[ad_1]

It was not meant to be, for what had been a comparatively orderly bounce from Might lows. Friday’s buying and selling drove the nail into the coffin of the 2-week lengthy bull flags with a ‘gap-and-run’ decrease, which now places the Might lows beneath stress.

If bulls are to get out of this with the prospects of a double backside, then at present or tomorrow has to see a spike low—ideally one with a large intraday vary—which capitulates the final of the weak arms.

But when we see one other day like Friday, then it is again to the drafting board as to in search of a backside.

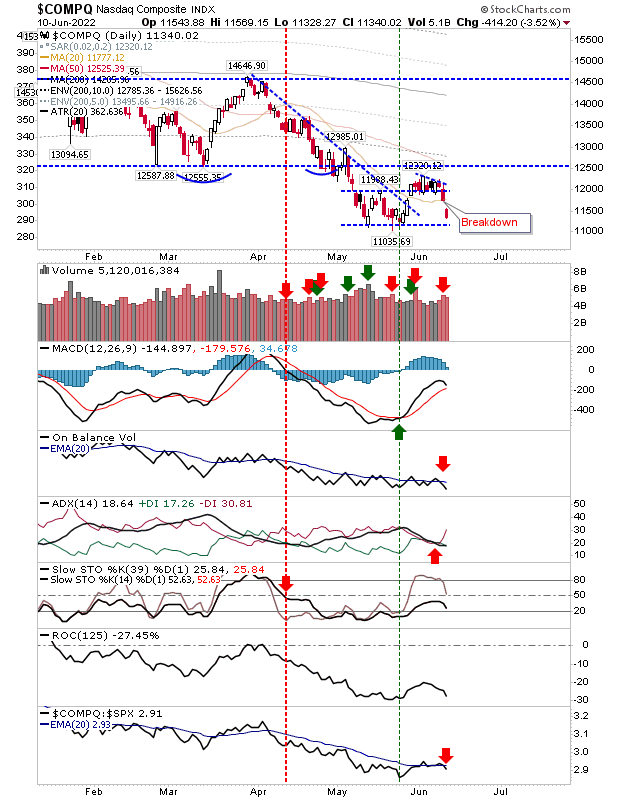

For the , we now have the Might spike low of 11,035, however actually, it is the candlestick actual physique help of 11,152 which has to carry on a closing value foundation—spike lows beneath this are high-quality (and are to be welcomed).

We now have technical stress with the uptick in bearish pattern energy, the relative ‘promote’ set off towards the , the ‘promote’ sign in On-Steadiness-Quantity, and a weak ‘purchase’ sign within the MACD which is near reversing to a powerful ‘promote’ (when the MACD line is beneath the zero line it is a weak ‘purchase’ and robust ‘promote;’ vice versa within the reverse situation).

COMPQ Day by day Chart

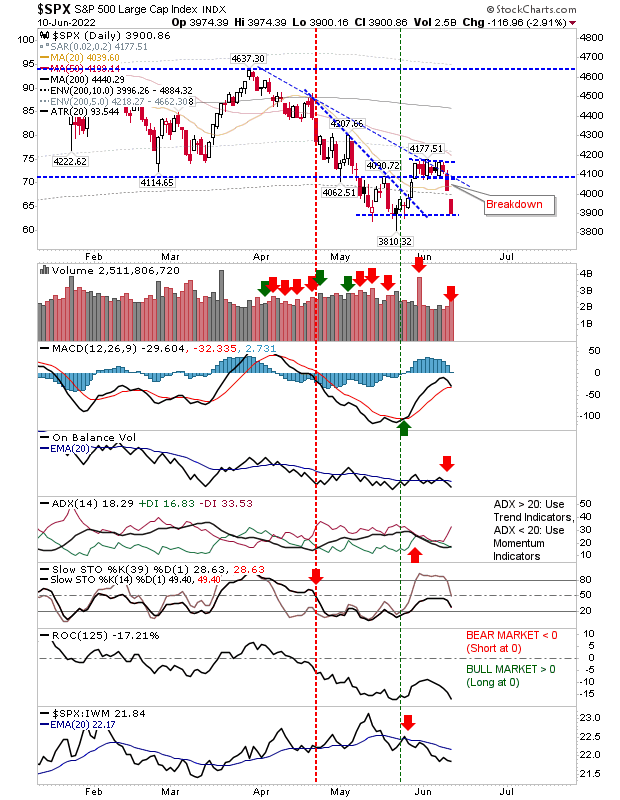

The S&P is already at its real-body help of three,887. Word how Stochastics (39,1) by no means made it above the mid-line, confirming a bear market rally (when this metric is beneath 50 we now have a cyclical bear market, and a cyclical bull market when above 50). The index additionally sits on the verge of a brand new robust ‘promote’ sign within the MACD.

SPX Day by day Chart

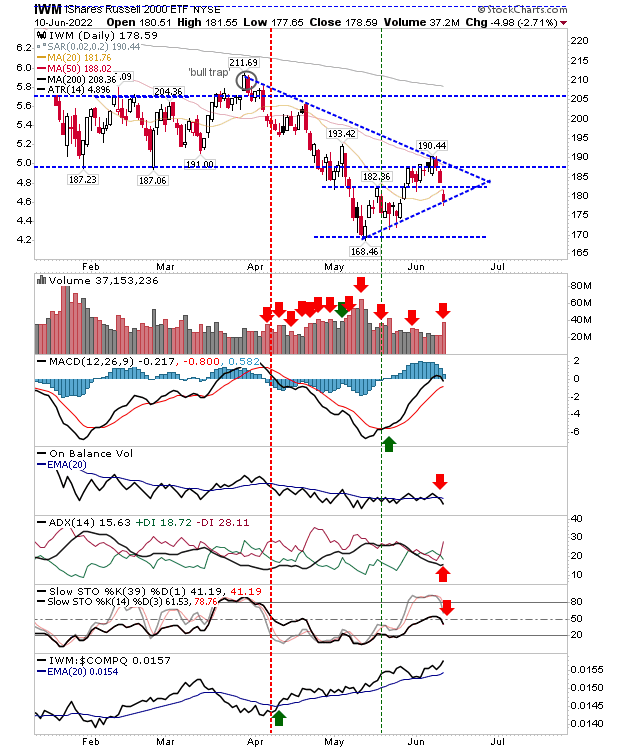

There’s a silver lining for markets and there shall be few singing its praises, however the () continues to carry out effectively (comparatively).

Sure, it could not keep away from the promoting of Thursday and Friday, but it surely did handle a short cross of the 50-midline in Stochastics (cyclical bull market territory) and its MACD is near returning above the bullish zero line.

It has regularly outperformed peer indices because the begin of April—with that relative efficiency accelerating during the last couple of days. That is an buyers set-up; progress shares is the place the stealth shopping for is occurring and markets try to maintain this a secret.

IWM Day by day Chart

The top-of-week market headlines look dangerous for Monday, however the Russell 2000 (IWM) was quietly doing higher than the S&P and NASDAQ. Take word, this isn’t a market to be promoting— significantly for progress shares that are (or are on the verge of) outperforming the Russell 2000.

[ad_2]