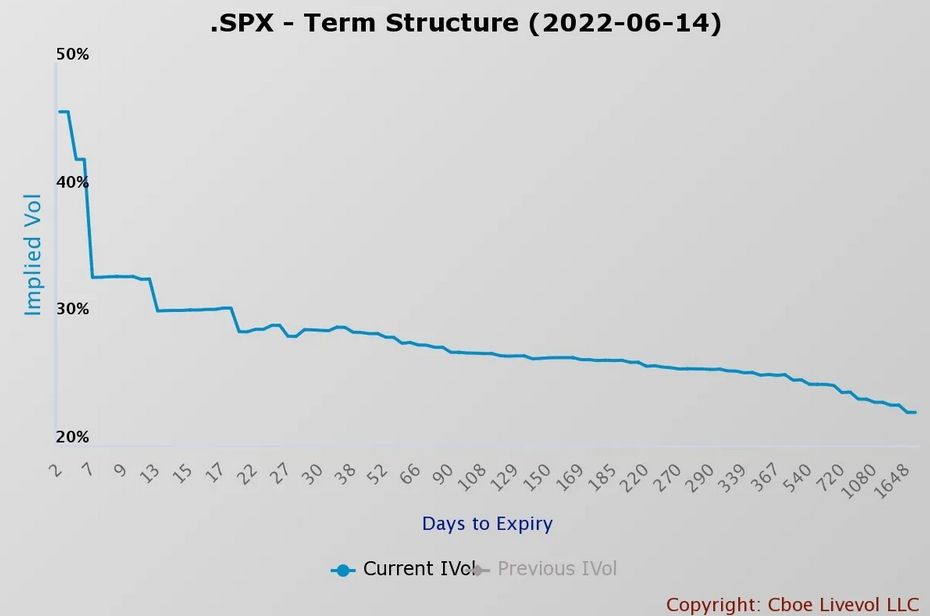

Look, I feel, both approach, there’s a good probability the market rallies submit FOMC. Implied could be very excessive and drops off a cliff when you get previous this week. In order that implied volatility soften ought to end in shares getting a pop.

It appears to be like like a pleasant falling wedge on the intraday of yesterday’s value motion. So, it wouldn’t shock me if the S&P 500 rallied again to three,815 following the Fed, whether or not they raised by 50 bps or 75 bps.

However finally, it’s what the Fed alerts for charges after June. I THINK the FOMC projections will point out that the Fed is prepared to sacrifice development and unemployment in its try and comprise inflation by downgrading its GDP development estimates and elevating its unemployment price forecasts.

That message will probably be extra significant than a 50 or 75-bps price hike. It’s why I feel any rally try will probably be short-lived. Too many individuals imagine the Fed goes to again off on the first signal of a weak job report or recession. The Fed must ship the message that it’ll not again down and can do no matter it takes to interrupt .

If it will possibly try this, the message will probably be extra significant. That can finally outcome within the S&P 500 heading in direction of a 14 PE ratio and a valuation of round 3,300 over time.

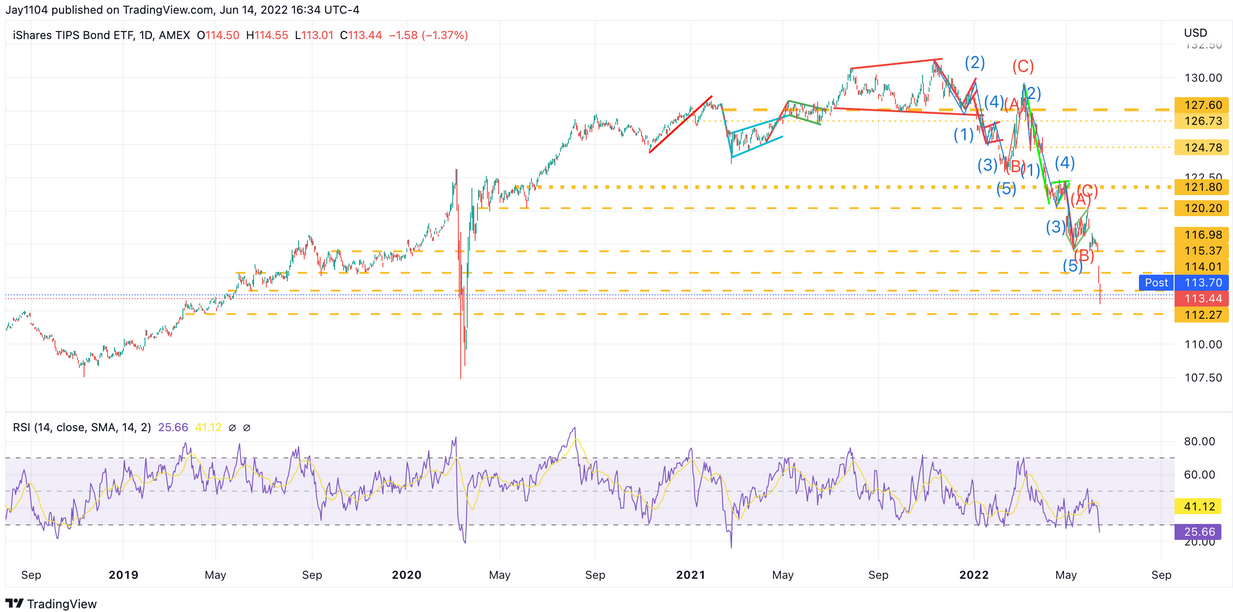

TIP ETF

The iShares TIPS Bond ETF (NYSE: fell sharply yesterday, making a brand new closing low, which I feel signifies that the Invesco QQQ Belief (NASDAQ:) shouldn’t be too far behind in making a brand new low of its personal.

Goldman Sachs

Goldman Sachs Group (NYSE:) hit the decrease finish of its buying and selling channel the final two days, so perhaps the case of a inventory market rebound isn’t all that loopy. That area on the pattern line for GS has served as a spot the place the inventory has bounced earlier than.

Financial institution of America

Financial institution of America (NYSE:) is again to its downtrend beginning on the finish of March, which may additionally function a spot for the inventory to rebound.

Roblox

If I’ve this proper, Roblox (NYSE:) ought to report its Might month-to-month metric tomorrow. They usually come on the fifteenth of the next month. I had seen some bullish name exercise within the inventory final week, and I nonetheless see these calls as being open. So perhaps the choices guys will get one proper.

Authentic Publish

[ad_2]