[ad_1]

- UPS shares are down over 19% for the reason that begin of 2022.

- Strong dividends might provide a hedge within the present inflationary setting.

- Lengthy-term traders might contemplate shopping for shares at present ranges.

- For instruments, information, and content material that will help you make higher investing selections, strive InvestingPro+.

Shareholders within the Atlanta, Georgia-based delivery large United Parcel Service (NYSE:) have seen the worth of their funding fall greater than 14.8% over the previous 52 weeks and 19.3% year-to-date (YTD). By comparability, the is down roughly 19% in 2022. In the meantime, fierce rival FedEx (NYSE:) shares have misplaced 20%.

On Feb. 1, UPS shares went over $233, hitting a report excessive. However by Might 19, they declined nearly 30%. UPS inventory’s 52-week vary has been $165.34-$233.72, whereas the market capitalization (cap) at present stands at $151.2 billion.

In 2021, United Parcel Service generated revenues of $97.3 billion. The logistics large leads the specific delivery and courier market within the US, intently adopted by FedEx. Subsequent come the U.S. Postal Service and Amazon‘s (NASDAQ:) logistics providers.

How Current Metrics Got here

UPS launched Q1 figures on Apr. 26. grew 6.4% year-over-year (YoY) and reached $24.4 billion. Adjusted diluted earnings per share (EPS) was $3.05, up 10.1% YoY.

The corporate generated $3.92 billion in free money movement in the course of the quarter. Earlier within the 12 months, UPS had raised costs to struggle inflation.

On the outcomes, CEO Carol Tomé commented:

“The agility of our community and the continued execution of our technique delivered one other quarter of sturdy monetary efficiency, placing us on our strategy to reaching our 2022 consolidated monetary targets.”

After the monetary launch, the corporate reaffirmed its FY 2022 monetary targets, projecting an all-time excessive income of $102 billion. Buyers are hopeful that UPS can proceed to capitalize on the expansion potential of e-commerce each within the US and worldwide.

Previous to the discharge of the Q1 outcomes, UPS inventory was round $182. However on June 10, it closed at $173.05. Shares at present help a dividend yield of three.51%.

What To Anticipate From United Parcel Service Inventory

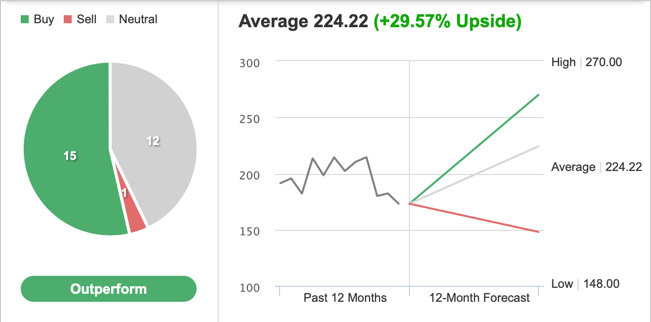

Amongst 28 analysts polled by way of Investing.com, UPS inventory has an “outperform” score. Wall Road has a 12-month median value goal of $224.22 for the inventory, suggesting a rise of virtually 30% from the present value. The 12-month value vary at present stands between $148 and $270.

Supply: Investing.com

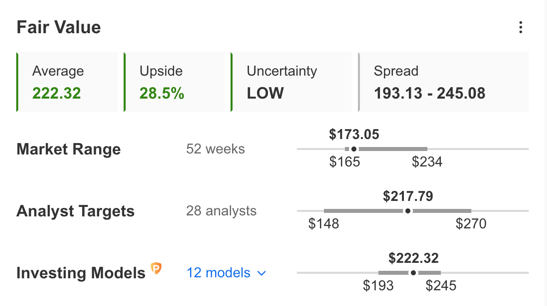

Equally, in accordance with quite a few valuation fashions, like people who would possibly contemplate P/E or P/S multiples or terminal values, the common honest worth for UPS inventory on InvestingPro stands at $222.32.

UPS Honest Worth

Supply: InvestingPro

In different phrases, basic valuation suggests shares might enhance by 28.5%.

We are able to additionally have a look at UPS’s monetary well being as decided by rating greater than 100 components in opposition to friends within the industrials sector.

For example, by way of progress, value momentum and revenue, it scores 4 out of 5. Its general rating of 4 factors is a superb efficiency rating.

At current, the inventory’s P/E, P/B and P/S ratios are 14.1x, 9.8x and 1.5x, respectively. Comparable metrics for friends stand at 16.4x, 4.4x and 0.8x, respectively.

Our expectation is for United Parcel Service inventory to commerce in a variety between $160 and $180 within the coming weeks. Afterwards, UPS shares might doubtlessly begin a brand new leg up.

Including UPS Inventory To Portfolios

United Parcel Service bulls who will not be involved about short-term volatility might contemplate investing now. Their goal value could be $222.32, as instructed by quantitative fashions.

Alternatively, traders might contemplate shopping for an exchange-traded fund (ETF) that has UPS inventory as a holding. Examples embrace:

- iShares Transportation Common ETF (NYSE:)

- Industrial Choose Sector SPDR® Fund (NYSE:)

- ProShares Provide Chain Logistics ETF (NYSE:)

- Vanguard Industrials Index Fund ETF Shares (NYSE:)

- U.S. International Sea to Sky Cargo ETF (NYSE:)

Lastly, traders who count on UPS inventory to bounce again within the weeks forward might contemplate establishing a bull name unfold.

Most possibility methods will not be appropriate for all retail traders. Subsequently, the next dialogue on UPS inventory is obtainable for instructional functions and never as an precise technique to be adopted by the common retail investor.

Bull Name Unfold On United Parcel Service Inventory

Value At Time Of Writing: $173.05

In a bull name unfold, a dealer has a protracted name with a decrease strike value and a brief name with the next strike value. Each legs of the commerce have the identical underlying inventory (i.e. United Parcel Service) and the identical expiration date.

The dealer needs UPS inventory to extend in value. In a bull name unfold, each the potential revenue and the potential loss ranges are restricted. The commerce is established for a web value (or web debit), which represents the utmost loss.

Right this moment’s bull name unfold commerce entails shopping for the Aug. 19 expiry 175 strike name for $10.10 and promoting the 180 strike name for $7.70.

Shopping for this name unfold prices the investor round $2.40 or $240 per contract, which can also be the utmost danger for this commerce.

We should always observe that the dealer might simply lose this quantity if the place is held to expiry and each legs expire nugatory, i.e., if the united statesstock value at expiration is beneath the strike value of the lengthy name (or $175 in our instance).

To calculate the utmost potential acquire, we will subtract the premium paid from the unfold between the 2 strikes, and multiply the consequence by 100. In different phrases: ($5.00 – $2.40) x 100 = $260.

The dealer will notice this most revenue if the United Parcel Service inventory value is at or above the strike value of the brief name (increased strike) at expiration (or $180 in our instance).

Backside Line

In latest months, UPS inventory has come below important stress. But, the decline has improved the margin of security for buy-and-hold traders who might contemplate investing quickly. Alternatively, skilled merchants might additionally arrange an choices commerce to profit from a possible run-up within the value of UPS inventory.

***

Excited by discovering your subsequent nice concept? InvestingPro+ offers you the possibility to display screen by way of 135K+ shares to search out the quickest rising or most undervalued shares on this planet, with skilled information, instruments, and insights. Study Extra.

[ad_2]